Binance Research: Real world assets tokenized RWA, bridging TradFi and DeFi

Real World Assets: The Bridge Between TradFi and DeFi

Original source: Mac Naggar,Binance Research

Web3 law

Currently, the total market value of virtual assets (mainly virtual currencies) is around $1 trillion, but according to McKinsey, the global financial system's annual transaction volume exceeded $5.76 trillion, and its market value exceeded $487 trillion. These data reveal the incredible value of real-world assets under the chain and the importance of connecting centralized and decentralized systems. Tokenization of real world assets (RWA) can serve as a bridge to achieve grafting and is likely to be the next big DeFi narrative.

This article compiles a report published by Binance Research on March 2, 2023: Real World Assets: The Bridge Between TradFi and DeFi, to be used as a learning reference for individuals exploring the world of Web3.

1. RWA background

对于大多数 DeFi 协议而言,投资者基于链上活动获得收益(如 DEX 交易费用,贷款协议产生的收益,以及最近火热的 LSD 等)。除此之外,一种新的真实收益(Real Yield)来源正在逐步崭露头角:存在于链下的现实世界资产(Real World Assets, RWA),通过 Token 化(Tokenization)之后带到链上,作为 DeFi 生态的另一种收益来源。

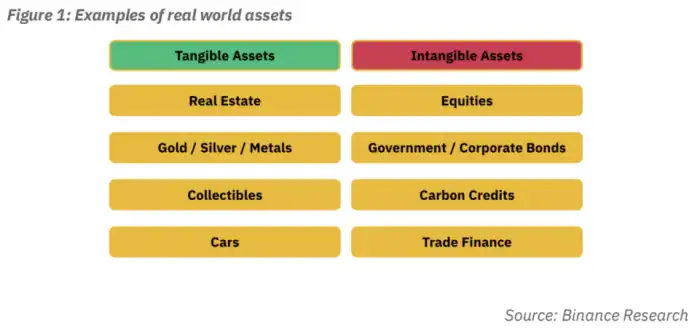

RWA 可以代表许多不同类型的传统资产(包括有形资产和无形资产),如商业地产、债券、汽车,以及几乎任何存储价值可以被 Token 化的资产。从区块链技术的早期开始,市场参与者就一直在寻求将 RWA 引入链上。传统 TradFi 机构如高盛(Goldman Sachs)、汉密尔顿巷(Hamilton Lane)、西门子(Siemens)和 KKR 等都宣布,正努力将自身的现实世界资产上链。此外,MakerDAO 和 Aave 等这类原生加密 DeFi 协议也正在作出调整,以与 RWA 兼容。

The potential impact of RWA's up-chain entry on the DeFi market is almost transformative. RWA can provide the DeFi market with sustainable, rich types of real yields backed by traditional assets. In addition, RWA can bridge the decentralized financial system and the traditional financial system for DeFi, which means that RWA can introduce the DeFi market to the massive liquidity, broad market opportunities and huge value capture of the traditional financial market in addition to the virtual asset market (virtual asset market assets value is about $1 trillion, Conventional financial market assets are worth $10tn). The introduction and implementation of RWA is essential if DeFi is to have an impact on the way traditional finance operates.

In this report, Binance Research provides a final overview of the challenges of RWA development by examining the rapidly evolving RWA ecology, including what RWA is, how RWA works, the purpose behind RWA, market analysis of RWA ecology, and key players in the RWA field.

Ii. Overview of RWA

2.1 What is RWA ?

如要将现实世界资产带入到 DeFi 生态,则需要将现实世界资产的价值 Token 化,即将现实资产的货币价值转换为数字 Token ,以便其价值能够在区块链上体现并交易。任何能够对应货币价值的现实世界资产 Token 化后都可以用 RWA 表示。

2.2 Purpose of RWA

The main driving force behind bringing real-world assets to blockchain: in the long term, DeFi is able to provide asset holders with unique market opportunities and efficiencies that are missing in the traditional financial system.

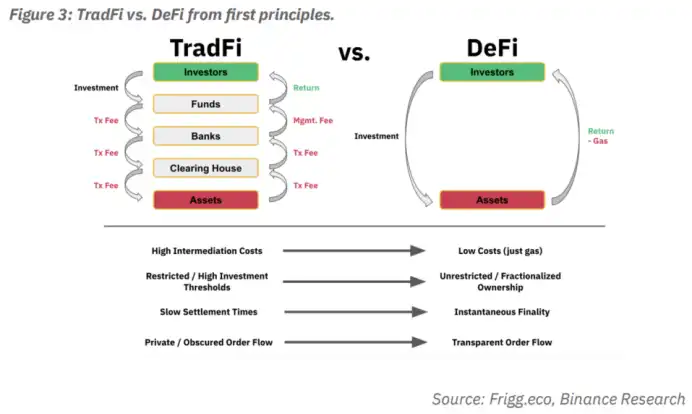

Historically, the traditional financial system (TradFi) relied on a system of intermediaries, including matchmakers, third party investigators, and government regulation. While these intermediary systems can provide security and trust endorsements to a certain extent, they do so at the expense of market opportunities and efficiency. When market participants are unwilling to pay fees to rent-seeking intermediaries, or are denied access to the market by heavy-handed regulators, or are unwilling to trade in a system in which their assets are controlled by third parties, market opportunities and efficiency are dramatically reduced.

DeFi is expected to remove some of the restrictions in TradFi, providing asset holders with substantial improvements in market opportunities and efficiency. DeFi minimizes or completely eliminates the intermediation system in TradFi, thereby effectively reducing a significant operating cost in financial markets.

除了消除中介系统之外,DeFi 的内部创新能够进一步提高市场效率并增加机会。例如,自动做市商机制(Automatic Market Maker, AMM)允许资产持有人即时获得流动性并完成交易,这在传统金融结算系统中并不常见。此外,通过资产 Token 化,资产持有者可以轻松分割、碎片化(Fractionalize)资产价值并分散风险,这使资金体量较小的投资者也能接触到传统投资门槛较高的资产。最后,区块链分布式账本的公开透明为 DeFi 的市场参与者提供了交易流程、资产所有权和资产计价的清晰度,这些往往隐藏在 TradFi 的黑箱中。

2.3 How does RWA Operate

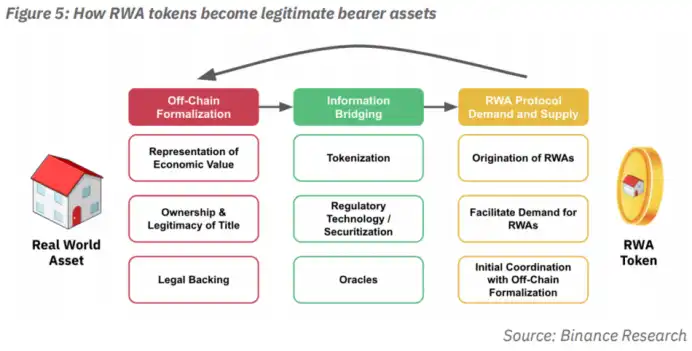

我们已经明确 RWA 是链下现实世界资产 Token 化的表示。那么厘清物理世界与数字世界中资产所有权和资产价值如何转换至关重要,即如何将 RWA 解释为现实世界资产的合法表示。将现实世界资产 Token 化,即 RWA 的流程分为三个阶段:(1)链下包装;(2)信息桥接;(3)RWA 协议需求和供应。

Off-Chain Formalization

In order to bring real-world assets into DeFi, the assets must first be packaged under the chain to make them compliant, so as to clarify the value of the assets, the ownership of the assets and the legal protection of the rights and interests of the assets.

Representation of Economic Value: The economic value of an asset can be represented by its fair market value in traditional financial markets, recent performance data, physical condition, or any other economic indicator.

Ownership & Ownership & Legitimacy of Title: The title to the assets may be secured by deed, mortgage, bill or any other form.

Legal Backing: In cases involving a change affecting the ownership or interest of an asset, there should be a clear resolution process. This usually includes specific legal procedures for asset liquidation, dispute resolution, and enforcement.

Information Bridging

Next, information about the economic value and ownership and equity of the asset is digitized and brought up the chain, where it is stored in a distributed ledger on the blockchain.

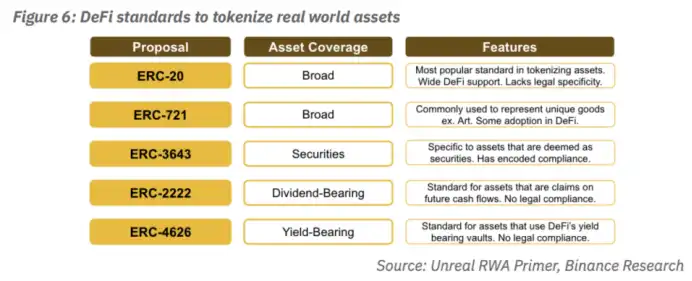

Token 化(Tokenization):在链下阶段包装的信息被数据化之后,上链并由数字 Token 中的元数据表示。这些元数据可以通过区块链访问,资产的经济价值和所有权及权益完全公开透明。不同的资产类别可以对应不同的 DeFi 协议标准。

监管技术/证券化(Regulatory Technology/Securitization):对于需要被监管或被视为证券的资产,可以通过合法合规的方式将资产纳入 DeFi。这些监管包括但不限于发行证券型 Token 的许可、KYC/AML/CTF、上架交易平台合规要求等。

Oracle: For RWA, it is necessary to refer to external data in the real world to accurately depict the value of the asset. For example, stock RWA, it is necessary to access the performance data of the stock, etc. However, because blockchain cannot bring external data directly from the centralized to the blockchain, data links such as Chainlink linking on-chain data to real-world information are needed to provide data such as the value of assets off the chain to the DeFi protocol.

(RWA Protocol Demand and Supply) (RWA Protocol Demand and Supply)

专注于 RWA 的 DeFi 协议推动了现实世界资产 Token 化的整个流程。在供应端,DeFi 协议监督 RWA 的形成。在需求端,DeFi 协议促成投资者对 RWA 的需求。通过这种方式,大多数专门研究 RWA 的 DeFi 协议既可以作为 RWA 形成的起点,也可以为 RWA 最终产品的提供市场。

2.4 Case: RealT Real Estate RWA

RealT is a DeFi RWA platform based on US real estate assets. RealT investors have access to real estate investment opportunities without having to take ownership of the show. Property owners on REALTs can sell fractional shares of ownership in their properties.

为了使一套位于美国的房产 Token 化,该房产的价值需要在链下先进行确认,这需要 RealT 委托第三方机构对房产进行评估、对所有权进行确认、设计房产权益的变更的应对措施(如出现租户不付租金、房产被抵押回收等情形)。

之后,将该房产的信息数据化后上链。更具体地说,该房产的相关数据将被 Token 化、证券化,并通过 Oracle 传输。RealT 并非对现实世界的实物资产 Token 化,而是根据 ERC-20 标准协议,对特殊目的载体(SPV)的股份进行 Token 化,该特殊目的载体(SPV)持有如房产所有权、房产收益权等财产契约。

In connection with securitization, RealT filed for an exemption from securities under Regulation D and Regulation S of the United States Securities Act, as the foregoing may involve the offering and sale of securities. In addition, RealT has built KYC technology into the agreement to legally comply with the rules for investors and sellers. Finally, RealT provides fair market value for its DeFi applications through Oracle.

2.5 Difference between RWA and ABS

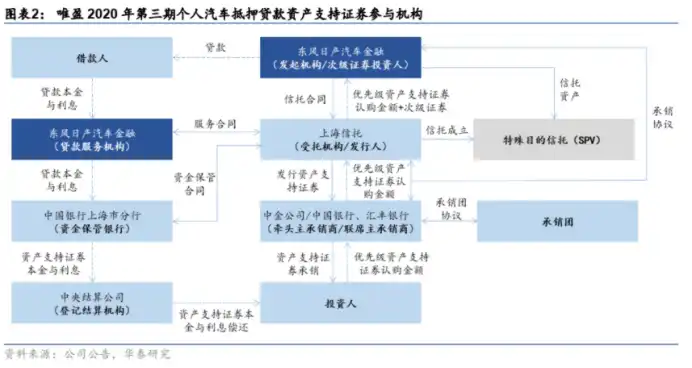

Asset-backed Security (ABS) refers to a financing method in which the originator combines the underlying assets expected to generate cash flow through structuring and other ways, so that they can be issued and traded in the market.

ABS reorganizes assets through special purpose vehicle (SPV) to achieve the effect of risk isolation and liquidity enhancement. ABS repackages the cash flow of the underlying asset to cut risks and returns, and realizes the isolation of the right relationship between the original equity and the underlying asset through the special purpose vehicle (SPV), so that investors can avoid the impact of the bankruptcy risk of the original equity and other asset risks.

On this basis, ABS products also carry out credit enhancement design through various credit enhancement means, so the credit rating of asset-backed securities is often higher than the main credit rating of the original owner. Through ABS, issuers can revitalize the stock of poor liquidity quality assets and expand financing channels. At the same time, the product features of ABS in various forms can meet the risk and return requirements of different investors.

ABS involves multiple participating institutions. The process of ABS includes the selection of underlying assets, the formation of asset pools, the establishment of special purpose vehicles (SPVS), asset transfer, asset stratification, credit enhancement and rating, sales transactions, capital recovery and distribution, etc. Generally speaking, the asset provider is called the initiator, also known as the original stakeholder, and the special purpose vehicle (SPV) set up by it is the formal issuer. In addition, the process of asset securitization also involves borrowers, investors, underwriters, fund custodians, registration and settlement institutions and other subjects.

ABS is recognized as a standardized creditor's asset, which is operated under traditional financial regulators (securities). All market participants, whether issuers, investors or intermediaries, have relatively high thresholds, and are subject to strong supervision by regulators.

Theoretically, the underlying assets of RWA can include assets with clear ownership and corresponding monetary value, including tangible assets and intangible assets. In addition, the RWA formed after the data linking of the underlying assets runs in the DeFi ecology, eliminating the need of the traditional financial system to provide credit endorsement by intermediaries. However, in the case of RealT, we can see that before the underlying assets are digitized, the participation of relevant organizations such as evaluation, finance and law is still needed to make the assets in the real world be digitized onto the chain in a compliant way. At this point, we can refer to the practice of ABS.

3. RWA market and Ecology

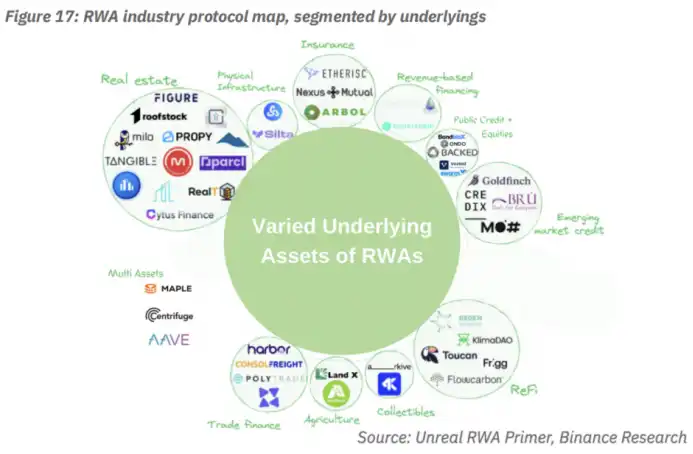

With the deepening of the DeFi market and the continuous penetration of the original DeFi main body and TradFi company into RWA, the RWA circuit is bound to flourish. Both the market type provided by RWA and the underlying asset type represented by RWA are increasingly diversified.

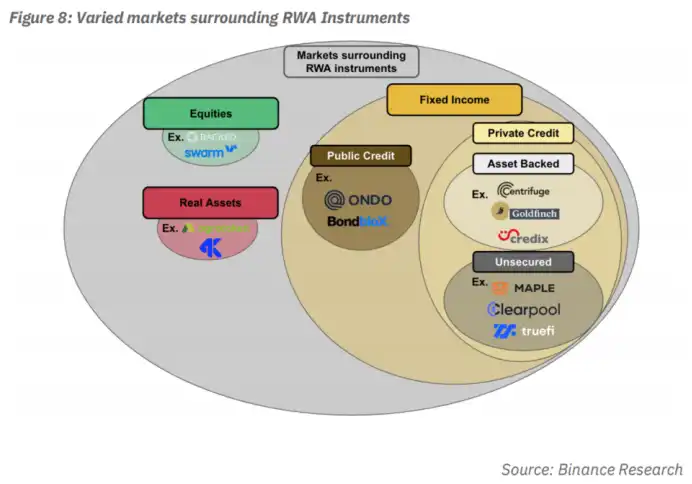

3.1 Equity and Real Asset Markets

In RWA ecology, the equity market accounts for a relatively small proportion. One of the reasons is that most underlying assets of the equity market can be traded in traditional financial markets, which are equipped with strict supervision, such as the securities regulatory Commission in most jurisdictions, which strictly regulates asset securitization. In addition, most of the underlying assets in the equity market have the attributes of physical ownership and other rights and interests. For example, in the above RealT real estate project, how to distinguish the ownership and rights of underlying physical assets in the real world and the digital world becomes very complicated. Such as Backed Finance, one of the few agreements offering equity RWA, is registered under Swiss-DLT and must fully support the ownership of the underlying assets in each RWA.

3.2 Fixed Income Markets

The fixed income market accounts for the majority of the RWA ecology. As the RWA protocol can segment and fragment the underlying assets, the fixed income assets with a fixed total amount and large volume that are not divided in the traditional financial field can reach more investors. This DeFi protocol innovation can attract market players from non-traditional sectors.

DeFi investors can thus enter the relatively high threshold of traditional financial fixed income field, open a new investment channel; Borrowers also have access to a financing channel with relatively low barriers, and the financing currency is more stable relative to its legal tender (Asia, Africa, Latin America, etc.). In the fixed income market, there are two main types of RWA agreements: (1) asset mortgage; (2) unsecured loans.

3.3 Underlying Assets of RWA

Fiat coin-based stablecoins are the original RWA and by far the most visible RWA foundation tool. Stablecoins are virtual assets designed to link their price to the market value of an external asset, usually a fiat currency. Since the first stablecoins were introduced in 2014, stablecoins have increasingly become the foundation of the virtual asset market, providing entry/exit into DeFi, on-chain price stability, and a familiar means of exchange.

Besides Stablecoins, the most popular underlying asset class as an RWA is real estate, followed by a climate-related base (such as carbon credits) and a public bond/equity base, followed by an emerging market credit base (mainly corporate debt), and so on.

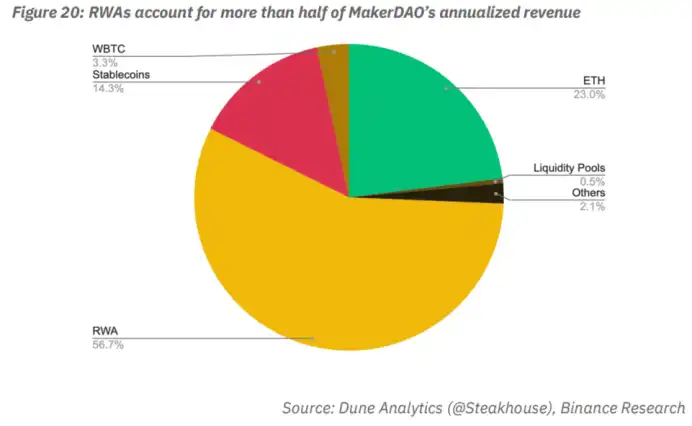

3.4 MakerDAO, a major participant in RWA market

MakerDAO, a mortgage lending platform on Ethereum, has arguably made the most progress in RWA adoption. MakerDAO allows borrowers to deposit collateralized assets in a "vault" so that the borrower can draw on the obligations of the protocol's original stablecoin DAI (which is denominated in dollars). The vault is a smart contract that holds the borrower's Ethereum-based collateral until all borrowed DAI are returned. As long as the value of the collateral remains above a certain threshold, the relevant liquidation mechanism will not be triggered. However, if the value of the collateral falls to the point of inadequacy, the vault will automatically liquidate the collateral through an auction process so that the loan can be repaid in a way that does not require trust.

The type of collateral a borrower can use is determined by the agreement's governing DAO, the MakerDAO. In 2020, MakerDAO voted to allow borrowers to post RWA-based collateral to the vault. In addition to this vote, MakerDAO has also chosen to fund Oracle Predictor development so that the value of RWA-based collateral on the platform can be priced seamlessly with the collateral's off-chain value.

Today, MakerDAO's RWA vault is worth more than $680 million. This means that MakerDAO has been able to expand the number of DAI issued to the market through the RWA-backed loan. In addition, this means that there is over $680 million in RWA to help maintain MakerDAO's $1 peg stability.

4. Development and Challenges of RWA

RWA is innovative in the way it connects TradFi and DeFi. However, in order to make this bridge viable in the long term, in addition to the development of the public chain suitable for RWA and the macro market environment, the policy regulation related to RWA needs to be further clarified. This will be the key to determining the development of RWA.

在今天的大多数国家,缺乏明确的法规来监管和管理现实世界资产的 Token 化。只有少数几个国家,如瑞士(承认虚拟资产为无记名资产)和法国(采用了 CAST 框架,这是一种使用底层区块链作为结算同时保留链下登记的混合形式),采取了对 RWA 发展有益的监管规定,明确了协议应该如何将现实世界资产带入区块链。进一步的监管清晰度将促进 RWA 领域的持续发展和创新。

此外,保护 RWA 价值的执行机制尚未建立。考虑这样一个场景:借款人拖欠贷款,协议必须清算其 RWA 抵押品以偿还贷款人。鉴于底层资产抵押品不是流动性的 ERC-20 Token ,清算这些资产以收回贷款人的资本可能比使用虚拟抵押品的贷款要麻烦得多。因此必须采用另一种为贷款方服务的清算程序。此外,也必须有一个链下的、法律约束的执行机制,以确保借款人的清算过程得到最佳处理。

While the idea of building a bridge between TradFi and DeFi is exciting, we should recognize that this bridge can only be achieved through seamless legal, operational coordination between the physical and digital realms. This type of coordination requires seamless information exchange and well-executed procedures in the event of a DeFi or TradFi failure.

More broadly, RWA's narrative is particularly noteworthy for the virtual asset market, as it is a more relevant example to the real world. DeFi is no longer isolated from the real world and TradFi. Increasingly, blockchain has real-world use cases and is proving its value as a transformative technology.

This article is for study and reference only, hope to help you, does not constitute any legal, investment advice, not your lawyer, DYOR.

Original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR