Approaching the liquidation line, the current status of Curve founder's position worth $170 million.

Original author: Delphi Digital, a research institution in the encryption industry

Translated by: Leo, Bob, BlockBeats

Curve Finance founder Michael Egorov has always been a familiar figure in the "borrowing and cashing out" community. Egorov also frequently mortgages CRV on Aave and Frax stablecoins, but recently due to the decline in CRV prices and the exploitation of its pools, the price of CRV has plummeted. As of the time of writing, the price of CRV is about $0.5, with a 24-hour drop of more than 20%, leading to a significant increase in the risk of Egorov's CRV-mortgaged loans being liquidated. Delphi Digital has written an article on "The Impact of Curve Founder's Loan Liquidation Price and CRV Crash on the Entire DeFi Field," which is translated by BlockBeats as follows:

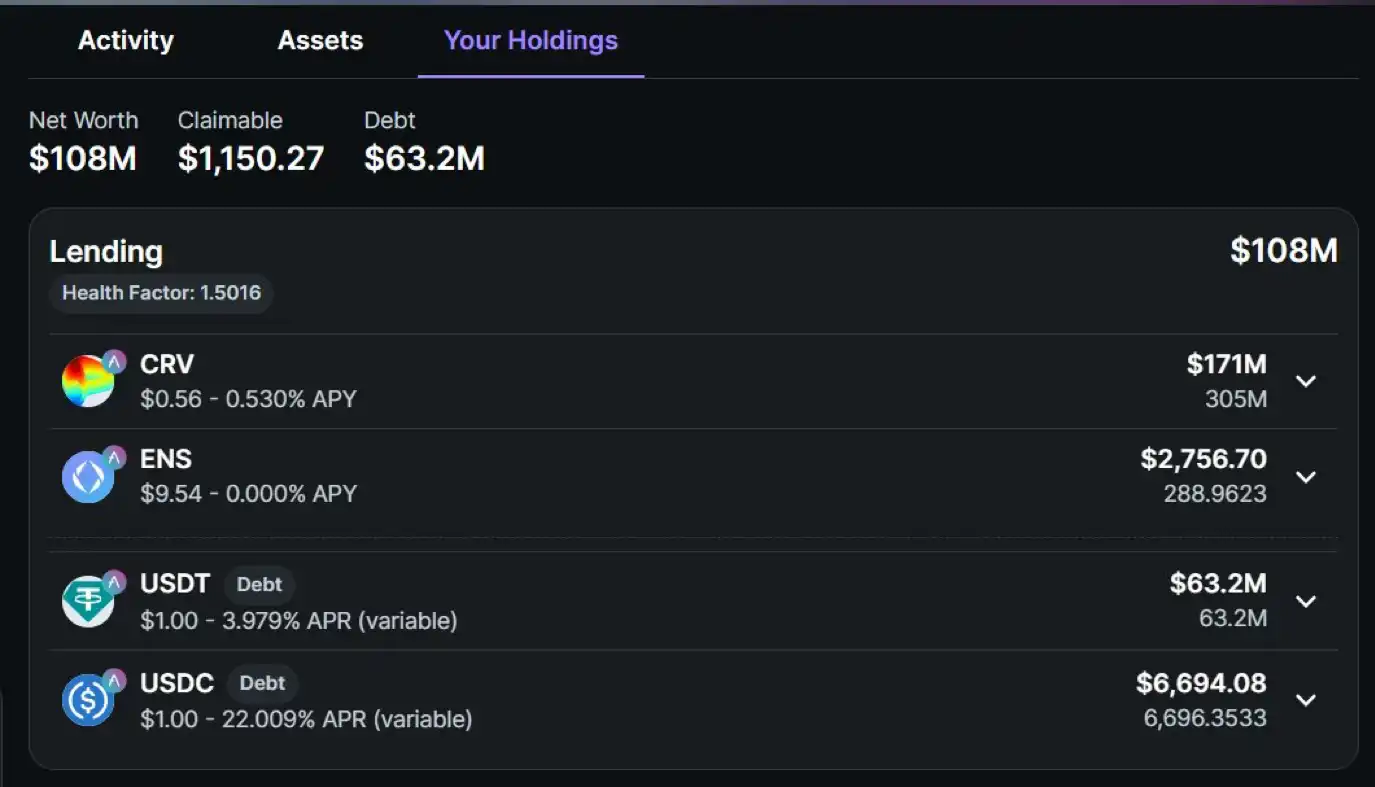

On the lending agreement Aave, Egorov has a 63.2 million USDT loan supported by 305 million US dollars of CRV.

Under the 55% liquidation threshold, his position will be liquidated when CRV reaches a price of 0.3767 USDT.

Based on the current CRV price, reaching the liquidation threshold only requires a decrease of about 33% in the CRV price. In addition, Egorov also paid an annual 4% APY for the loan.

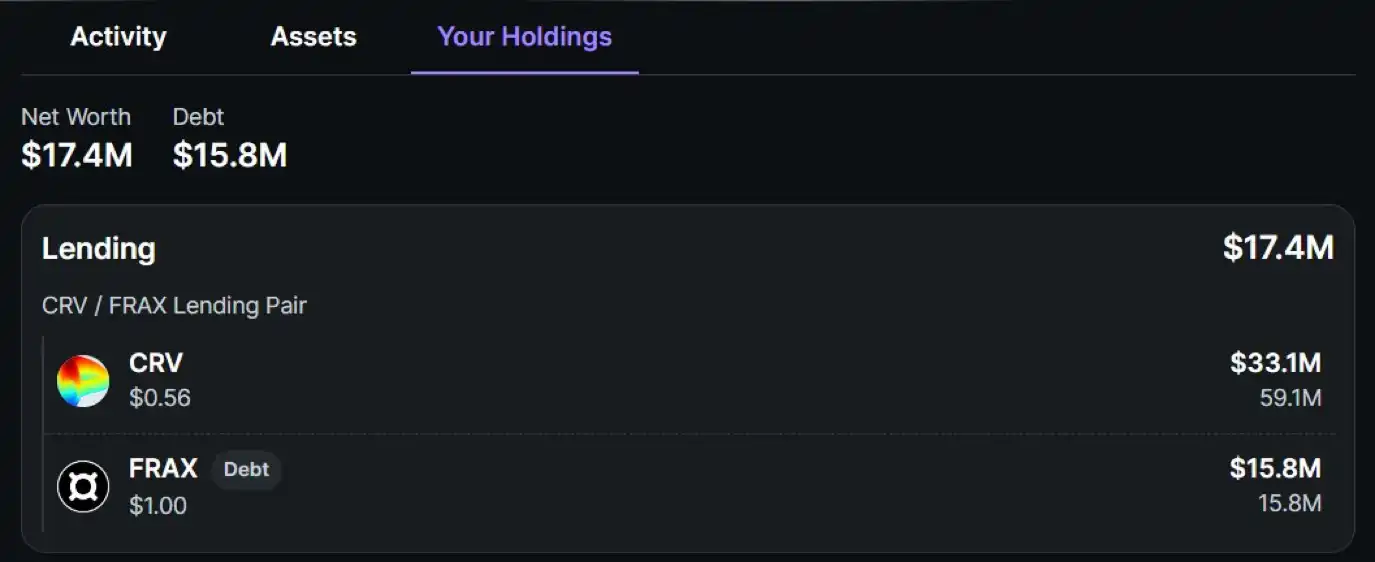

Although this is much less than his CRV collateral and stablecoin borrowing on Aave, due to Fraxlend's time-weighted variable interest rate, CRV still carries significant risk.

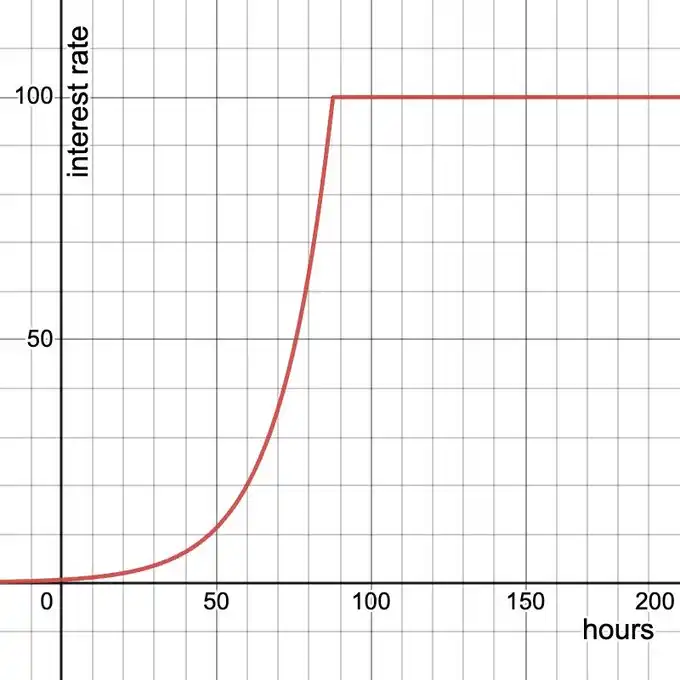

According to the current 100% utilization rate, the interest rate will double every 12 hours.

The current interest rate is 81.20%, but it is expected that the APY will rise to its highest point in 3.5 days, nearly 10,000%.

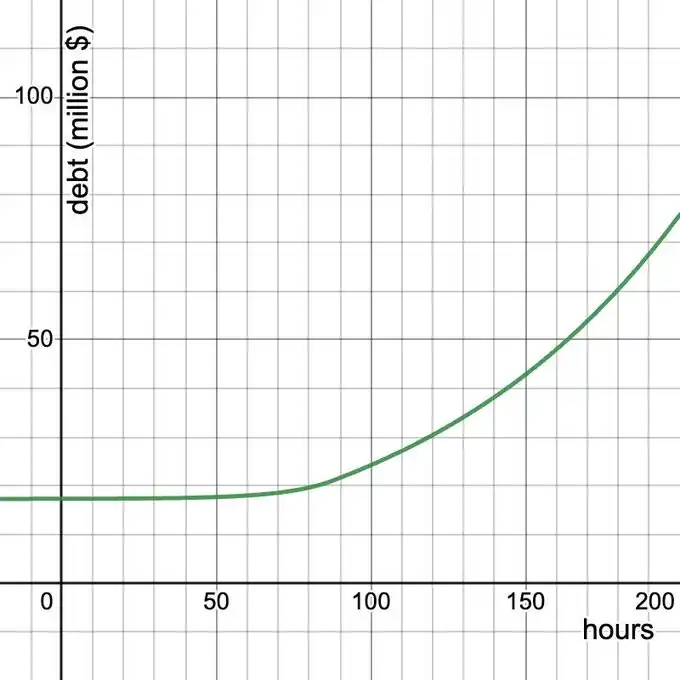

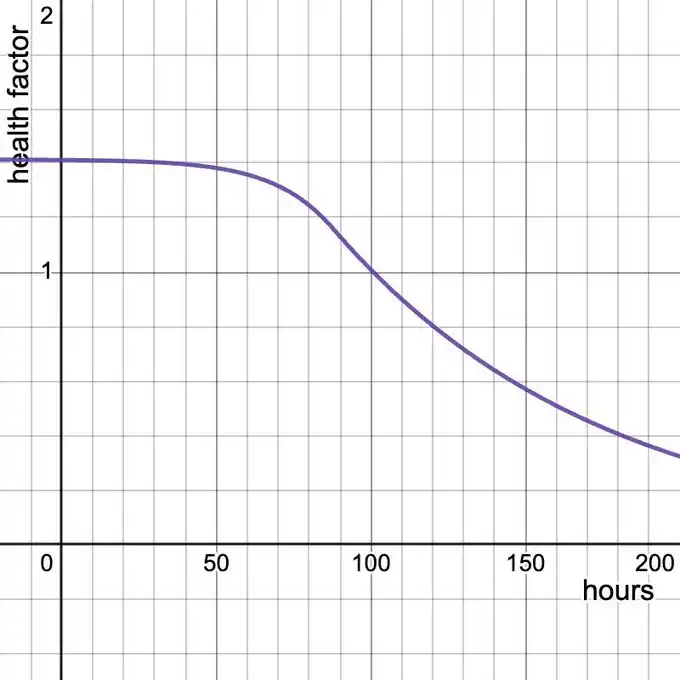

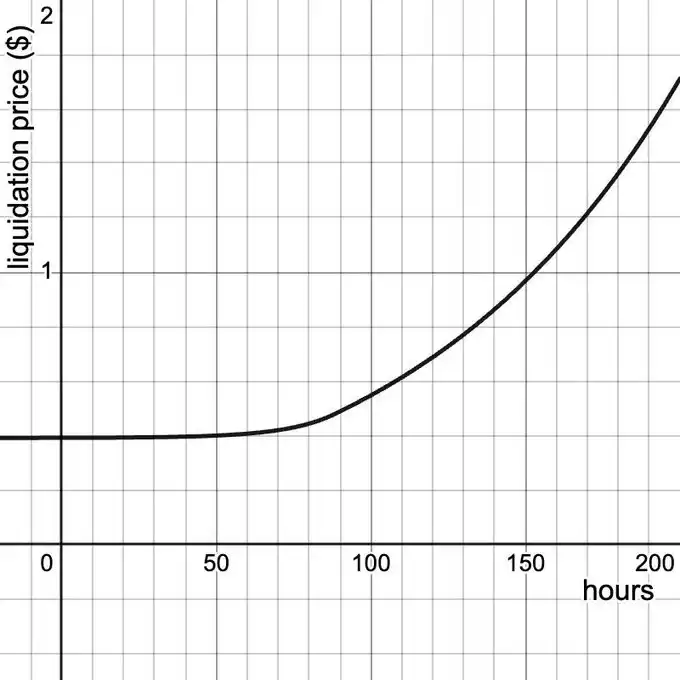

Regardless of the price fluctuations of CRV, this index-like interest rate may lead to its liquidation. In the case of a maximum LTV of 75%, the liquidation price of its position within 4.5 days is 0.517 USD (CRV), which is only a 10% drop from the current CRV price.

Egorov has attempted to reduce debt and utilization twice, and in the past 24 hours he has repaid a total of 4 million FRAX (3.5m, 500k). However, the market utilization rate remains at 100%, and users quickly removed liquidity after his repayment.

Considering the existing low liquidity, these large-scale risk positions pose a serious concern for the CRV price composition.

Currently, there is approximately $10 million worth of CRV liquidity on-chain, and there is a sell order of $370,000 at a depth of -2% on Binance.

Therefore, the CRV price may plummet to extremely low levels, triggering a chain reaction in most areas of the DeFi ecosystem.

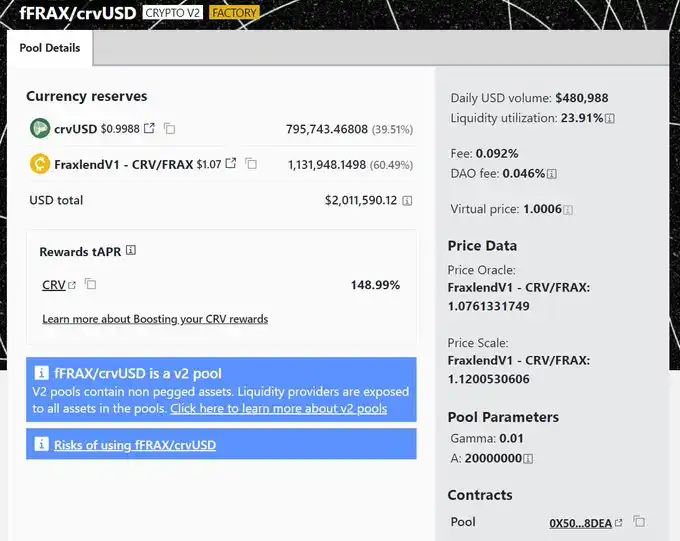

This is an attempt to encourage liquidity into the lending market in order to lower utilization rates and reduce the risk of debt spiraling out of control.

Within 4 hours of its launch, the pool has attracted $2 million in liquidity and reduced utilization to 89%.

We will actively monitor the situation in this thread and please be sure to bookmark it.

Delphi members can get the latest information through Eason Wu's latest Alpha Feed post, which can be seen here.

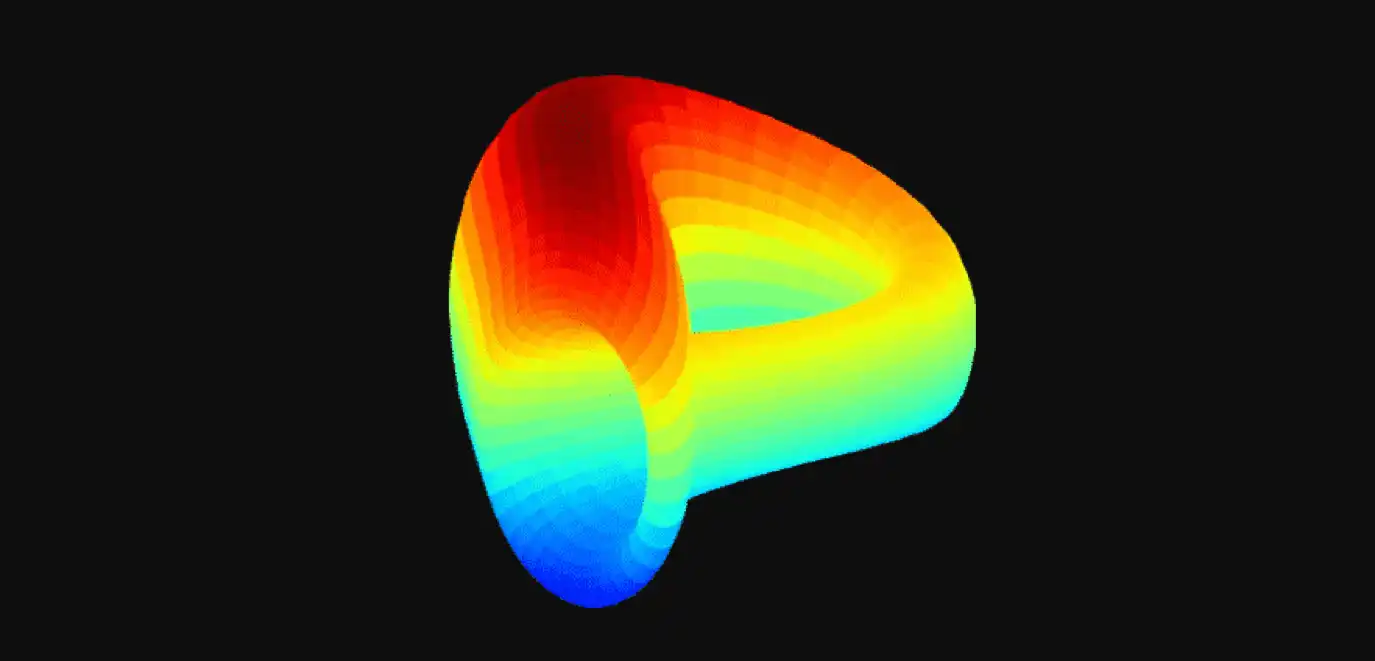

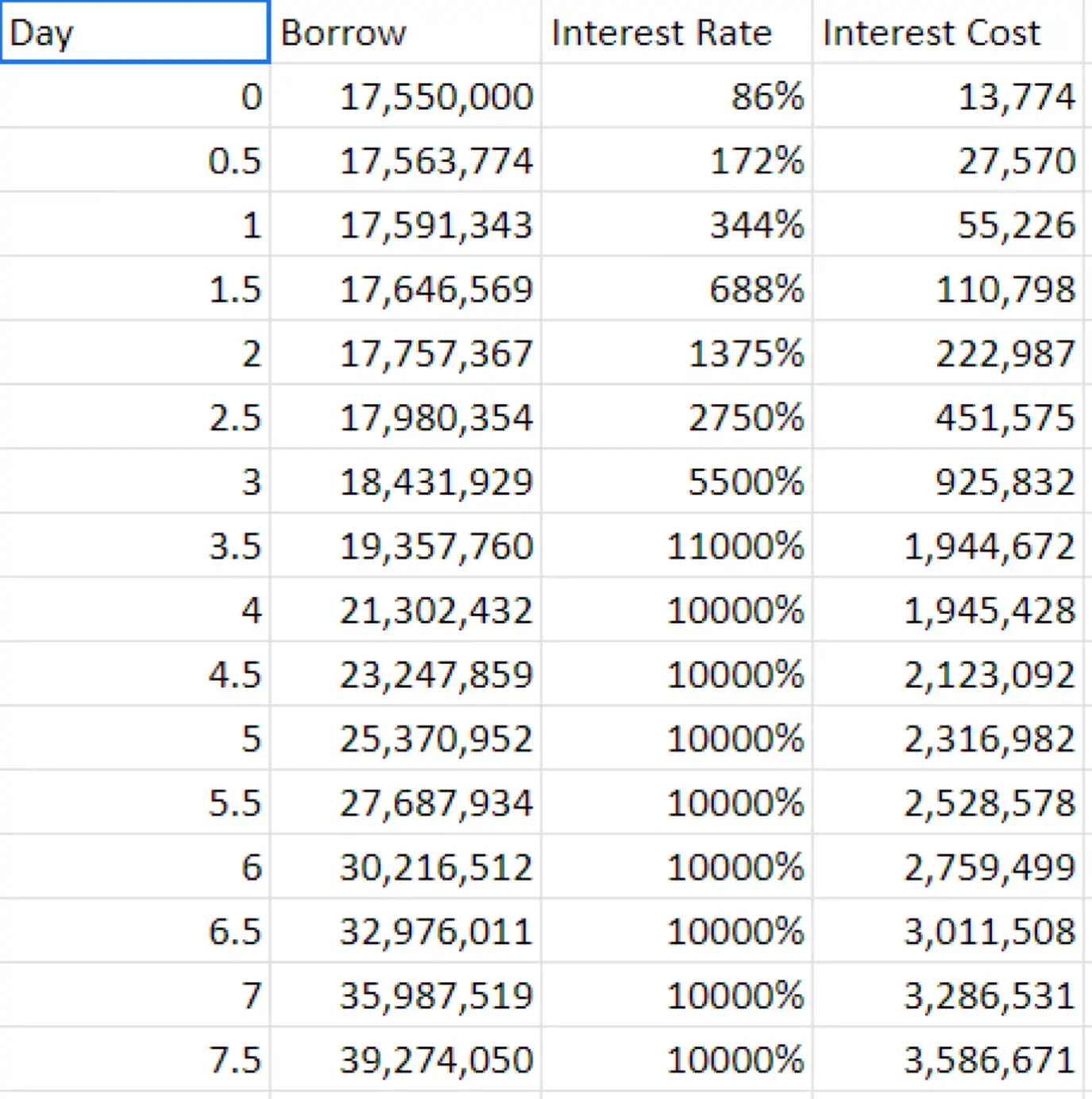

Larry0x has also compiled some charts that we want to share.

It is worth noting that these charts assume that the position will not change (there will be no increase in collateral or repayment of debt), the CRV price will not change, and the utilization rate will always remain at 100%.

Interest Rate vs. Time (Hours)

Debt (million US dollars) vs. Time (hours)

Health Score vs. Time (hours)

Clearing Price (USD) vs. Time (Hours)

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI