Bound Finance, the first LSDfi project supporting RWA, has the feature of having an airdrop.

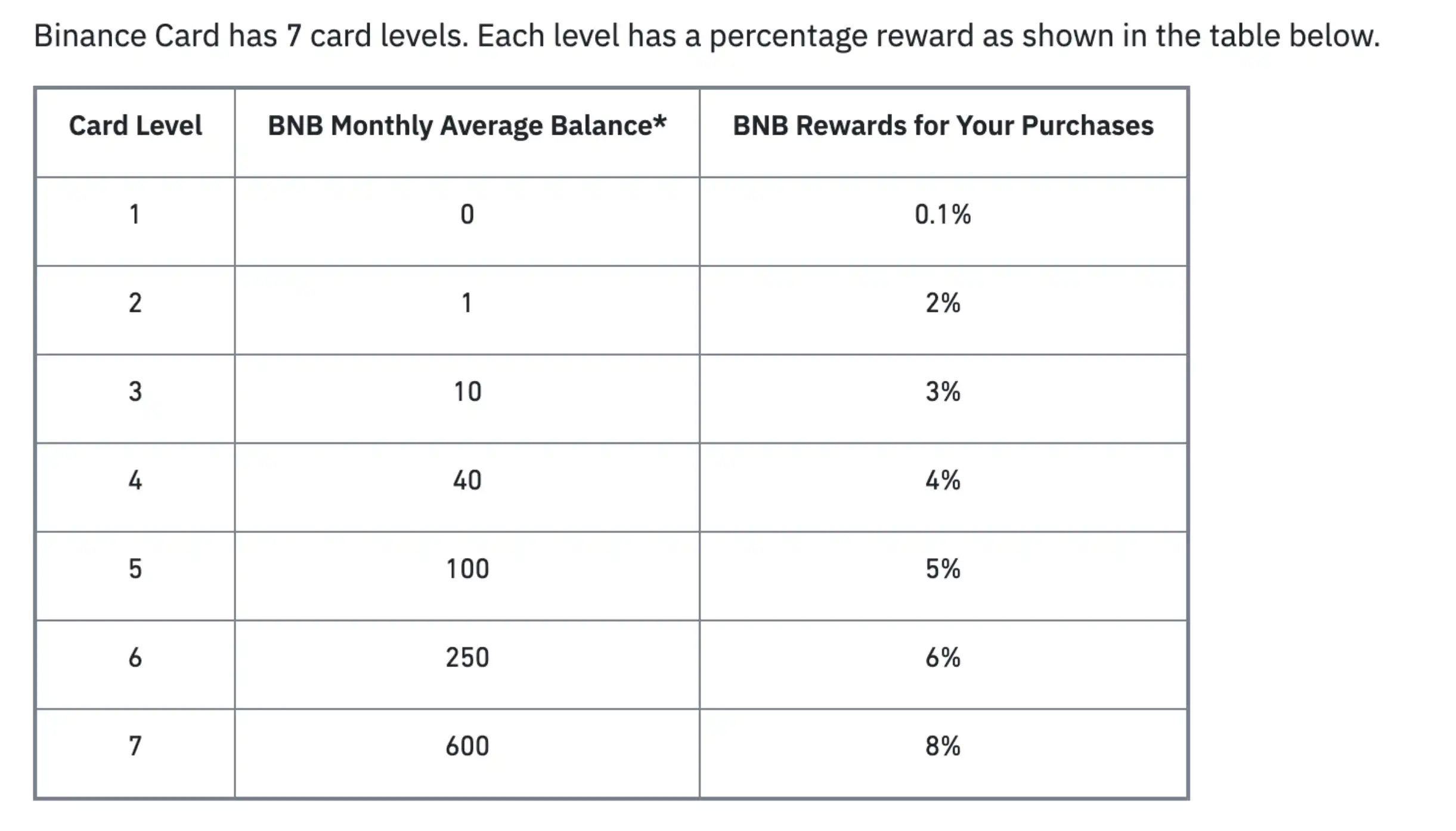

The cashback rate of traditional financial cards is very low, and there are restrictions on users' consumption methods. Not every brand has a cashback policy for every purchase. On the other hand, the cashback threshold for crypto cards is higher. For example, Binance requires holding 600 BNB or more assets to get the highest cashback rate of 8%. This requires holding a large amount of BNB for a long time, but BNB is not a stable asset, and its fluctuations have a great impact on holders. For ordinary retail investors, 600 BNB is a huge asset.

Binance card holding BNB quantity and return ratio table.

Bound Finance Introduction

Bound Finance is an RWA protocol based on the LSDfi model. With the emergence of LSDfi and Shanghai Upgrade, innovative DeFi mechanisms have emerged, especially innovative mechanisms for CDP holders. Bound Finance has created a new mechanism called "LSDfi Cashback" to bridge the gap between DeFi lending and crypto card users. The protocol aims to create a mutually beneficial collaborative system by leveraging the strengths of these two applications, primarily by supporting high-rate rebates for financial card users through LSDfi's high yields.

The official social media of the protocol states: Bound Finance is the world's first to use the LSDfi protocol to offer up to 12% cashback on all transactions made with any credit or debit card.

DeFi Lending

Crypto participants with large amounts of encrypted assets often pledge their assets to obtain margin trading loans or reduce opportunity costs. These users can obtain stablecoin loans through DeFi platforms such as Compound and Aave. The mechanism of Bound is to use DeFi lending providers such as Maker and Aave to earn profits through their collateral and stablecoin loans in the BCK savings account.

Financial Card

Compared with cryptocurrency lending users, cryptocurrency users have relatively less encrypted assets or savings, which creates conditions for collaborative creation between two different user groups. Based on this, Bound Finance proposed the concept of LSDFi Cashback (LSDfi cashback) to connect the infrastructure of these two market economies. Bound uses the collateral (ETH) of cryptocurrency lending users to generate ETH collateral rewards, which can provide funds for cashback and user rewards for application users. At the same time, Bound uses game theory to balance the rewards that can be shared by cryptocurrency card users and cryptocurrency lending users.

Bound Finance RWA Operational Details

Bound Finance's solution is to transform any existing Visa, Mastercard, or Amex card into a high-yield cashback card, offering a large cashback rate of 10-15% per transaction. Additionally, the service requires no additional cards, separate accounts, token staking, or subscriptions. By integrating with the Plaid API, Bound can monitor every transaction of all the user's credit or debit cards and provide users with generous cashback of 10-15% based on the daily rate of each transaction.

Through the above path, Bound Finance has officially entered RWA and has also made progress in the adoption of traditional and crypto economies. Bound's ultimate goal is to bridge the gap between traditional and crypto economies and ensure the widespread adoption of crypto.

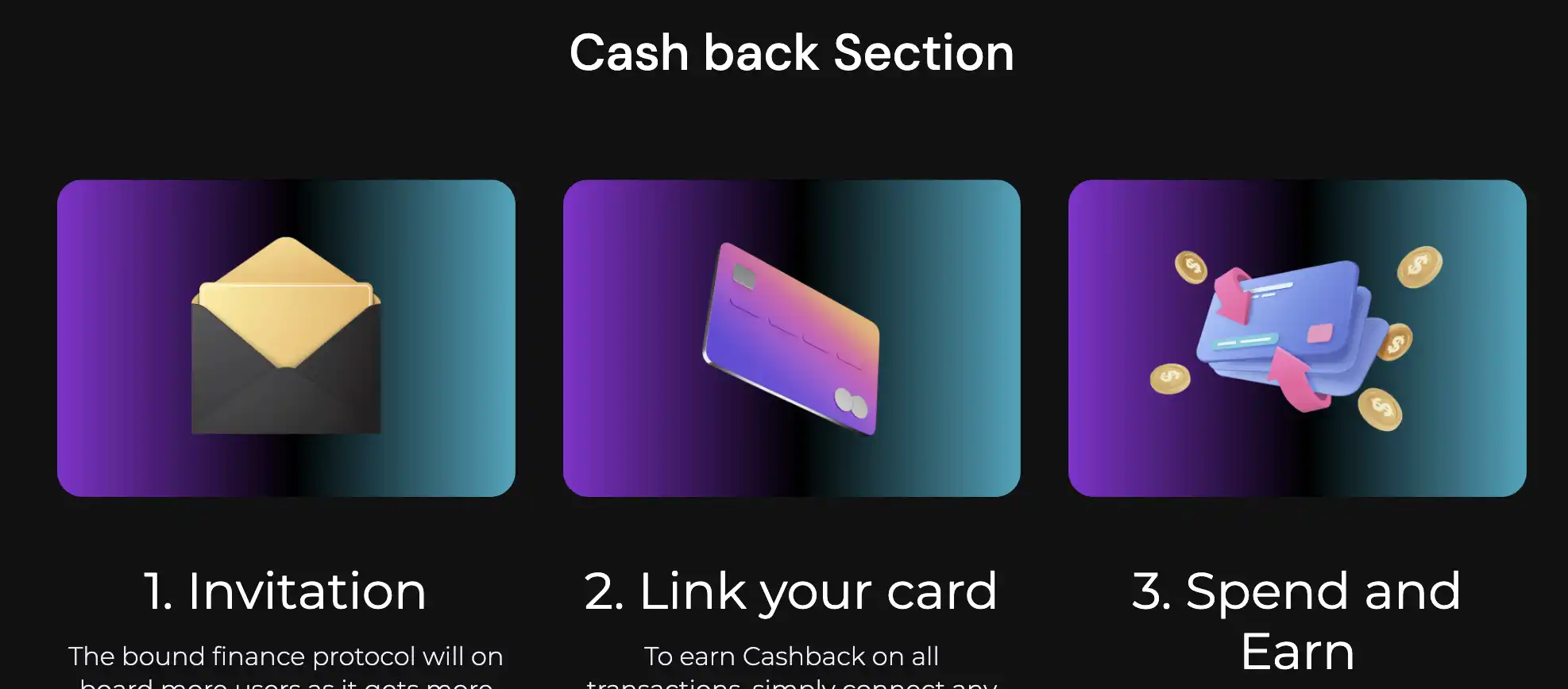

LSDfi How to conduct cashback

Specifically, the cashback process for Bound requires users to obtain and accept an invitation link, bind their card information to the Bound platform, and earn 12% cashback on every purchase after binding. The cashback will not reset the next day and can accumulate over time. User expenses include payment of utilities, car-related expenses, and other daily expenses.

The cash return mechanism of LSDfi is determined by the amount of funds saved in the BCK account and the amount of ETH pledged. Assuming that the amount of ETH in the BCK savings account is $1500, the daily allowance provided to all cash return users is also $1500. In the case of a cash return rate of 15%, the total cash return that can be obtained on that day is:

All cashback to users totals $1500 x 0.15 = $225.

Therefore, we will allocate $225 worth of ETH from the staking rewards pool of ETH to pay for the cashback distributed to all users on that day. When calculating the rewards allocated to users, a cashback rate of 10-15% typically corresponds to a staking reward of around 6-9%.

For example, if 1 ETH is equal to the total staking reward received, Bound will deduct 20% of the total amount and then select 75% from the remaining reward. From this 75%, 10% will be selected, which is equivalent to 0.06 ETH or 6 points from the total staking reward as cashback. The maximum cashback is about 15%, which is equivalent to 0.09 ETH or 9 points selected from the total staking reward's 10% as cashback.

The amount of cash returned to users is subject to the decisions made by BoundDAO and can be adjusted based on the stability of the protocol, macroeconomic factors, and overall economic health. The specifics of any changes will be determined through DAO proposals and voting.

The remaining percentage of the pledge reward is used as the total revenue of the protocol, which is used to pay employee salaries, maintain the website and servers, fund marketing, promote research and development, and provide insurance for Slashing protection.

Bound Finance token

The LSD section corresponding to RWA in Bound adopts a 3-token mode: BCKETH, BCK, and BCKGov, all of which are the main tokens for Bound's operation and benefits, used to obtain high yields for Bound's LSDfi section.

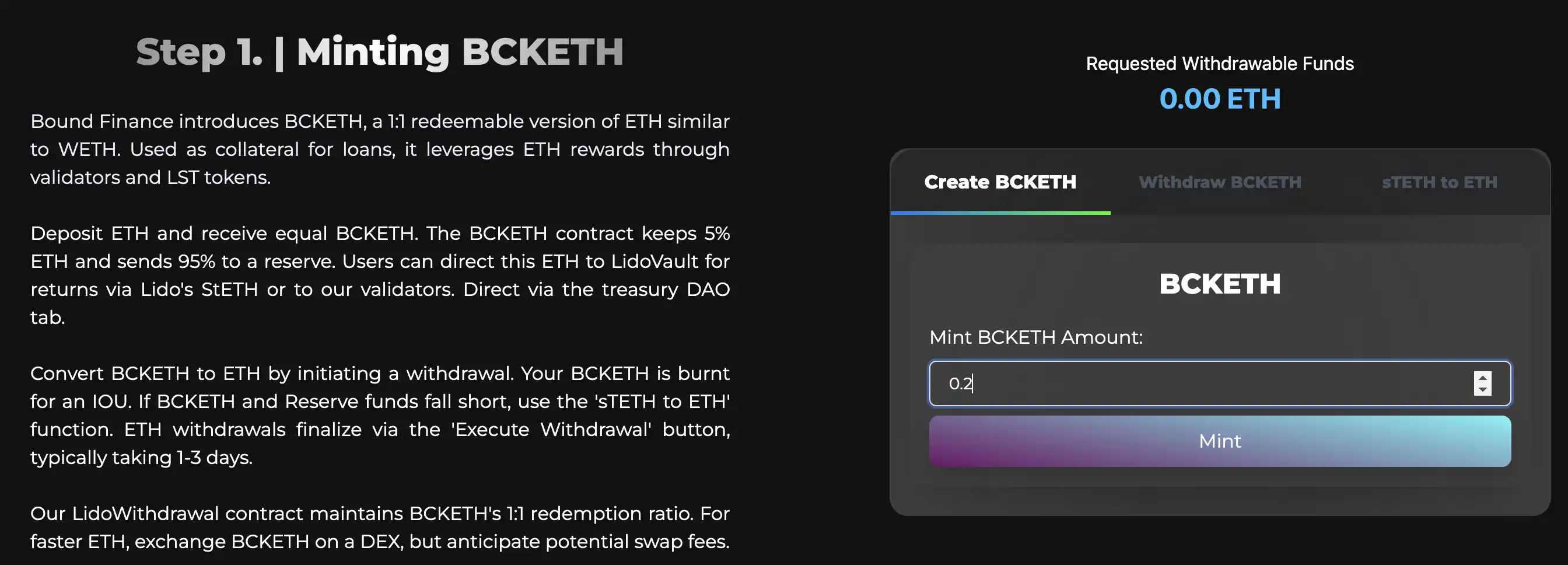

BCKETH

BCKETH (Back ETH) is a type of ERC20 token that is pegged 1:1 to ETH. Similar to WETH, it is the main collateral in the Bound Finance protocol. Users can deposit ETH to mint BCKETH, and conversely, they can extract ETH by destroying BCKETH.

BCK

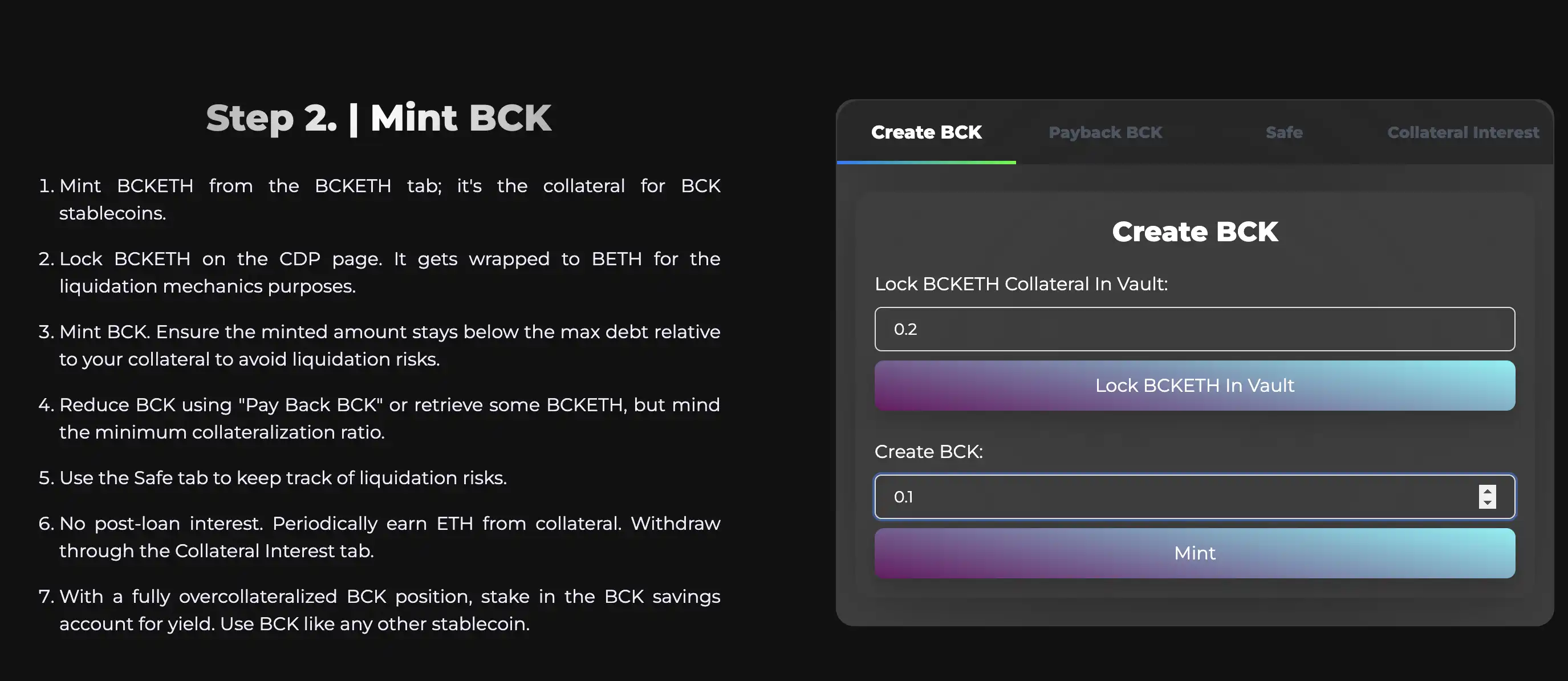

BCK is a USD stablecoin launched by Bound Finance, supported by BCKETH collateral to ensure its price stability and safety. This collateralization method also avoids regulatory risks, demonstrating its fairness and decentralized nature.

The stability mechanism of BCK is maintained through the circulation and supply of BCK in the market. For example, if the price of BCK rises above $1, users have the opportunity to use BCKETH as collateral to mint new BCK, which can then be sold on DEX, increasing the supply of BCK and causing its price to drop to around $1. Conversely, if the price of BCK falls below $1, users can purchase BCK at a discounted price from the market and then exchange it for BCKETH worth $1 on Bound Finance. This increase in buying activity will push the price of BCK back up to around $1.

The opposite of this is Bound Finance's BCK savings account, which allows users to earn an annual return of approximately 8% on USDC stablecoin deposits and also enables BCK zero-interest lending by depositing BCKETH into Bound Finance. The BCK savings account is an important part of the Bound Finance ecosystem, rewarding BCK holders and borrowers while maintaining platform stability and growth.

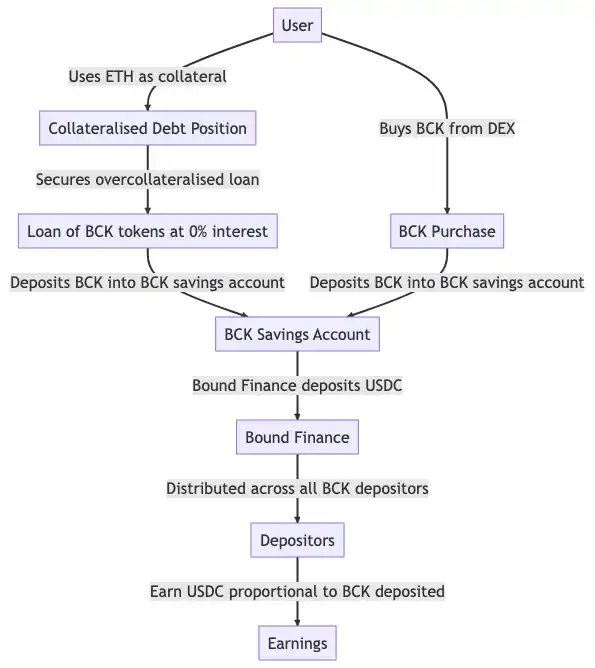

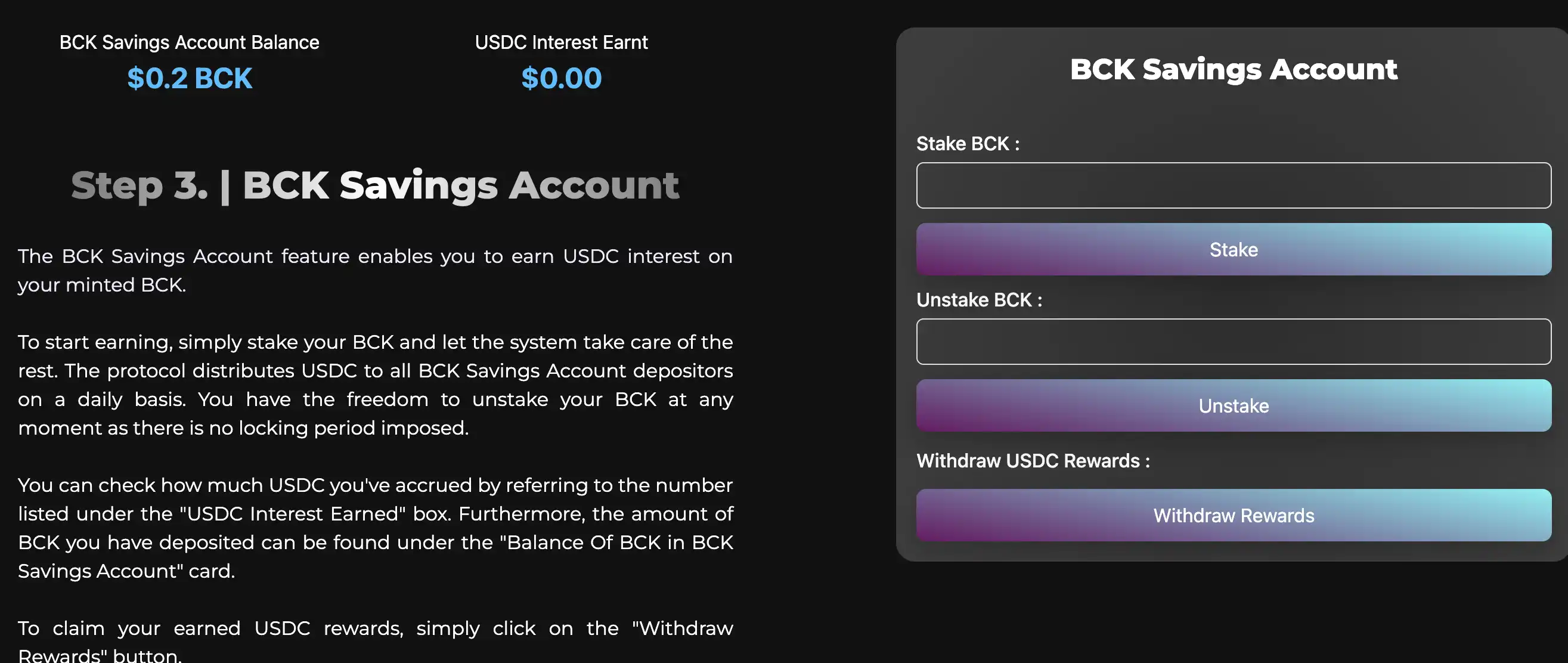

The operation method of BCK savings account is as follows:

Deposit and loan: Bound Finance users can obtain BCK by using their pledged BCKETH as collateral, and then deposit the BCK into their BCK savings account.

Revenue: Bound Finance does not charge interest on BCK loans like traditional finance (zero interest), but allows users to earn interest by holding collateral in the debt collateral position (CDP), with revenue coming from ETH staking rewards.

USDC Daily Allocation: Bound Finance deposits a certain amount of USDC into the BCK savings account every day (by converting a portion of the ETH collateral yield into USDC), and then distributes all USDC fairly to savers. Each saver's share is proportional to the amount of BCK deposited into their BCK savings account.

Sustainable Growth Model: This innovative model promotes growth and incentive cycles for all participants, ensuring Bound Finance's continued viability and profitability.

BCKGov

BCKKGov is the governance token of BoundDAO, playing a critical role in managing the Bound Finance Validator wallet, a key component of the Bound Finance system. The wallet enables DAO participants to oversee the allocation of ETH collateral to validators. Additionally, BCGov holders will also receive a portion of the profits generated by the protocol and can vote on future decisions of the protocol.

Bound Finance Airdrop Tutorial

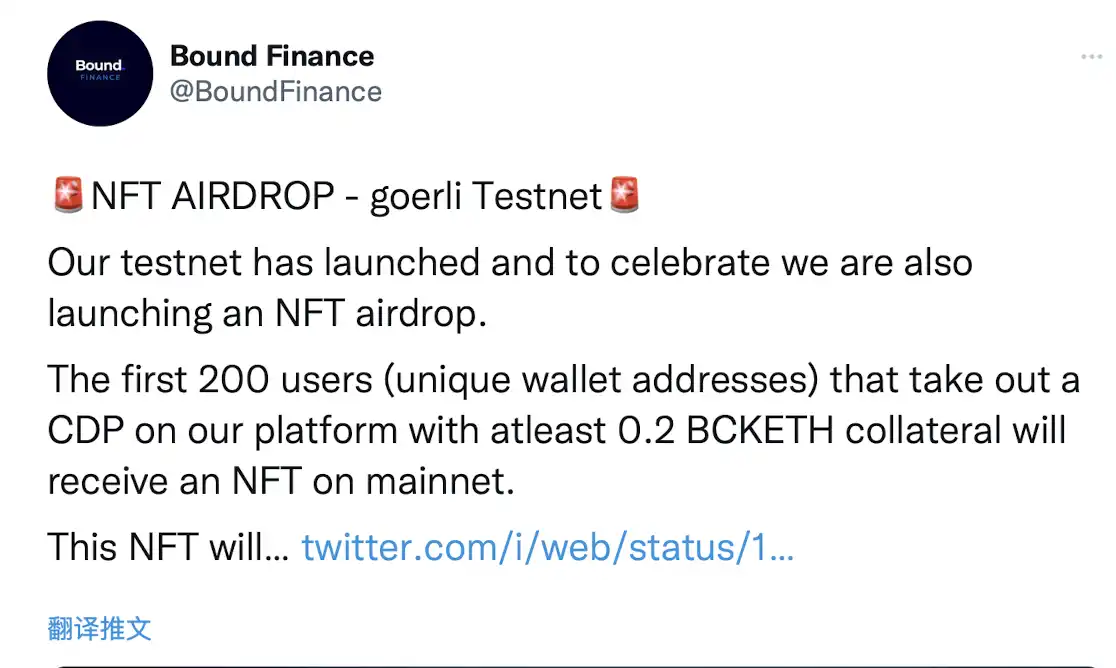

Bound Finance's official announcement recently announced its NFT airdrop plan. The first 200 users are eligible to receive their NFT airdrop on the mainnet and will receive blessings in the future. The airdrop tutorial is as follows:

First, you need to have 0.3 or more GETH in your Little Fox Wallet. Then, go to the Bound Finance website and click on Mint BCKETH. Enter 0.2 or more ETH and click on Mint.

Next, click on the CDP section of the page, enter 0.2 BCKETH and lock it as collateral for BCK. Then, enter a certain amount of ETH in the Create BCK section to mint BCK.

Step 3, enter a number lower than your Mint BCK holding amount, and click on "Stake BCK".

Bound Finance announced that the first 200 users with at least 0.2 ETH collateral can receive a mainnet NFT airdrop. NFT holders are eligible for discounts when their tokens are publicly sold. Even if you are not among the first 200, anyone who completes the tutorial will have a chance to receive a $250 USDC reward provided by Bound.

Conclusion

Some of you may wonder why Bound Finance was chosen as the rebate fund instead of other well-established LSDfi platforms, given the need to increase mainstream adoption. Bound's explanation is based on the combination of ETH's current value and staking rewards, calculated using the Bound model. The APY of Bound Finance is approximately 4.4%, compared to Rocket Pool's rETH (as of July 11, 2023) with an APY of approximately 3.32%, and Lido Finance's stETH (as of July 11, 2023) with an APY of approximately 3.9%. Bound Finance is higher than both of them.

Summarizing the advantages of Bound Finance, as follows:

Dual yield generation: Unlike other LSDFi platforms, Bound Finance provides yield for both BCK holders and BCKETH holders.

Dynamic Internal Validator: Bound Finance operates its own Ethereum validator, eliminating the reliance on third-party staking platforms such as Rocket Pool or LidoFinance, which charge a portion of staking rewards. BoundDAO continuously monitors its validator for security and efficiency. In the long run, this model can bring the maximum investment return to users.

Stablecoin profit: In addition to potential gains from the rise in ETH prices, the protocol also increases the income of stablecoin loans in the form of USDC, and users earn income by depositing BCK into the BCK savings account.

No cost and interest: Bound Finance does not charge any interest or fees for minting or withdrawing collateral loans, enhancing its user-friendliness.

RWA Use Case: Most LSDfi platforms reward staking users with a small portion of the protocol's earnings. Bound Finance aims to leverage an innovative cashback mechanism, combined with the crypto market and cashback application user market, to bring a true RWA use case.

Currently, it appears that Bound Finance's innovative 3-token mechanism and revenue strategy have unique advantages, such as the dual revenue of BCK and BCKETH, the potential for higher returns as ETH rises, and user-friendly, fee-free strategies that are highly attractive to users focused on CDP. However, Bound Finance is still in its early stages and may be worth keeping an eye on or becoming the next alpha.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI