Bitfinex report: Market confidence in Bitcoin remains strong, Q4 is expected to be very bullish

BlockBeats news, on August 19, Bitfinex released a report saying that compared with Bitcoin ETF, Ethereum ETF continues to struggle, and large capital outflows have caused Ethereum to perform poorly relative to Bitcoin. Although emerging Ethereum ETFs such as BlackRock's iShares Ethereum Trust have some positive inflows, established products such as Grayscale's Ethereum Trust (ETHE) have faced a large outflow, which has been exacerbated by aggressive selling by major market makers such as Jump Trading. This has led to a 40% drop in Ethereum prices as of early August, and the ETH/BTC ratio has fallen to its lowest level in more than 1,200 days.

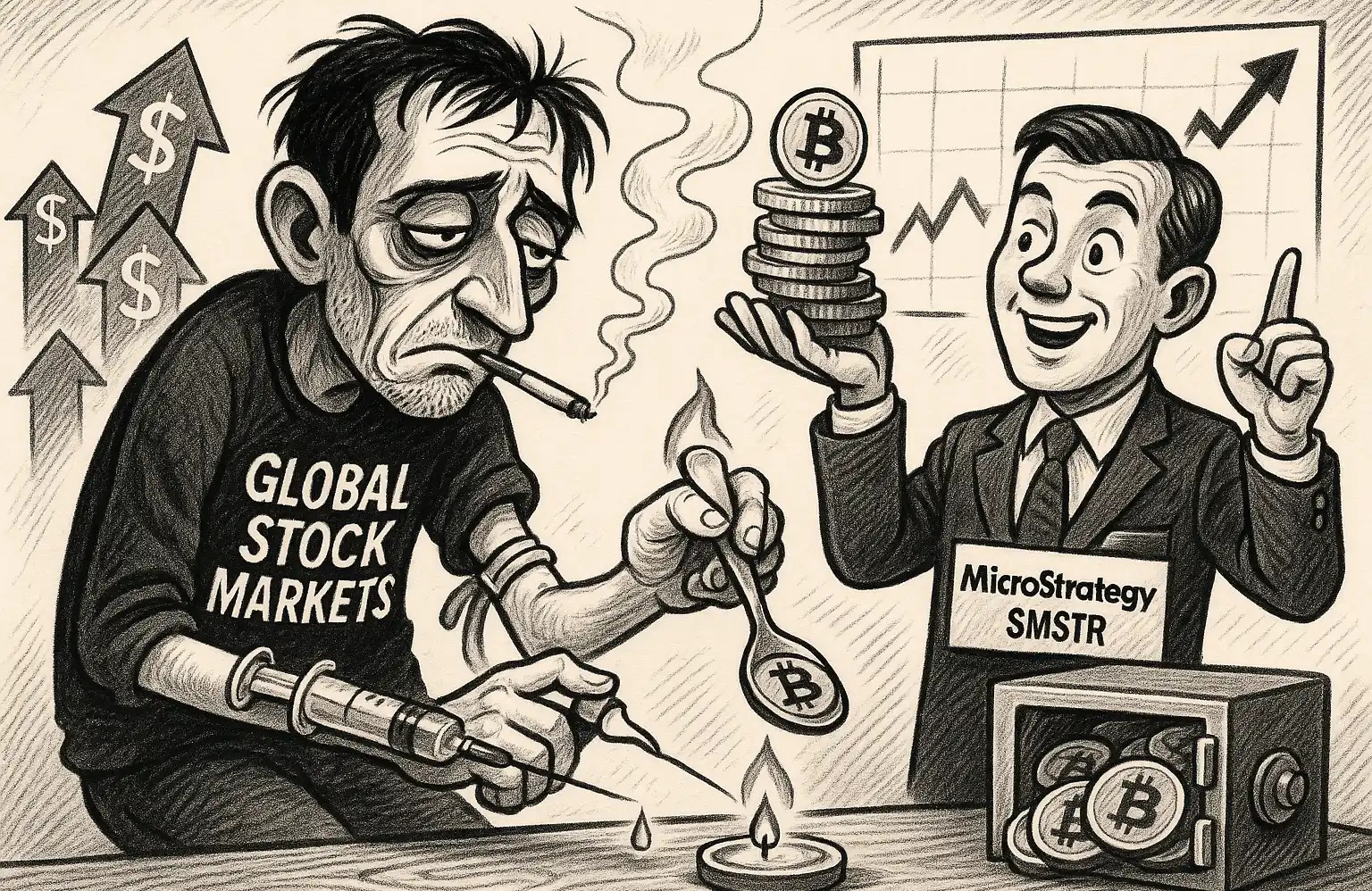

In contrast, Bitcoin ETFs have shown resilience, with continued inflows and more stable price performance. Despite challenges such as oversupply, market confidence in Bitcoin remains strong. Bitcoin is still expected to develop along the trajectory of previous halving years, and we expect the fourth quarter to be very bullish. Based on historical data, either the lows of the third quarter have already occurred, or we have one last round of declines to find the bottom of Bitcoin.

With the Ethereum ETF facing challenges in terms of performance and outflows, the next few months will be the key factor in determining whether it can recover and attract continued investor interest. Key factors such as the macroeconomic environment and potential Fed rate cuts will significantly affect future ETF fund flows and market dynamics, affecting the market performance of Ethereum and Bitcoin.

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data