APY Winter? An article summarizing high-yield DeFi projects in the market.

Original author: Fungi Alpha, a cryptocurrency KOL

Translated by: Leo, BlockBeats

DeFi projects are still worth paying attention to due to their high returns. Cryptocurrency KOL Fungi Alpha has selected DeFi projects that can earn high returns based on the chain standard. BlockBeats has compiled the following:

The rise of encrypted narratives has taken away the leading position of DeFi, but this does not affect the high-yield projects of DeFi. Here are some DeFi projects worth paying attention to that I have selected:

Ponzi speculation is very interesting, but it is also high-risk, so we need to focus on safety, speculation, and narrative. Let's start with the BNB chain. Whether you notice it or not, it has a wide user base and promising prospects with opBNB!

BNB Chain

KTX.Finance

KTX.Finance is a decentralized derivatives and social trading protocol on the BNB chain, which can offer leverage up to 50 times. The platform is operating and developing according to plan, and the team recently announced deployment on Mantle. A secure option is to provide liquidity in the KLP pool (similar to the GLP model). The project offers 143% APR, with 27% APR paid in BNB.

Arbitrum Chain

HMX

Arbitrum is quite popular among real yield and perps dex projects, so there are many opportunities to earn high returns on Arbitrum, which is relatively safe (although risks related to DeFi always exist). HMX is a decentralized perpetual protocol on Arb, providing cross-chain margin and multi-asset collateral support.

HMX's TVL data is very good. Logically speaking, this is reflected in the yield of HLP (HMX's liquidity token), with a total APR of 68%, of which about 31% APR belongs to USDC.e, which is also the reason why HMX is widely adopted.

Hyperliquid's HLP vault is also very good, with a TVL of $5 million, vault profit of over $600,000, and current APR of 162%. Deposit USDC and let the vault accumulate fees from the trader's PnL.

Good Entry

Good Entry is a perp Dex on Arbitrum, which is not widely followed at present. Users can avoid the impact of liquidation when trading with leverage. Another highlight is ezVaults, where most rewards are in native tokens. It is recommended to participate early.

Stella

Stella is a zero-cost lending and leverage strategy protocol on Arbitrum, providing leverage liquidity mining strategies and its unique pay-as-you-go fee model. The following table shows the annual interest rate under maximum leverage, but the basic annual interest rate is also worth paying attention to. The project currently does not have a token.

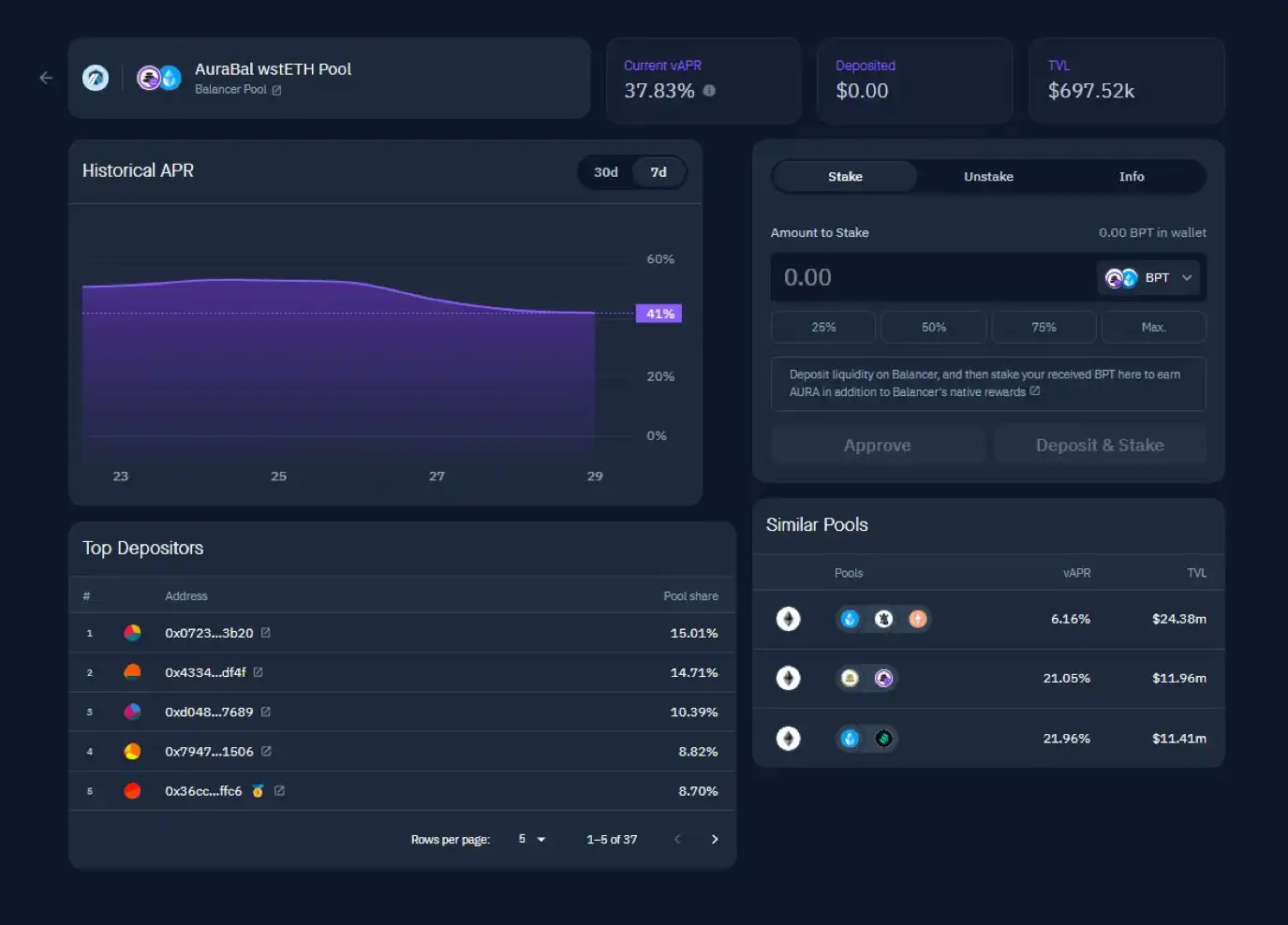

Aura Finance

Aura Finance is a protocol built on top of the Balancer system. It provides maximum incentives for Balancer liquidity providers and BAL stakeholders through the social aggregation of BAL deposits and Aura's native token. The operation is simple: users first provide liquidity on Balancer, and then use BPT to obtain additional returns on Aura. The pool currently offers approximately 38% APR.

Umami DAO

Umami DAO is a non-custodial DeFi yield protocol that aims to create and launch a series of DeFi yield products to return fees to UMAMI holders. Users can earn decent APR by depositing tokens such as BTC, ETH, USDC, UNI, LINK, etc. into the protocol. The APR for USDC or ETH is higher, around 15.4%-19.9%.

Buffer Finance

Buffer Finance is a non-custodial options trading platform and a veteran project on Arbitrum. Users can choose from four time ranges on the platform: 5m/15m/1hr/4hr, and stake BFR and/or BLP to earn real profits from generated fees. The USDC Vault APR of Buffer is 25.59%, which is also a good profit project on Arbitrum.

Trader Joe

Trader Joe is well-known to everyone, it is a one-stop DeFi platform on Arbitrum, with a wide range of businesses including spot Dex, decentralized lending, NFT trading platform (Joepeg) and launchpad (Rocket Joe), and its APR data has always been good.

Gamma

Gamma is a protocol designed specifically for centralized liquidity, with non-custodial, automated, and active management. Users can deploy funds to liquidity pools to earn high yields, and the APR data for this protocol is also very high. With its superior liquidity management mechanism, users can confidently add assets to the pool.

MUX Protocol

MUX Protocol is a decentralized leveraged trading protocol that enables trading with zero price impact and up to 100x leverage. Traders have no counterparty risk and are provided with an optimized on-chain trading experience. Additionally, MUX is a multi-chain native protocol that aggregates liquidity across multiple deployed chains to maximize capital efficiency. Currently, the protocol has a trading volume of $14.5 billion and an ETH APR of 21%.

Optimism Chain

UniDex Exchange

UniDex Exchange is a DeFi platform similar to NASDAQ, where traders can place orders for any type of financial instrument. UniDex will send orders to the best available price based on hundreds of sources and matching orders. Currently, the platform offers various trading tools such as options, contracts, and cross-chain trading. UniDex has recently improved its UI and increased the share of income that stakers can receive. Additionally, UniDex is developing the UniDex Chain, and the deposit APR for DAI on the platform is approximately 20%-40%.

The Granary

The Granary is a cross-chain lending protocol, and the APR for DAI deposits on Granary has reached 27%.

Kyber Network

Kyber Network is a multi-chain cryptocurrency trading and liquidity center that connects liquidity from different sources to achieve the best exchange rate. Its product, KyberSwap, is a DEX aggregator. Kyber Network is also a veteran DeFi project, and its Elastic Pools are very popular, especially on the Op chain, with a very high APR.

Base Chain

Aerodrome

When it comes to the hottest DeFi project on the Base chain, Aerodrome is definitely one of them. It is a branch of Velodrome and a DeFi project worth paying attention to. As of the time of writing, according to Defillama data, Aerodrome's TVL has exceeded $200 million.

Polygon Chain

Metavault.Trade

Metavault.Trade is a decentralized spot and perpetual trading platform. The MVLP on Metavault offers approximately 27% APR for MATIC deposits and is very secure.

Pearl

Pearl is a Solidly forked protocol. In addition, Pearl also collaborates with USDR (a stablecoin that generates income) to bring high returns, with some stablecoin LP APRs in the project ranging from 27% to 37%.

Retro

Retro is an AMM DEX on Polygon. In addition, Retro also brings higher yields to the protocol through Soligly forks. The average APR data of the protocol is also impressive, such as the USDC/agEUR pool.

Ethereum Chain

After all that talk about L2, we cannot ignore the high-yield DeFi protocols on Ethereum.

ambient

Ambient (formerly known as CrocSwap) is a DEX that allows for concentrated and environment-constant product liquidity on any pair of assets through a bilateral AMM. There are also reports that the protocol will be deployed on Berachain. It appears that deploying liquidity on Ambient could be beneficial in the future (perhaps with an airdrop).

Silo Labs

Silo Finance is a decentralized lending protocol. Recently, Silo Llama was launched on Ethereum, which is a fork of the Silo protocol. It allows users to borrow and lend by collateralizing crvUSD and receive CRV rewards.

Sommelier Finance

Sommelier Finance is a decentralized asset management protocol based on Cosmos SDK. Its FRAX and ETH vaults offer a 12% APY.

Jones DAO

Jones DAO is a protocol focused on high yield, strategy, and liquidity, containing vaults that provide one-click access to institutional trading strategies. It unlocks DeFi liquidity and capital efficiency through interest-bearing token yields. Its jAURA vaults have excellent returns, and AURA holders can maximize their AURA holdings' returns through the vaults.

The above does not constitute financial advice, but rather some good projects that can increase user asset returns. Hope it can help you, DYOR!

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI