Is the current NFT market an over-leveraged "false bull market"?

Article:0xLaughing, rhythm BlockBeats

Most blue chips have seen varying degrees of gains in the past month

Since the FTX explosion, sentiment in the crypto market has continued to sour in the haze of this incident, and the NFT market is no exception. But starting in mid-December, led by NFT leader Yuga Labs, the ApeCoin pledge within the ecosystem and the latest "Jimmy Monkey" storyline further propels the development of "Ape Universe", Doodles, Moonbirds, Azuki and other top blue chip projects released good news successively and all had varying degrees of increase. Blur's third round of airdrop activity is also in full swing. As mainstream tokens such as BTC, ETH, and SOL are also gaining ground, NFT communities are beginning to feel optimistic that the bulls will soon return, and the whole market is experiencing a wave of "sunny spring".

There is no doubt that the good news of the NFT blue chips has guided the development of the NFT market, but behind the rise, there is often real money to support. Buy the source of funds in the end is "institution approach" or "old leek recharge"? Or are we finally waiting for new customers to arrive on the sidelines with new money?

Is "true warming" or "false bull market", explore carefully, found behind may already be a crisis.

Blur's airdrop campaign heats up

The third round of the airdrop will go live

Blur's third airdrop campaign is online

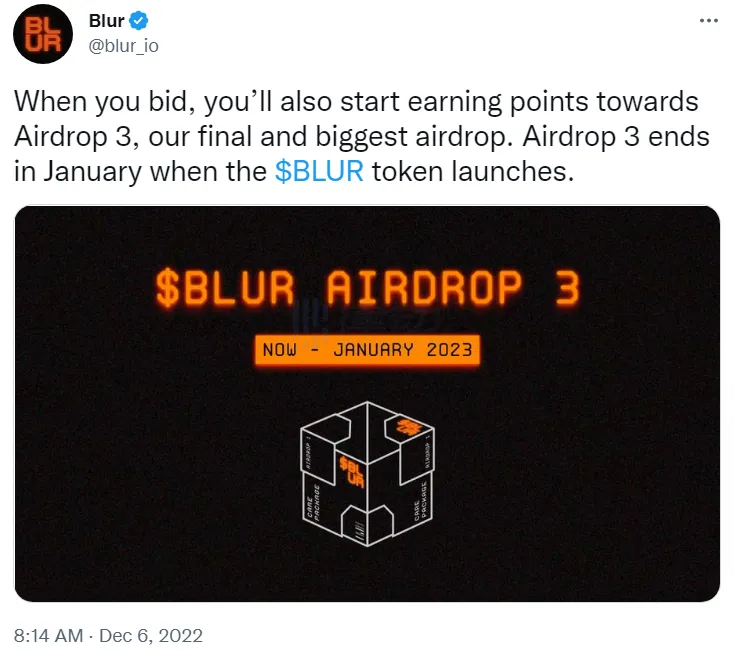

December 6, NFT Market Blur releasedannouncementDeclared the second round of airdrops open for application. There will also be a third round of Blur airdrops, the final and largest Blur airdrop, where users can start earning points for the third round of Blur airdrops when they place a bid.

After Blur's third round of airdrops began, the NFT market saw a significant increase in turnover.Dune)

With Blur's third round of airdrops, the NFT market saw a significant increase in sales.

According to BlockBeats previouslyreport, Dec. 11, Dune AnalyticsdataAccording to the report, 24-hour trading volume of blue-chip NFT, including BAYC and Azuki, increased greatly due to the announcement of the third round of airdrop by Blur. Among them:

• BAYC Series NFT 24-hour transaction volume of 3,365.56 ETH;

• MAYC Series NFT 24h turnover of 3,287.25 ETH;

• Azuki Series NFT has a 24-hour transaction volume of 4,670.3 ETH;

• CloneX Series NFT has a 24-hour transaction volume of 3,459.68 ETH.

Dune data also shows that the phenomenon of the huge increase in the trading volume of the NFT market is not a flash in the pan. Compared with the NFT bear market in the previous months, which showed little fluctuation, the Blur airdrop activity has continuously promoted the high trading volume of the NFT market until now.

Why did the airdrop activate the market?

Comparison of trading volume across NFT trading platforms

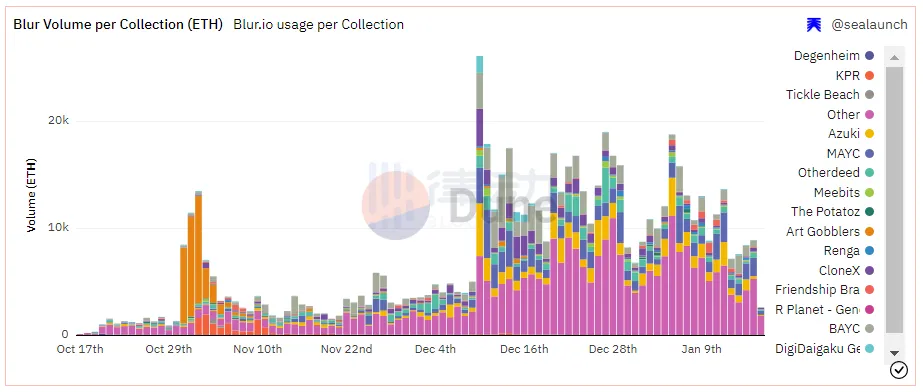

From Dune AnalyticsdataIt can be seen that before the launch of the third round of airdrop, Blur and OpenSea had some ups and downs: Blur introduced zero commission and optional royalties in order to reduce the friction of user transactions, and introduced the "ETH direct bidding" function. In addition, Blur also has advantages such as faster interaction speed. OpenSea uses its brand to keep users engaged, and has launched a "mandatory royalty tool" to force NFT and trading platforms to take sides.

However, Blur's third airdrop campaign gradually tipped the scales in its favor: at one point Blur accounted for 74% of the entire NFT market, before falling back a bit, but still beating OpenSea.

The trick is that this "Bid to Airdrop" campaign helps provide greater liquidity for NFT transactions on Blur's platform.

In the third round, Blur will reward users with points based on the 24-hour transaction volume of an NFT series. The bid closest to the floor price (the one most likely to be accepted by the offer) will be judged by the system to receive the majority of points, and the amount of points gained will be proportional to the bidding time.

At the same time, after users deposit their ETH for bidding into Blur platform, they can bid repeatedly across the NFT series, and the points can be accumulated repeatedly.

As we all know, due to the indivisible and high unit price of NFT (blue chip NFT starts at 10E), small quantity (the total amount is less than 10k is the most common), and the difference in rarity (owners may subjectively think their NFT is more distinctive),The floor price often does not match the offer price, and the transaction depth is insufficient, which is the main reason for the inefficiency of matching transactions in the NFT market.

This creates a bad situation:

• & have spentTraders who want to sell NFT quickly to close a position at a fair value often suffer large slip-point losses

• & have spentCapital inefficiency

Blur's approach to the third round of airdrops, however, worked (leaving aside the rights and wrongs of its royalty strategy) :

• & have spentUsers can use their money more efficiently to trade/masturbate;

• & have spentSuch bidding rules encourage buyers and sellers to compete among themselves.The bidder/buyer will try their best to close the offer price to the floor price/fair value of this NFT series in order to obtain the air drop, so that the seller can sell at a better price and obtain better exit liquidity, thus achieving the purpose of improving the efficiency of the transaction matching between the buyer and the seller. The transaction depth, liquidity, matchmaking efficiency and other aspects of Blur platform have been improved.

BendDAO saw ApeCoin pledge activity, staged a grass boat borrow arrows play

BendDAO and Yuga Labs officially launched the ApeCoin pledge activity on the same day

ApeCoin's "Standalone Portfolio Pledge Mining"

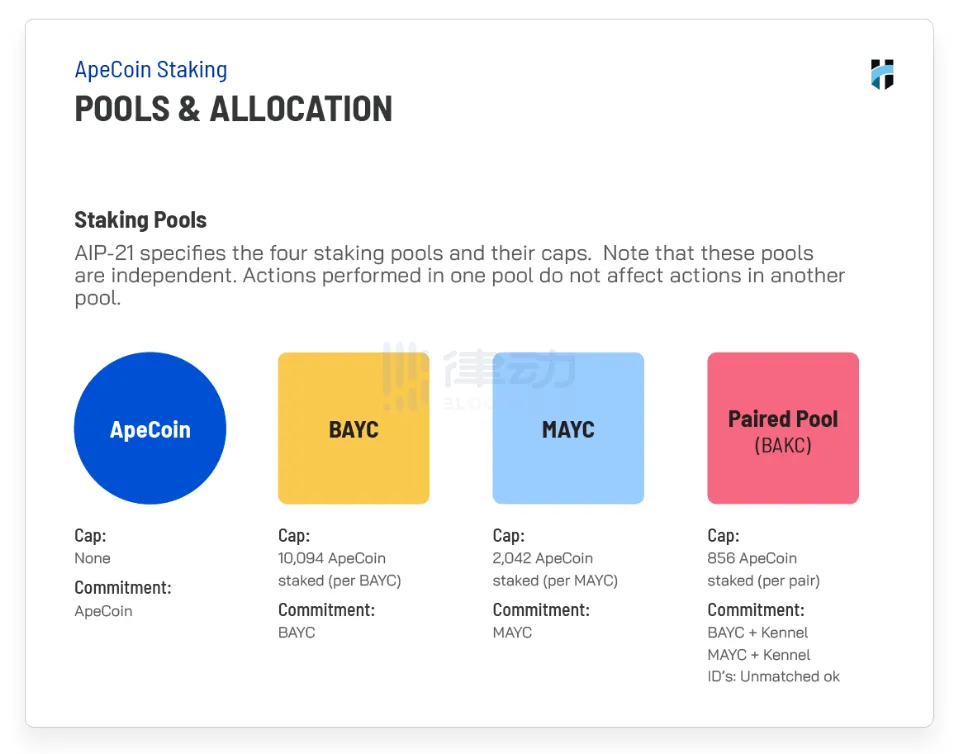

On December 6, Hormizen Labs, responsible for creating the ApeCoin DAO pledge system, was officialannounce, ApeStake.io has officially launched and opened APE deposit. The pledge mining system of ApeStake.io divides user assets into four pools according to categories, namely, ApeCoin pool, BAYC pool, MAYC pool and BAKC matching pool. Users need to hold the assets required by each pool to match by themselves, which can be described as "independent combination pledge mining".

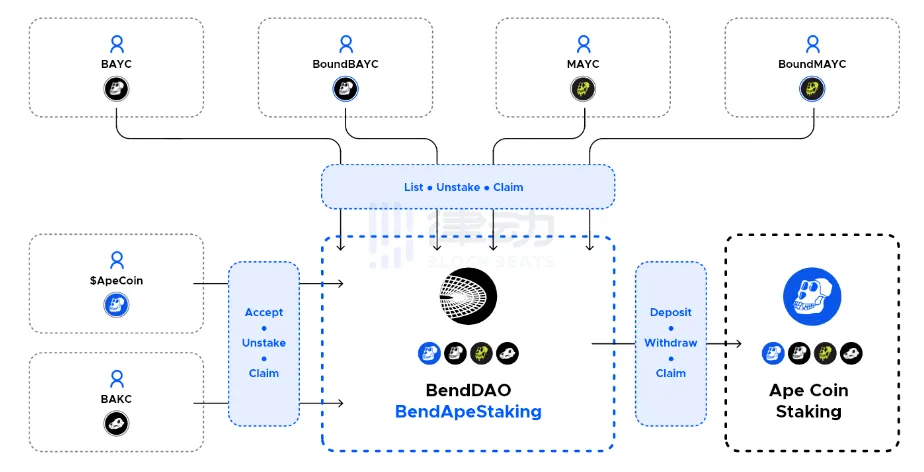

BendDAO uses "paired pledge mining" (photo: BendDAO)document)

Just 10 hours later, BendDAO, NFT's liquidity platform for peer-to-pool lending, followed suitannounceApe pledge system was launched. Different from ApeStake.io, BendDAO broke the restrictions on holding assets and adopted a "paired pledge mining" scheme. Users can participate in pledge mining even if they only hold part of the assets required by the mine pool. In other words, users can mine if they only own ApeCoin or one NFT (BAYC\MAYC\BAKC).

For example, Xiao Ming only has one NFT BAYC (or MAYC\BAKC). If he participates in the official pledge mining, he also needs to replenish the ApeCoin corresponding to the mine pool he wants to participate in, so as to achieve the highest expected rate of return. Now, with BendDAO, in addition to the official "independent combined pledge mining" option, there are other ways for Ming to participate in mining with only one NFT: Xiao Ming can choose 0 ApeCoin to pledge his NFT, and the system will match him with ApeCoin pledged by others, and they will become Co-Staker together. In addition, Xiao Ming can set the proportion of mining income distribution. The more income contribution, the easier it will be matched to ApeCoin.

In return for increasing the chance to match NFT holders with ApeCoin holders, BendDAO takes a 4% cut of the user pledge as a matching service. This revenue is important for BendDAO, but more importantly, it attracts more blue chips to pledge.

Mr BendDAO took advantage of the situation by raising the mortgage ratio

In addition to these features, BendDAO's Paired Pledge mining solution,It also allows users to put their NFT on the BendDAO as collateral for loan or invoice transactions during the pledge mining period. But also take into account the corresponding special circumstances, according toOfficial documentIf the NFT is sold or liquidated during the pledge mining period, the matching contract can, at the appropriate time, uncommit all the tokens and rewards in the pledge contract to be withdrawn and returned to the original NFT and ApeCoin holders through an interceptor.

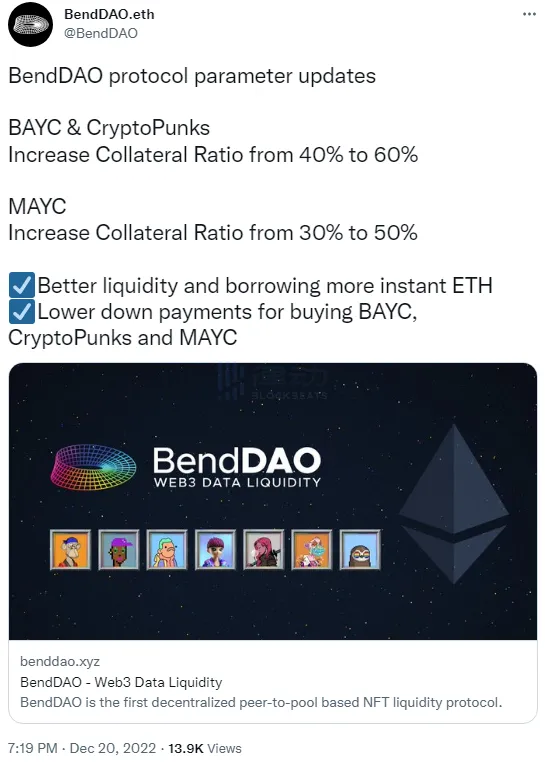

BendDAO announced that BAYC/CryptoPunks/MAYC both increased their mortgage ratios by 20%

With that in mind, BendDAO was released on December 20, 2022announcement, announced an increase in BAYC and CryptoPunks' mortgage ratio from 40% to 60%, and MAYC's mortgage ratio from 30% to 50%. Users will benefit in two ways:

• Better liquidity and the ability to borrow more ETH instantly

• Lower down payments for BAYC, CryptoPunks, and MAYC loans

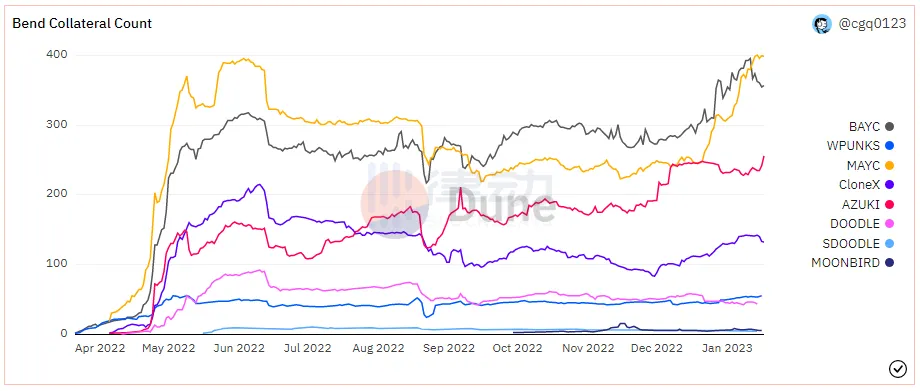

BAYC/MAYC has significantly increased its mortgage volume since December 20 (Photo:Dune)

The results were immediate, with BAYC and MAYC taking out more mortgages that day. According toDuneData, as of publication, the number of BayCs pledged on BendDAO rose from 303 on the day of adjustment to as high as 396, and MAYC rose from 246 to as high as 401. During this period, the amount of money lent by NFT on BendDAO also increased to 28,581 ETH (calculated figures)source), roughly $45.73 million at a recent price of $1,600, most of which was lent through BAYC and MAYC.

The new lending is made up of three main components:

• New user who has just mortgaged BAYC/MAYC and borrowed at 60%/50% mortgage ratio respectively

• Old users who had already mortgaged BAYC/MAYC and borrowed at the old mortgage rate can borrow 20% more now that the mortgage rate has gone up

• New and existing users of other BendDao-supported blue chip NFT complete mortgages (a smaller ratio than the above two points)

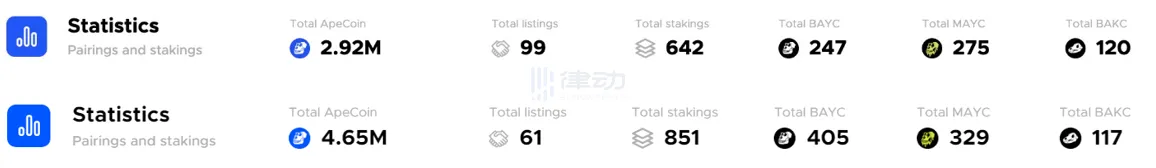

More participants of ApeCoin pledge mining activity on BendDAO (upper: December 16 lower: as of the publication)

In addition, some of these monkey holders, attracted by higher mortgage ratios, are participating in ApeCoin's pledge mining activities. Comparing today with the situation before the mortgage ratio adjustment (16 December), the total number of Apecoins pledged rose by 59.25% from 29,200 to 46,500; The amount of BAYC/MAYC pledged rose from 247/275 to 405/329, an increase of 63.97%/19.64%, respectively.

It follows that,BendDAO has successfully converted the traffic attracted by ApeCoin's pledge mining activities into customers of the platform's main business, and part of the customers participating in mortgage lending will participate in ApeCoin's pledge mining activities. Through the exchange flow of this good drama of "grass-boat borrowing arrows", BendDAO's business of mining, lending, trading, down payment and other businesses all benefit, which can be said to be an overall win.

Good news for the NFT blue chips

Yuga Labs' Jimmy Monkey market is here

"Treasure Box" in BAYC animation video

Yuga Labs has been busy in the last month: in addition to the ApeCoin pledge, the day after BendDAO announced that it was raising the mortgage ratio of Yuga-series NFT, BAYC announced the launch of the"The Trial of Jimmy the MonkeyIn the latest installment of "Jimmy Monkey" and "Treasure Box," there is a Dookey Dash, a temple run-like parkour game that requires holding and matching the "BAYC Sewer Pass" to get in.

Simian Universe asset holders receive different levels of BAYC Sewer Pass depending on their holdings

Refer to theNew BAYC storyline underway: How to play the new Dookey Dash game with the BAYC Sewer PassThere are 30,000 BAYC Sewer passes in total, and BAYC and MAYC holders are entitled to receive free BAYC Sewer Passes.

But depending on the holdings, the BAYC Sewer Pass they received is divided into four sewer levels:

• Hold a MAYC to receive the Tier 1 BAYC Sewer Pass

• Hold 1 MAYC + 1 BAKC to receive Tier 2 BAYC Sewer Pass

• Hold 1 BAYC to receive Tier 3 BAYC Sewer Pass

• Hold 1 BAYC + 1 BAKC to receive Tier 4 BAYC Sewer Pass

Players who hold a higher level of the BAYC Sewer Pass get a higher score bonus in the game, helping to sewer the sewer pass.

The same asset matching scheme appeared in two Yuga Labs events, and the need to create "out of thin air" further drove up the price of the "ape Universe" assets, which would also repeatedly enter BendDAO's "collateralized collateralized loan" flywheel.

Doodles 2 is about to land

Doodles artist and co-founder burnt toast TsengreleaseDescription Suspected Doodles 2 was displayed

According to thereport,2022 年 12 月 19 日,NFT 系列 Doodles 创始人 Jordan Castro 在官方 Discord 宣布,Dooplicator 的效用公布和 Genesis Box 的开图将于 2023 年 1 月后陆续进行,同时 Doodles 2 也将于明年开启内测。Castro 表示,过去一年通过探索其他区块链和 Layer 2 网络,已为 Doodles 2 找到完美归宿。目前测试网合约已部署,同时本周将发布 Doodles 2 角色预览。 此外,Castro 就产品延迟推出向社区致歉,并指出延误的主要原因在于「对产品性能有高标准」,同时还存在一些技术/架构上的决策和业务方面的考虑。

The announcement means that after almost a year of being dormant, Doodles will finally begin continuous deliveries of Doodles 2 products from January 2023, in anticipation of a surge in sales of the related series.

Moonbirds is driving the conversation and imagination in Hollywood

January 7, 2023, according to The Blockreport,NFT 项目 Moonbirds 创始人 Kevin Rose 与好莱坞大型经纪公司 United Talent Agency(UTA)签约,UTA 将管理 Kevin Rose 及其所有子公司的 Web3 权益。 自 2014 年以来,UTA 一直通过其 UTA Ventures 部门进行投资,投资过 Cameo、Consensys、Masterclass、Patreon、Pietra 等公司,去年 10 月 UTA 与 Investcorp 合作推出投资机构 UTA.VC,将重点投资创作者经济和 Web3 等。

In addition, the Moonbirds II Oddities series will also move forward in 2023.

Azuki anniversary and the anticipation of the coin issue

The Azuki was launched in a Dutch auction on January 12 last year, and the gas-saving ERC721A protocol has made a mark on the NFT world with its innovative ideas and East-meets-West aesthetic.

After a year of ups and downs of development, Azuki has always maintained in the top blue chip echelon. According to the above timeline of Blur, BendDAO and Yuga Labs, Azuki's anniversary will be celebrated on January 12, 2023.

The contents of the $BEAN Token were actually written in MindMap on the Azuki website a long time ago

Without a doubt, anniversaries are great marketing milestones for every NFT project. It is a time to reflect on the big events of the past year, summarize the project delivery, and look to the future with the community and Holder.

对于 Azuki,在展望未来时,「发币」始终是一个好主题。于是从 12 月开始,$BEAN 不断被各个社区提起,人们看到关于 $BEAN 的截图如获珍宝,一时之间以为「『发币』将在周年庆发生 」 这件事已经通过这个「证据」被坐实。然而实际上,关于它的内容在 2022 年早些时候就已经出现在了 Azuki 官网的 MindMap 中,并不是新内容。

Azuki's virtual cityHilumia

However, Azuki did deliver new content for the anniversary.

After "Street" and "Relic", Azuki welcomed itworldviewThe third chapter of the Virtual CityHilumia。Azuki NFT 持有者或社区参与者现在可以参与探索,其中包含了一个高品质玩具店 Slowpoke's Toy Haven、设计平台 Ember Square、滑板爱好者社区 Golden Skate Park、以及意见「收集箱」Garden Express。 目前 Hilumia 尚未发布正式路线图,但社区认为该项目可能会是 Azuki Mindmap 的沉浸式版本。

Celebrate the NFT market "spring", with a timeline to clarify the various coincidences

The main participants of this NFT market "Xiaoyangchun" project progress timeline

By combing the time line, we can find the driving force of the NFT market recovery in various stages:

1. Firstly, Blur's airdrop activity has warmed up the NFT market. The three rounds of airdrop activity since October are more like cultivating users' habit of continuing to use Blur for trading.

2. Then, ApeCoin's pledge activity was launched. BendDAO followed the official steps and adjusted the mortgage ratio of NFT related to it.

3. Finally, all NFT blue chip projects simultaneously released good news in the short term, boosting market confidence, creating demand and driving up both price and trading volume.

Beware of the "over-leverage" crisis

NFT's Google Global Search Index continues to decline

According toGoogle Global Search IndexIt shows that the popularity of the NFT has continued to decline over the past year, with the only rebound occurring in mid-2022, presumably thenTrump NFTSale caused concern, after the heat continues to maintain a downward trend.

This can be verified from the side, this NFT market recovery is not caused by the new flow and new funds from the outside world, such a "false bull market" should be vigilant.

Add leverage, and how big is the "bubble"?

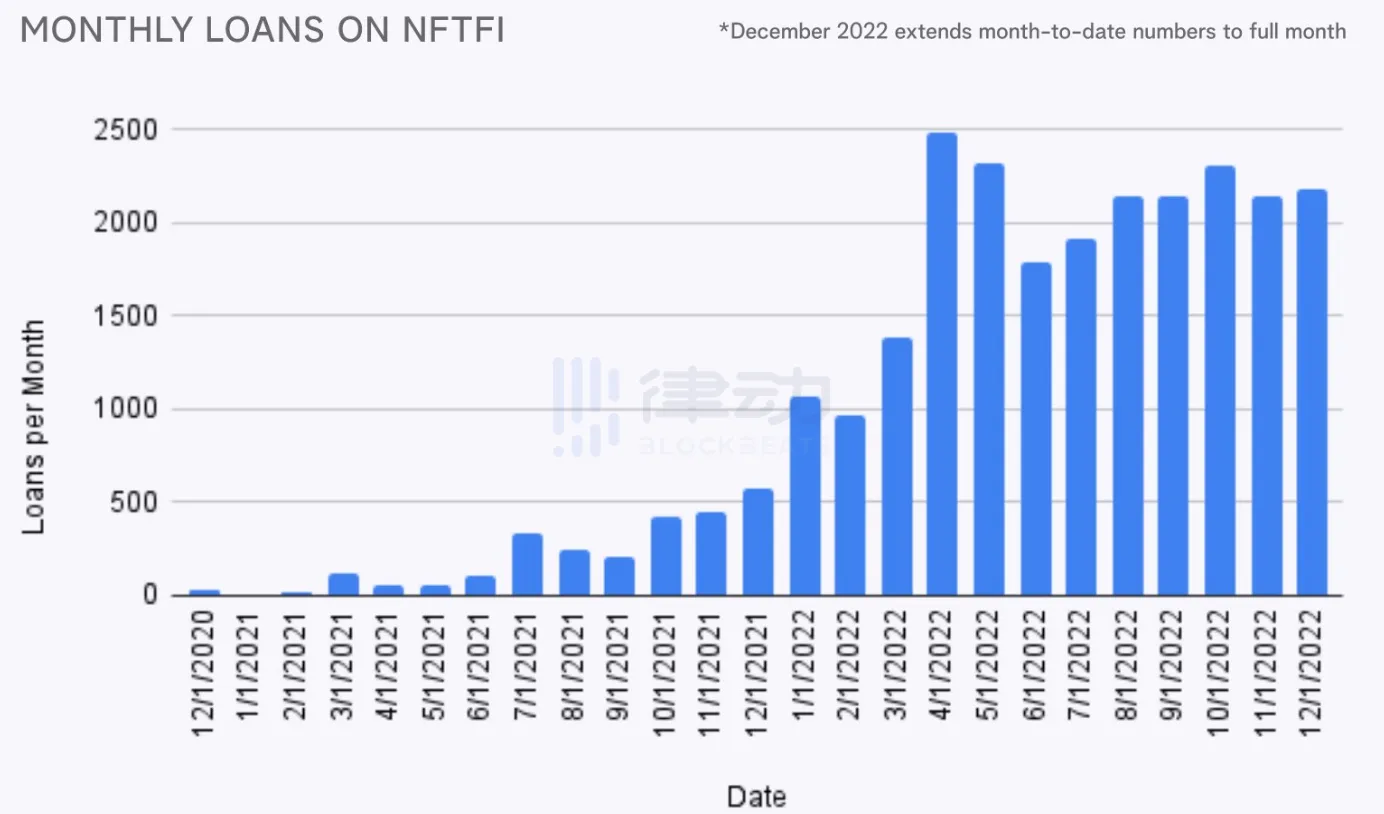

NFTFi monthly loans

According to PROOF analystsWarDaddyCapitalAccording to the latest report, despite the low volume of bearish NFT transactions, the number of NFT related loans issued is now close to the April 2022 high. Total lending to NFT on the NFTFi platform is close to an all-time high.

Number of NFTFi borrowers

More lenders are entering the market, with the total number of borrowers peaking in March and April, but lenders are now hitting new highs. As a result, the APR on borrowing has fallen sharply over time.

At the same time, the mortgage ratio of each NFT lending platform is not the same. BendDAO, which is introduced above, improves the mortgage ratio of some top blue chips. Some platforms such as Rollbit can even set the mortgage ratio as high as 80%. Increasing leverage blows the bubble bigger and bigger.

Unsustainably high APY

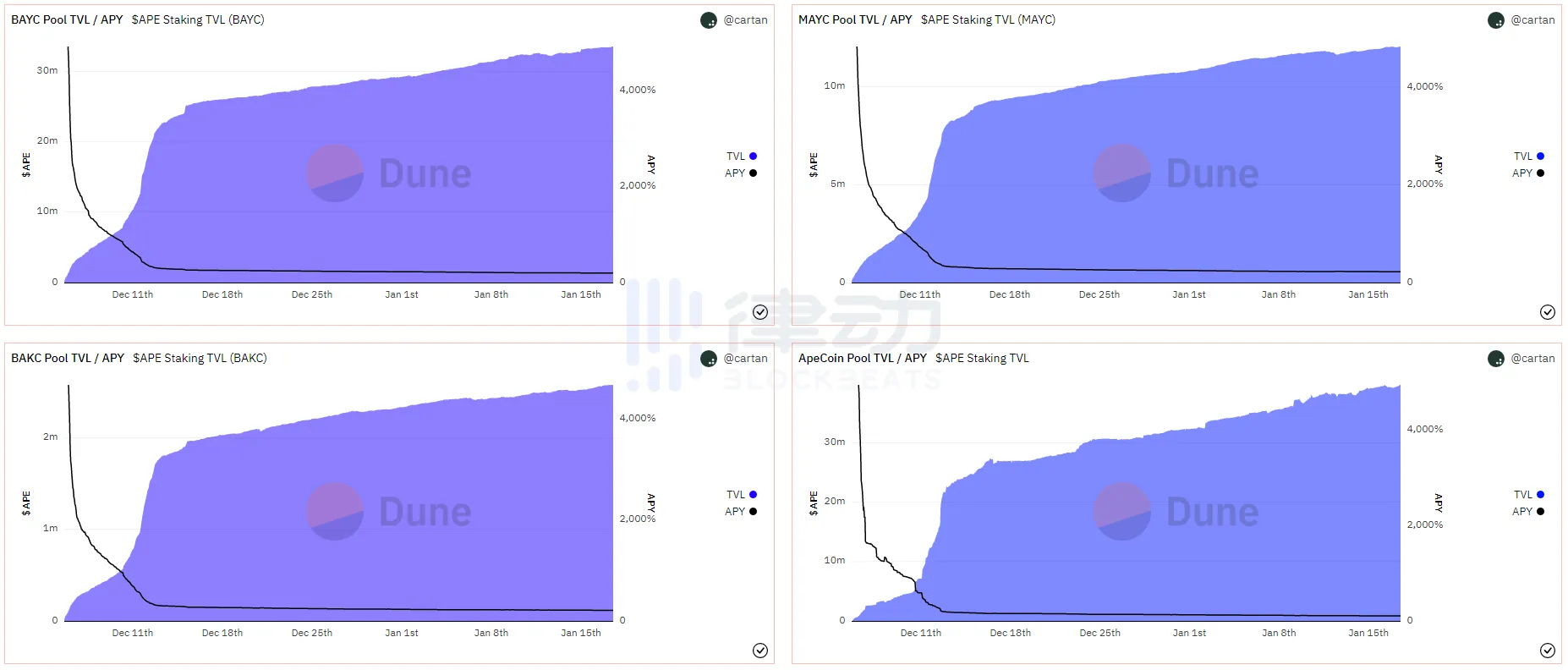

ApeCoin pledge mining APY changes for ApeStake.io official four pools (Figure:Dune)

ApeCoin's unlock curve (Figure:TokenUnlocks)

According to Dune data, the APY of the four ApeStake.io pools decreased from nearly 5,000 percent at the beginning to about 200 percent at present within a month after the initiation of pledge mining, all in the form of an inverse proportional function.

The unlocking of ApeCoin's Token will inevitably increase the supply of ApeCoin in the market. Almost the whole token economics follows the old-fashioned Ponzi model. The high APY is unsustainable, so how to guarantee the safe exit of investors who enter at various stages is a problem. Similarly, the Token economy model for BendDAO is also about unsustainableQuestioning voice.

The end of Blur's airdrop could set off a chain reaction

As mentioned above, Blur's airdrop activities have warmed up the NFT market. In particular, the third round of airdrop activities has improved the transaction depth, liquidity, matchmaking efficiency and other aspects of Blur platform.

However, cause and effect follow each other. When Blur's airdrop activity ends, the unprofitability may lead to the cancellation of a large number of bidding orders, and its advantages in terms of transaction depth, liquidity, matchmaking efficiency and other aspects will be sharply weakened in a short time, thus losing the buffer against the large fluctuations of NFT market.

If things get worse and the NFT market falls, there will be a chain reaction:

• After the user deposits his ETH for bidding into Blur platform in order to obtain airdrop, he may participate in multiple NFT series repeat bidding with the same amount of money. When one of the NFT series has been bid down, the bidding order will be completed, which will cause the money to disappear in the bidding of other NFT series. It also means a loss of trading depth and liquidity;

• Some of the NFT lending platforms currently maintain high collateral ratios, making liquidation more likely to be triggered when the NFT market falls. When combined with the sudden reduction in Blur market liquidity, runs and bad debts may be more likely to occur.

conclusion

Looking back on this short month, it looks like the NFT players were all in cahoots: Blur was the first mover, laying the groundwork for liquidity and warming up the market; BendDAO is the "main course", which releases the capital liquidity of top blue chips by ApeCoin's top current activity, and "new money" comes from here; NFT blue chip to play "dessert", money has been in place, release good news to boost the market, dealers retail pull together.

The symbolism is that this is almost a mini-bull market driven by NFTFi, and BendDAO picked a good time to pull the trigger. But the financialisation of the NFT market has always been a double-edged sword: on the one hand, we hope that NFTFIs and NFT financings will bring more liquidity to the whole market and improve the utilization of funds, on the other hand, we fear that undermortgaging and over-leveraging will trigger a terrible event that triggers a thunderstorm.

Be prepared for the worst, or at least not be turned from leader to scapegoat when the building collapses.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR