Nasdaq: Resume 2022 meta universe venture capital, forecast 2023 trend

原文标题:《 纳斯达克|复盘 2022 年元宇宙风投,预测 2022 趋势 》

Source: Nasdaq

Old yuppie

The economic downturn, crypto bear market, is let all. builder And VC All headache stages, 2022 From one year to the next, venture capitalists have gone from gushing at the beginning of the year to gushing at the end. Today, we take a look at a report from NASDAQ on metacomverse venture capital.

After The rise of platforms such as The Sandbox and Decentraland, billions of dollars in primary and secondary land sales, and soaring NFT prices. 2021 In the years since, investor interest in the metaverse has somewhat subsided. Ironically, at the same time, corporate and private equity money has poured into the space. McKinsey 6 The monthly report says there have been. 1200 More than a billion dollars have been poured into the metaverse. 2021 More than twice as many as in all of 2005.

This year's corporate metauniverse confirms that. From Nike and Gucci to Snoop Dogg And brands like Time magazine have invested heavily in the Metaverse project as a way to revolutionize experiential brand engagement. Meta In Horizon Worlds Doubled down on the experiment.

However, we have learned that there is more venture capital in the consumer-focused space from Web3-focused funds than from mainstream VCS, corporations and private equity. We are OpenSea, Decentraland, Axie Infinity, Star Atlas And The Sandbox We've all seen that.

With that in mind, let's take a look. 2022 Years of venture capital landscape to understand 2023 What might happen in 2005.

"Early in 2022, it became clear to us that it would be the 'spades' startups that would get the most attention from investors, an apt metaphor given the' gold rush 'mentality of many established consumer brands."

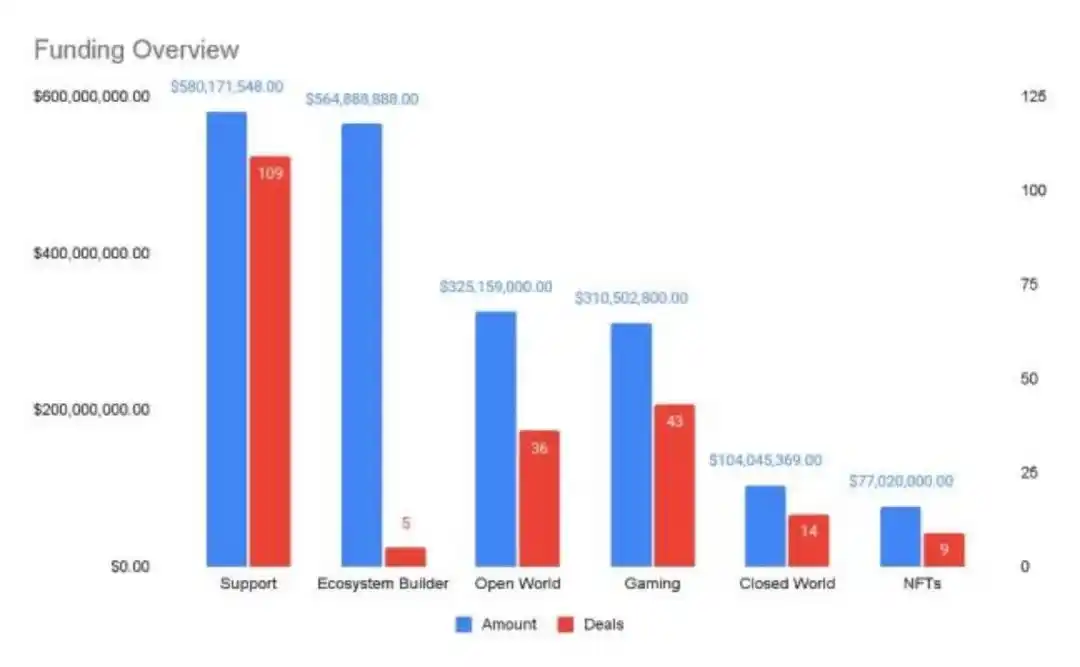

Who got the financing

As corporate money flowed into the metaverse, three things happened. The first is a surge in demand for support services. Digital architects, game designers, AI developers, content creators, and customized metacomes services are in increased demand when it comes to building metacomes experiences, whether on open platforms or closed worlds.

The second thing that happens is fragmentation. The success of large metaverse platforms paves the way for specific purpose and theme platforms. Sports, arts and consumer brands have consistently been the top three themes, while remote work collaboration and education have emerged as viable candidates for building specific worlds.

The third thing is a renewed focus on Web3 games. Given the controversial history of Web3 games, and the many brand initiatives around gamification on the metacomes platform, it is clear that a new economic model and gameplay innovation is needed. This year's crop of Web3 game startups is trying to do just that.

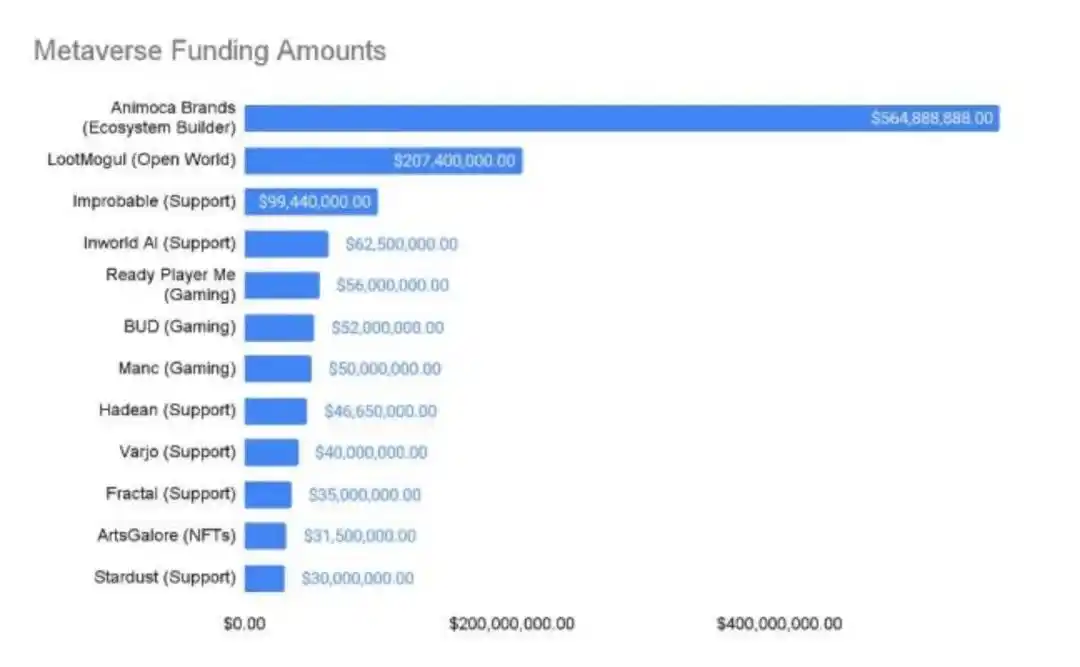

Venture capitalists have been quick to pick up on these trends. Startups backing the metaverse are the main beneficiaries. Gaming startups aren't far behind, especially those in the extended reality (XR) space. But it's the Web3 giant Animoca Brands that has received the most funding. This follows a pattern in recent years in which investors fund late-stage ecosystems and then let those ecosystems fund early-stage startups. We've seen this trend in all the major blockchain ecosystems, and now we're in the ecosystem unknowable. Animoca Brands I saw it on my body.

Who is investing

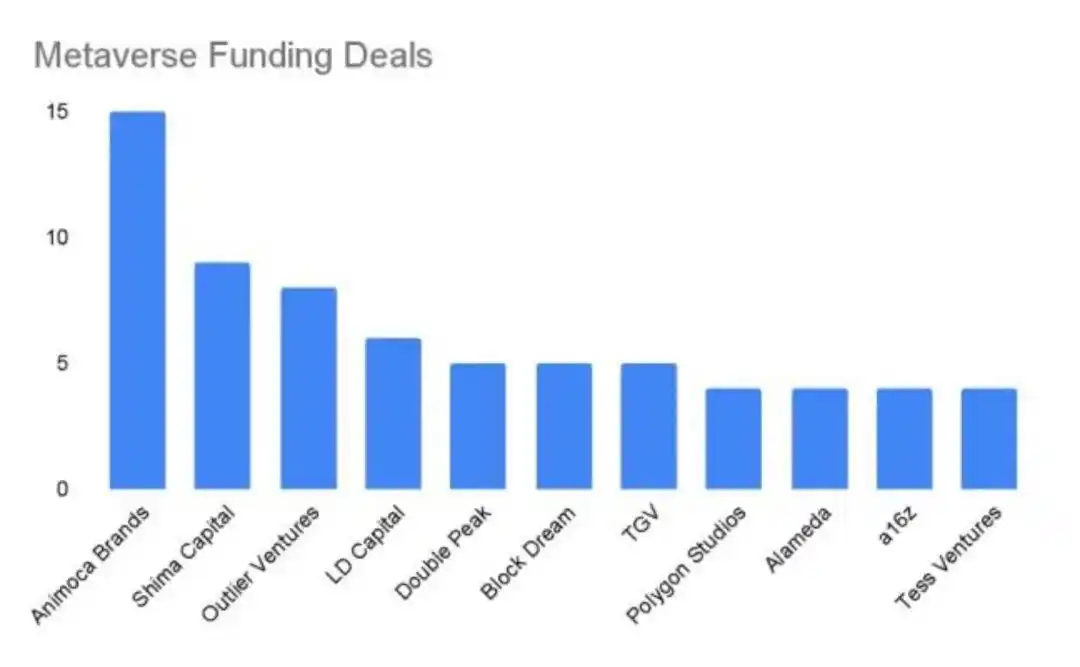

From the first quarter to the fourth quarter of this year, financing deals fell markedly. This coincides with the arrival of the current cryptocurrency winter. We also see that investors have stayed away. 2021 The fourth quarter and 2022 The first quarter of 2009 was characterized by speculation driven, more speculative investment. The focus is now on focusing on builders who offer real value to their customers. One area is startups that make it easier for brands and businesses to get a foothold in the metacall.

Another thing we've seen this year is that metaverse investments represent a relatively small portion of total blockchain investments. Take Shima Capital So far, for example, the company has made a significant contribution in 2022 The year has come to an end. 102 A transaction in which 52 The pen is in blockchain. However, only one of these deals is available. 17% Can be described as metaverse investing. Outlier Ventures And LD Capital have a higher proportion of , respectively; 50% And 30% . This shows that the entire industry is gearing up for growth. Given the inherent interoperability of Web3 technologies, investments that benefit one sector indirectly benefit others.

So far, Animoca Brands In 2022 Completed the most metaverse transactions in 2010. This is in line with the company's mission to contribute to the building of an open metaverse. Its deals span open metaverse platforms, support companies, and Web3 game developers. Another ecosystem builder. Studios Is also actively trying to bring in more metaverse companies. Polygon Blockchain. Interestingly, Alameda Research also showed a clear interest in metacomes before it went out of business.

Outlook 2023 years

If this year's meta-universe investment campaign has taught us anything, it's that the future is bright for the concept of an open metaverse. Despite the ongoing cryptocurrency winter, builders will continue to build and innovators will continue to innovate. Now is the time to look for investment opportunities, to look for startups that are working hard now, that will help grow the industry in the future.

In stark contrast, Meta nbsp; Horizon Worlds Adventure in 2022 The year has encountered considerable deceleration obstacles. After getting off to an ambitious start, the company had to revise its monthly active user target closer. 50% , not to mention having to lay off thousands of employees. On the surface, Meta The trouble is an indictment of the closed metaverse. It's expensive to access. VR Device, while the actual utility is unclear. However, it is clear that Horizon Worlds Success should not be taken as a barometer of the whole metacomverse concept.

Here's what it looks like. 2023 Some trends to watch this year:

Support services such as architecture, artificial intelligence and avatars will continue to account for a large share of investment

The metaverse is not going away. Open and closed platforms will continue to emerge. Businesses will find new ways to take advantage of this technology, and more of our lives will shift to the virtual world. We'll start to see that. AI Innovations like avatar representation, virtual robot training, and a new wave of interesting Web3 games based on a stable economic model.

The open metaverse platform will invest heavily in expanding its own ecosystem

This is already happening to some extent, but we expect it to happen in the future. 2023 Expect to see more of this in 2010, especially as the metacombe platform launched this year seeks additional funding next year. If we were in 2023 The first half of 2010 really came out of the cryptocurrency cold, and we should be able to see the established metacomph platforms complete the funding that was planned for this year.

After a tough year for Web3 games, it's going to get even stronger with improved economics and usability

Web3 game developers may be the most affected by the current cryptocurrency winter. As Token prices have plummeted, so has the number of people playing their games. This sends a clear message that GameFi's economic model needs to be more robust and the gameplay needs to get better. For this reason, in 2023 In 2010 and beyond, we'll likely see more games combining the "free to play" model with the new "play and earn" model.

A new set of industries will bring more traffic to the open metaverse

Concerts and other live events are prime examples. Well-known brands and celebrities have only scratched the surface of merging physical and digital experiences. We expect to see more innovation in this area, especially as we go along. XR The improvement and popularization of technology.

methodology

We want to focus specifically on companies that are building metacomph platforms or building tools and services that support metacomph platforms. By using Crunchbase Data, we set the description keywords to "metaverse" and "virtual world" in the search filter. We then categorized each company as an "ecosystem builder," "open world," "closed world," "gaming," "NFT," or "support," based on its description. For the "NFT" category, we only consider those in it. NFT Companies that show a clear connection between their work and the metaverse.

Other reports and articles on financing tend to include online gaming, virtual reality and augmented reality. We see this as a blanket approach that greatly exaggerates the amount of money being spent on the development of the metaverse. Simply put, not all online games and extended reality experiences should be seen as related to the concept of a metaverse.

The data is up to 2022 Year 12 Month 7 Day. Please note that in our search 309 Of the financing deals, only 215 The pen has a definite amount. It should therefore be noted that the total amount of financing and transaction estimates stated are lower than the amount actually invested.

Original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI