Blur founder Pacman: We want to make the NFT market more liquid

Host: David Bankless

Guest: Blur founder Paceman

Compiled by Kxp, BlockBeats

Blur's three-season airdrop has been the focus of the crypto market chase since late last year. Lately, Blur has been growing exponentially, even in the NFT market, which was briefly dormant.

Blur has a number of figures that shine, including the fact that the volume of Blur transactions in the past week (13 -- 19 February) was nearly $390 million, four times the volume of OpenSea transactions in the same period ($89 million). Market hot discussion: Whether OpenSea, which has long occupied the leading position in the NFT market, is really untouchable?

For the first time, OpenSea is taking a passive defensive step: on February 18, OpenSea announced that the transaction time limit has been reduced to zero and that it has enabled optional royalties. "Since October, there has been a shift in active transactions and users to the NFT market, which does not fully execute creator revenue," OpenSea admits. "Despite our best efforts, this shift has accelerated dramatically." In a rare move, OpenSea was briefly forced to hand over the ability to dominate the rhythm of the NFT market in exchange for the brutal growth of Blur.

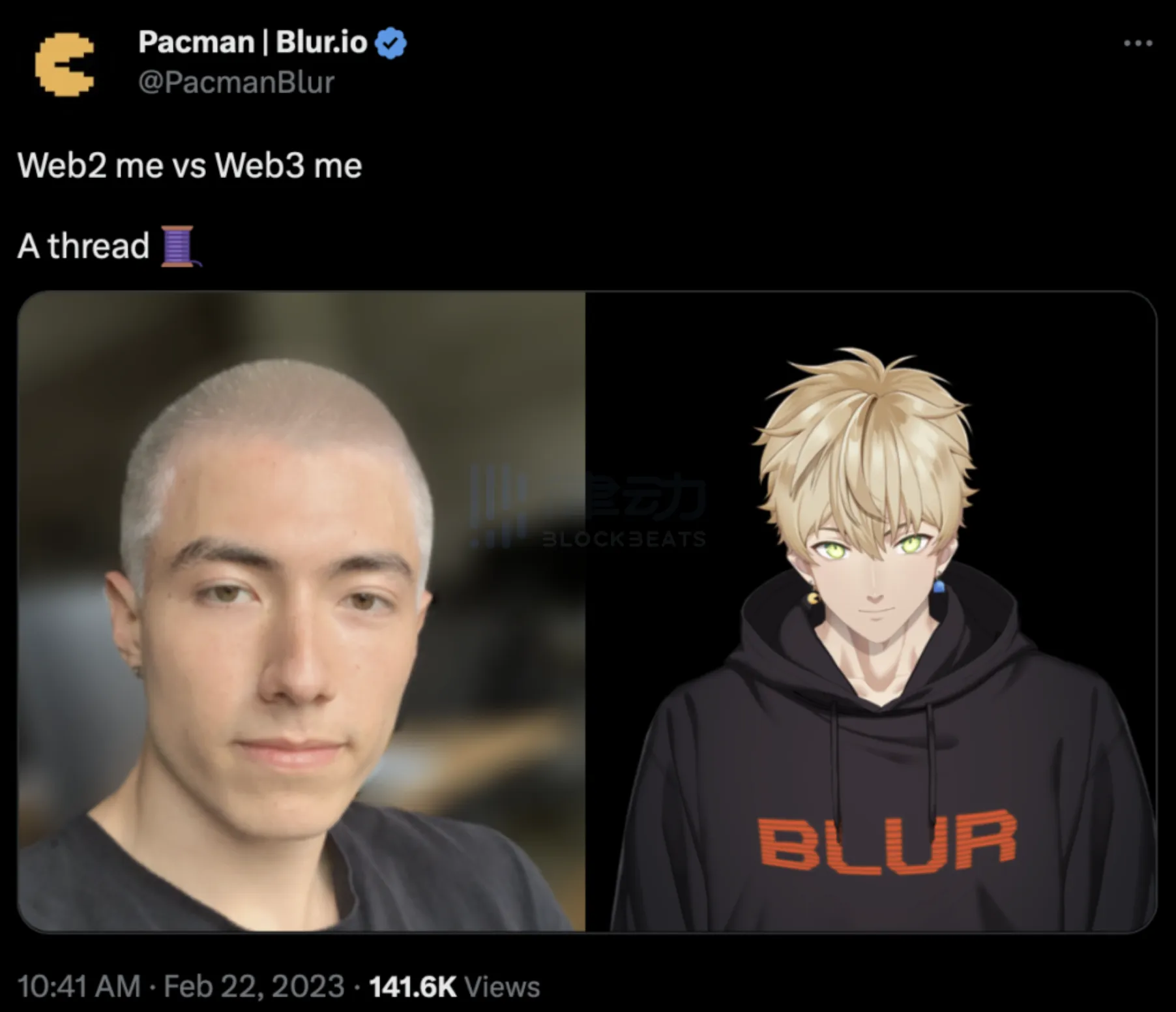

Earlier today, Blur exploded the Internet again in a surprising way after founder Pacman posted photos and a biography on social media.

Bankless conducted an exclusive interview with Pacman and discussed with him about BLUR airdrop, growth strategy, royalty and other related topics. BlockBeats combed and translated them as follows:

David: Welcome to this very special episode of Bankless. Today we're going to talk about the airdrop that happened recently, because it burned the highest amount of Ethereum ever in 24 hours, which I'm really excited about. We're talking, of course, about the Token that the Blur NFT exchange has just released on the market, and it's getting a lot of attention. Some quick stats: Blur has more than $1 billion in transactions, more than 1 billion transactions, and nearly 100,000 active users. It has been gaining market share since late 2022 and has overtaken Opensea. So we brought in Blur founder Pacman to talk about how Blur are positioning themselves in the world of NFT. Who is their target audience? A trader or a collector? How do they plan to grow Blur, and how is this recently airdropped Token organized? What does this Token do? In addition, there are a number of copyright disputes are currently a hot topic in NFT circles.

David: Hello, we have Pacman here today. Pacman, welcome to the show.

Pacman:Thank you very much for inviting me.

David: Pacman, we'll be talking about the Blur NFT exchange market, airdrops, and copyright battles, but as Bankless listeners may know, I'm not focused on the NFT world, but on the DeFi, protocol, or Tier 2 realms, so I wanted to start this conversation with the basics. Can you tell me a little bit about yourself, why you started Blur and how the idea came about in the first place?

Pacman:No problem. I can tell you about my background. I started in engineering about eight years ago in Silicon Valley. I started out as an engineer and quickly started my own business. In 2016, I participated in Y combinator's accelerator program. For those who know about the Web2.0 space, they know about Y combinator, as they've funded well-known companies like Dropbox, Stripe, Airbnb, and Reddit. After that, I really wanted to go to school and ended up going to MIT to study math and computer science, where I met my co-founder Galaga. We hit it off immediately and started working together from the start, first on side projects, then left MIT to start our first company in 2018. We ran the company for three years before selling it at the end of 2021 and immediately began development of the Blur project. The reason is that I personally loved NFT in 2021 and bought my first NFT Bloodmap. I was totally hooked on the NFT trade, but I was very frustrated with the existing market infrastructure. All the existing markets are very retail and very slow and cumbersome. I wanted a more professional NFT trading platform, so we started Blur.

David: So, you positioned yourself early on as an NFT trader, and that's what attracted you, but the lack of an NFT trader infrastructure was the main impetus to start Blur.

Pacman:Yes, it is.

David: Can you talk specifically about some of the weaknesses you saw in NFT trading before Blur?

Pacman:As someone who knows more about the Token space, I would like to compare the progress of the NFT market to the progress of Token trading. The initial infrastructure, like Mt.Gox or Coinbase, was rudimentary and retail-oriented. However, as industry demand grows, infrastructure development becomes more sophisticated and financial oriented. We've seen the growth from retail-friendly platforms like Coinbase to more Crypto native trading platforms like Binance, OKEx and BitMax that are more financialized. Similarly, the NFT market has only recently experienced growth and the infrastructure has not had enough time to develop, although demand in the sector has been expanding. Our goal is to meet users' needs for specialized infrastructure.

David: Can you explain the niche Blur is aiming for in the NFT world?

Pacman:The existing market that preceded Blur provided a satisfying shopping experience for NFT newcomers, but it was inadequate for active collectors or traders looking to buy or sell in bulk, monitor real-time market trends and make quick decisions in a volatile market. The avalanche of orders from popular collections caused the platforms to crash. Prior to Blur, the NFT market platform treated NFT as a shopping experience, which was fine for newbies, but it didn't meet the needs of advanced traders looking for real-time order books, real-time order speed, depth charting, fast charting capabilities, and real-time data updates. Blur was designed from the beginning to cater to the needs of professional traders, as evidenced by our early announcements and blog posts.

David: OK, so you're optimizing for people who are really inclined to the financial side of these NFTs, these NFTS are tokens, so they have some kind of financial side attribute. Other people might just browse through Opensea and say, "Oh, I think I like that. I think I'll add it to my shopping cart." These people are obviously not the target audience for Blur, the target audience for Blur is the power users in the NFT industry, am I right?

Pacman:It must be. When people buy Bitcoin, ETH, or any other Token, they are usually looking for its utility. However, the trading platforms that trade these tokens are primarily designed to facilitate trading and speculation, which is a common phenomenon in any market. These platforms play an important role in serving the needs of traders and speculators. For Blur as a protocol and a market, our focus is on increasing the liquidity and efficiency of the market to facilitate growth, just as advanced trading platform infrastructure and tokens enable growth in the wider space.

David: Prior to our conversation, I looked at some statistics from Dune Analytics, and I'll reiterate what I shared earlier: $1 billion in total transactions, more than 1 billion transactions, and nearly 100,000 active users. What has Blur developed that attracts so much volume and deal activity? Suppose we want to create an NFT market that is highly optimized for power users. In that case, let's talk about what this is all about. What has Blur built that makes these users want to take advantage of their platform?

Pacman:David, thank you for taking the time to do some research, it's over a billion, 1.2 billion specifically. Hill Dobby has a great analysis chart, which I'll share later, that he did exhaustively. Imagine the Token exchange market if Coinbase was the only Crypto native exchange and other exchanges, such as Binance, ceased operations, which is exactly what the market looked like 394 days ago when Blur started work. The NFT market, which at its peak was trading $4 billion worth of transactions a month, relied entirely on basic, non-specialist infrastructure. One of our products, Blurbidding, integrates the UI and protocol, allowing traders to bid using ETH, with the bid order book displayed directly on the market. While this is a fundamental feature of the Token trading space, it has greatly impacted the NFT industry. Now that traders can examine the order book, they are more confident when buying NFT and have a better chance of sustaining the price. Order books were not a basic feature of the NFT world until Blur introduced this feature.

David: Blur has rolled out UI and user interface upgrades, more visualization of the state of the market, and some on-chain optimization of the way transactions are executed. It does sound like these changes will give users more data and tools to refine the financial attributes of the NFT.

Pacman:Before we released Blur bidding, bidding on NFT required users to convert their ETH to WETH, which was a messy experience even for power users. We have streamlined the process at the protocol level, allowing users to bid by depositing ETH into their own pool of funds, which not only enables bidding, but also enables the purchase of NFT. This simple concept fills an important gap in the market, and protocols like Uniswap are enabling the DeFi world to grow by serving unmet needs. Blur's products and protocols are simple, but they fill a need that was previously unaddressed.

David: As you mentioned, you started working on Blur 394 days ago, and a year and a month later, you released the Token. Token airdrop is the reason for this interview with you, because tokens always arouse people's interest. Can you discuss the story of the Token and what stages it went through before it finally made it into the public eye? Can you walk us through how this Token was conceived, born, and released to the public?

Pacman:All aspects of Token and Blur were planned from day one. The market presents a clear opportunity to build a Crypto native trading platform where most existing markets fail to take into account the capabilities of Web3. DeFi was the inspiration for Blur because in Web2 it was impossible to give the end user control of the platform. In contrast, Web3 allows the end user to control protocol and value accumulation, and to participate in the network through incentives. NFT enables decentralized ownership of digital collectibles, but they are traded on the Web2 marketplace. Despite its obvious adjacency to DeFi and Token, it clearly lacks effective infrastructure and business model consistency. We wanted to build Blur because we wanted to improve on those deficiencies.

David: Your initial concept was to create an NFT marketplace that would have a native Token. This is a response to Opensea due to state regulation and its limitations as a Web 2.5 platform. Your goal was to improve the trading experience in the NFT market while integrating a Token from the start, so was the Token part of the plan from the start?

Pacman:Of course, the difference between agreements is whether they were intended to be decentralized from the start, as is the case with most existing agreements today. For example, Uniswap could have been centralized, imposing restrictions and KYC on each user, but instead it was developed to facilitate decentralization. Similarly, after studying existing markets, we found that they were designed with a Web2 approach and lacked a focus on decentralization from the start. Given the importance of network effects in determining the success of a protocol, it is clear that the protocol controlled by the end user will win in the end. This was the driving force behind our decision to develop a NFT market with user control at its core.

David: The concept of Web3 is centered around community ownership and control. While creating a Token is easy, actually distributing it to the community in a meaningful way is a different challenge. Can you elaborate on Blur's strategy for issuing tokens to ensure that it is distributed to the appropriate community members?

Pacman:When planning airdrops, our priority is to encourage mobility rather than volume. Incentivizing volume tends to attract traders on the sidelines or arbitrageurs, who can profit from a fake trade until it is no longer profitable. Other marketplaces that incentivize trading volumes have also run into this problem. In contrast, successful DeFi platforms like Curve incentivise liquidity on both sides of the peg, which helps maintain the anchoring relationship between tokens. The incentive to trade comes from having good liquidity. We chose to incentivise liquidity and get the tokens into the right users' hands because this can bring real users into the space and they will maintain the network effects even after the incentives are gone. To test this approach, we ranked the airdrop rewards, so the first issue of the rewards was published on Blur and provided selling side liquidity.

David: Before we talk about that airdrop, can you give us a quick overview?

Pacman:We took an unconventional approach to the airdrop and were very explicit in asking for liquidity to be provided to Blur, first to the sellers and then to the buyers in order to get the airdrop. This is because we believe that incentives should incentivize behaviour, and purely retrospective airdrops can be a waste of resources that could be used to develop agreements. We want to reward early adopters who help establish the network effects of the protocol from day one, rather than users who come in after the network effects have already been established. By allocating our funds efficiently, we can promote growth and achieve the ultimate goal of our agreement. We designed our airdrops to be multiple rounds until the Token is finally issued to achieve this goal.

David: Yes, you did multiple rounds of airdrops, and the important thing is that you clarified the criteria for accepting airdrops, which is something that other projects don't do at all because they're afraid that speculators or arbitrageurs will abuse the system. Am I right in thinking that there is no loophole in the rules for accepting airdrops?

Pacman:Indeed, this is a challenging problem, because when incentive systems are clear, they tend to attract people who are trying to find loopholes. Some of our early investors made their fortunes by figuring out how to take advantage of the early DeFi summer incentive system in ways that creators never even considered. Incentive liquidity, however, is less easily exploited because liquidity is liquidity, whether from miners or genuine bidders. By bidding on the order book, people take a real risk, and it cannot easily be changed. While there are ways to hack the system, such as cancelling bids before they are filled, or operating before a trade, we focused on creating a mechanism that allows users to provide liquidity that is difficult to attack. If we can do that, then a clear system can work well and bring real value to the network. The solution may not fit all protocols or airdrops, as it is not a one-size-fits-all solution, but it is vital for Blur to build network effects and liquidity in a market that is competing with platforms already worth tens of millions of dollars. So we have to focus on ways in which we can develop the agreement.

David: OK, so let's talk about the three stages of airdrop standards. Can you walk us through each stage and its objectives?

Pacman:Of course. The airdrops were carried out in three phases: the first phase was a retroactive trading airdrop based on the volume of transactions in the six months prior to October 19; The second stage is the listing airdrop, which rewards those who list in Blur and provide liquidity to the order book; The third stage is the bid drop, where the reward shifts entirely from listing to bidding. Interestingly, after stopping listing incentives, we saw an increase in the number of sell offers, indicating that the program was having an effect and bringing real users into the agreement. Our focus is on incentivizing buying liquidity to fill the order book. The purpose of this strategy is to create a network effect for the market.

David: Did you accidentally influence the price of any NFT in the process? What are the side effects of this?

Pacman:Blur's incentives are interesting because there was a Twitter hashtag that went viral when they tweaked them. Initially, people claim that incentives hurt the floor price, but when the incentives are transferred to the buyer, people still claim that incentives hurt the floor price. This is shocking because it usually supports asset prices. As the Token offering approaches, there is speculation that the incentive is coming to an end, and the people who started that conversation claim that this will cause the floor price to collapse again. This chain of events reflects the fact that any form of incentive, regardless of its direction, has a negative impact on the floor price.

David: Well, it does sound like something that happens on CryptoTwitter, often with extreme marketing strategies.

Pacman:I agree, the term "anger marketing" seems to fit the case. But I would argue that liquidity is mainly about enabling assets to find their true market price, rather than directly affecting the price itself. If a change in liquidity does lead to a change in price, it indicates that the perceived price was not accurate, and that the floor price, bid-ask spread, and list price do not truly reflect the value of the asset. In reality, the price of an asset is not a static number, but people tend to anchor around a specific number. Liquidity incentives offer a different perspective on the true price of assets, but it is still a limited perspective. Ultimately, liquidity is only one aspect of an asset's true value.

David: The instantaneous price of an asset provides only a fleeting glimpse of the big picture. Also, I would like to know more about the current status of the Token. Specifically, how many people have received airdrops, what is the current supply of tokens, and how does it compare to the supply of tokens that have been issued? Could you tell me more about the Token indicators?

Pacman:The total supply of the Token is 3 billion Blur, with airdrops accounting for 12% or 360 million Blur. A significant number of airdrops have already been claimed, with the remainder available within the next 60 days. The structure of Blur tokenomics is similar to Uniswap, with simplicity and clarity. Blur is an NFT trading platform protocol and Uniswap is a Token trading platform protocol. From a higher perspective, they are essentially the same. In a bear market, in a back-to-basics scenario, the straightforward tokenomic design is preferred over the complex design of protocols such as Curve and GMX. While these complex designs are strong in bull markets, they are less ideal in bear markets. The Blur agreement is flexible, allowing the community to vote and use the Vault Token for future tokenomics designs. The Token will be vested in the holder, providing a clear picture of the value of holding the Token.

David: Now that the airdrop is over, I would like to ask you some details about the Token price. Currently trading at 70 cents on CoinGecko, the total supply of tokens is 3 billion, equivalent to a market capitalization of $2.1 billion. If my calculations are correct, a 12 percent airdrop to the community is worth about $250 million, and that's just for the first season, since the second season has already begun. Can you talk about the user reaction to the $2 billion market cap and the allocation of $250 million to airdrops?

Pacman:I also believe that protocols and tokens should provide value to the community. In addition, we believe the Token makes sense because of the business activity taking place in secondary markets such as Opensea, where the value is concentrated in the founders and a few funds rather than the community. The power of the protocol is that it can give the Token to the community. If we execute this strategy effectively, we can bring billions of dollars of value to the community. As an end user, I would choose to use a protocol that pays me to control it. To be able to distribute $240 - $250 million worth of value in the first quarter is incredible. Not only that, but Blur's Token works with the community to distribute more value to them, which will ultimately be in the best interest of the agreement. Capital allocation is important when it comes to protocol governance and allocating tokens through governance. We must allocate capital to productive use cases to further advance the protocol. We will continue to contribute in this direction and ensure its value. If the community allocates tokens efficiently, it will bring high returns to the members. What we're doing today is just one of those experiments.

David: I have a final question. As we discussed, Opensea has equity, and all the value of that equity is far removed from the Web3 world. I've looked at some of the transaction numbers and it looks like Blur is starting to approach Opensea's transaction numbers. Blur has a secret weapon in the form of a Web3 world Token, a tool that Opensea does not have, do you think this tool will make Blur number one in the NFT market and dethrone Opensea?

Pacman:Your question is a very good one, and as a stickler for metrics, I'd like to point out that Blur has done about 30 per cent more transactions than Opensea in the past week. However, we have to maintain this trend over a long period of time to finally succeed. I think there are several layers to this, one of which is that Blur serves an area of the market that has not been properly served before, namely the professional trader. The value of the Token is an incredible tool that can realize huge potential that was not possible before. When you think about the players who might want access to the NFT space, these include not only NFT traders or users of the space, but also onlookers who are keenly aware that the space is growing. Despite the collapse of the FTX and the institutions we relied on for liquidity, all the growth Blur achieved was sustained through the worst bear market we have ever seen. The NFT space has shown that it's persistent and sticky, and once people get into it, they get hooked. It used to be hard to get exposure in the NFT market, especially for large funds looking for a $100 million exposure. However, with Blur's leading market share in this area, it has effectively become an index about NFT and, more specifically, the fastest growing segment of NFT, the professional transactions. This index is an important development that could enable more participants to access NFT in a way that was not possible before.

David: How did Blur Token perform? While market forces generally dictate this, what governance privileges does the Token provide to the Blur platform? How do you think it will be received by the financial community, and what will people think when they see this Token? Does it only offer broad exposure to NFT, or will it be able to pick specific NFT winners?

Pacman:The perception of Blur tokens varies from participant to participant. For active NFT traders, the Token is a means of gaining agreement growth and rewards. For others, especially those who find the field challenging, it may provide a passive opportunity to gain access to a rapidly growing market. The potential for NFT is huge, especially for the next generation of consumers who have grown up in the age of digital goods. Blur offers these users a way to passively participate in the NFT market.

David: So, let's talk about season 2. What's in Season 2? You said the second season has already started, so can you tell us more about it?

Pacman:Season 2 will not have the original 12 percent airdrop, as it was designated for Season 1. However, it still has a sizable pool of coffers available for the community to vote on for future awards or other initiatives. These measures may include translation services, new sub-DAOs, or other programs, not just incentive programs. One important reason for continuing to offer incentives is that listing volume increased even though listing incentives were discontinued in the first quarter. When considering efficient capital allocation, it may not make sense to continue to allocate large amounts to listing incentives. Looking at the current NFT infrastructure, it is still somewhat rudimentary, lacking many advanced financial primitials. Since NFT is a different asset class, it is not just a trade, but more of a combination of shopping and trading. While Token infrastructure has been developed, there is still room for more growth and specialization in the NFT space. Given this potential for growth and development, it makes sense to continue offering rewards in Season 2, as new behaviors and products may be introduced, not only from the core contributors, but also from the community. The community has already shared some exciting ideas with us that can be built on next season.

David: The overall idea of Season 1 was to distribute tokens among the community, and the goal of Season 2 was to give the community a voice through governance using tokens. This means that season 2 should motivate not only users to use the agreement, but also the community to participate in the management of the agreement, right?

Pacman:Yes, the incentive committee has a specific allocation and can use up to 10 percent of the reward in the second season or later. Anything above that, however, can be harnessed through governance. For example, recent Optimism airdrops were distributed to those involved in governance, highlighting the value of such engagement. To further increase the value of the agreement, we need to decentralize the community of holders and the entire decision-making process, thereby promoting growth. The malleability of Blur's agreement presents a huge opportunity, and a large pool of funds can be used to allocate incentives to facilitate the development of the agreement.

David: governance is really hard to manipulate, so there is no such thing as "governance farming". I think season 3 is too far away at this point, because it may only be determined by the rulers who appeared in Season 2, isn't it?

Pacman:I think so.

David: I have one last question about the NFT royalty dispute. Although this is a topic that needs to be discussed in more depth, I would like to talk briefly with you. From my DeFi perspective, it looks like Opensea and Blur are in a tug of war over how to execute royalties, with Blur prioritizing optimizing the transaction experience and Opensea focusing on artists and royalties. Do you have any thoughts or insights to share about this ongoing conflict?

Pacman:This is an interesting question. We have different ideas about what will work in this area. About two to three weeks after its launch, Opensea issued a new policy requiring collectible creators to have a filter to filter Blur in order to earn royalties on their platform. We have adopted this policy to enforce royalties on collections with filter Blur, as it temporarily discourages transactions that do not honour royalties. The problem is that other platforms, such as NFT's AMM and zero-royalty Web 2.0 style marketplaces, do not enforce royalties and thus attract the attention of many traders. Markets tend to lower fees over time, and enforcing royalties across the board can create an incentive for new players to enter the market without charging royalties in order to grow. We are trying to design a system that can achieve a steady state and is sustainable. We take full royalties on all collections that include filters, but we know that's not viable in the long run. We also impose a minimum 0.5 per cent royalty rate on existing collections to increase enforcement without forcing traders to leave. We want to avoid dangerous centralization, so we take a more game approach. We predict that we can reach a stable state in five to ten years, and we are working towards that. When we introduced the bids and incentives, there was some suggestion that Blur was hurting floor prices regardless of the incentives, showing that the market didn't always reach the same conclusion as us. We are trying to do our job as the operator of this space and keep guiding the market in the right direction.

David: Of course, I really appreciate your willingness to share your thoughts. They are very in-depth. You have a very integrated strategy in place and you are executing it aggressively. Thank you for all you have done to help grow the field and I look forward to seeing what the future brings to Blur.

Original link

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群:https://t.me/theblockbeats

Telegram 交流群:https://t.me/BlockBeats_App

Twitter 官方账号:https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI