Uniswap V3 ecosystem links to Bitcoin, Oku Trade will be deployed on the veteran Bitcoin sidechain Rootstock.

Table of Contents:

· Oku Trade deployed to Rootstock: Empowering Uniswap on the left hand, capturing Bitcoin ecosystem value on the right hand

· Who is the deploying entity GFX Labs?

· Rootstock: A fully equipped veteran Bitcoin sidechain

· Uniswap smart contract has previously been deployed to the Bitcoin network

On December 11th, according to The Defiant's report, GFX Labs co-founder Getty Hill stated that their developed DeFi product, Oku Trade, will be deployed on the Bitcoin sidechain Rootstock later this week.

It is worth noting that Oku Trade uses the smart contract of Uniswap V3 to obtain liquidity and facilitate trading. This means that GFX Labs will further build a bridge between Uniswap and the Bitcoin ecosystem.

Oku Trade deployed to Rootstock: Empowering Uniswap with the left hand, capturing the value of the Bitcoin ecosystem with the right hand

According to reports, after this deployment of Oku Trade to Rootstock, it will "enhance the DeFi functionality available on the Bitcoin network", and Oku Trade will also provide trading tools for Rootstock, including analysis, limit orders, and liquidity provider position management.

Hill stated that the deployment of GFX Labs this time will allow UNI holders to vote on key parameters of the protocol, including the well-known "fee switch", which can charge a certain percentage of fees for transactions and return value to Uniswap's DAO. In addition, Hill pointed out that deploying V3 on new protocols such as Rootstock or others means that "the availability of competing liquidity protocols is lower."

In other words, for Oku Trade, deploying on Rootstock can to some extent avoid the fierce competition in the DeFi field, while also helping Uniswap capture more value from the Bitcoin ecosystem, thereby empowering the Uniswap DAO. Therefore, Hill also stated that GFX Labs plans to deploy Oku Trade and Uniswap V3 on other blockchains in the near future.

According to DeFiLlama data, as of the time of writing, Rootstock has 9 protocols. In terms of TVL ranking, Rootstock ranks 26th among all blockchains, with a TVL of 113.89 million US dollars. Among the top 30 blockchains, only Bitcoin and Rootstock are related to the Bitcoin ecosystem.

Rootstock: A Fully Equipped Bitcoin Sidechain with a Complete Ecosystem

The deployed entity Rootstock is also worth paying attention to.

Rootstock is a Bitcoin sidechain that was proposed as early as 2018, with an initial fundraising of 22,000 BTC. Its advantages mainly lie in the fact that developers can build Dapps based on the OS framework of Rootstock itself.

Related reading: "Inventory of BTC ecological protocols, which protocols can stand out?"

As a veteran sidechain, the Rootstock ecosystem currently has 104 projects covering 15 tracks including data analysis, lending, stablecoins, oracles, payment channels, wallets, etc. It can be said to be one of the more complete Bitcoin ecosystem protocols.

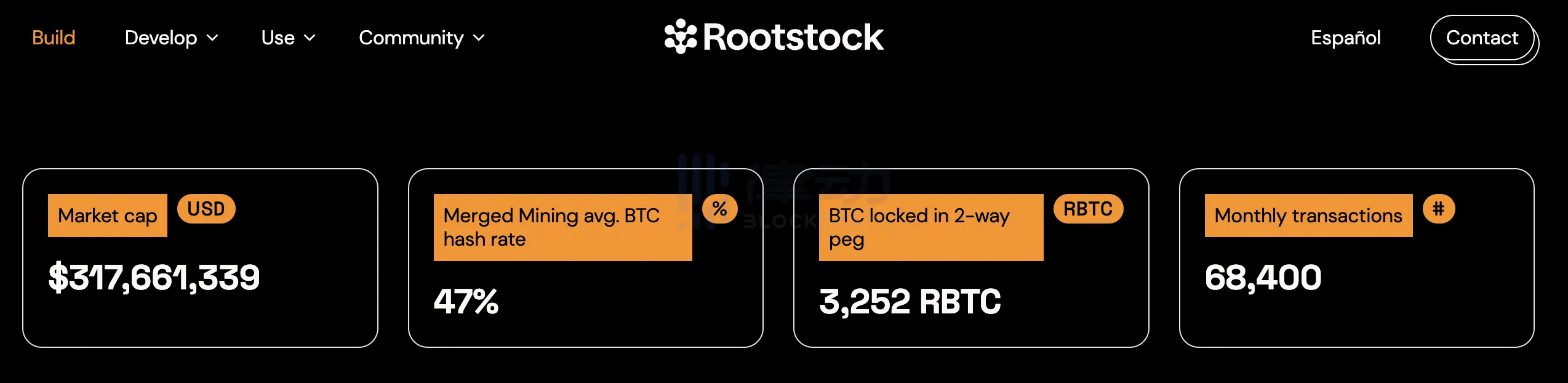

According to data from the Rootstock official website, as of the time of writing, its ecosystem's locked-in value (TVL) is approximately $317 million, including 3252 RBTC (valued at approximately $135 million at current RBTC market prices). The monthly trading volume is 68,400, making it one of the more prominent protocols in the Bitcoin ecosystem.

Who is the deployment subject GFX Labs?

It is worth noting that the main body of this deployment, GFX Labs, is a diversified blockchain development company. In September 2022, it received a $1.6 million grant from the Uniswap Foundation and subsequently launched Oku Trade, which is built on the Uni v3 contract. This platform helps users conduct limit order trading through the protocol and provides LP positions.

So far, GFX Labs has launched Uniswap V3 on 7 chains including Ethereum, Optimism, and Arbitrum through the deployment of Oku Trade. In addition, GFX Labs' products also include the DeFi protocol Interest Protocol, the on-chain tool Web3 Sheets, and the analytics tool GFX Analytics.

The Interest Protocol, which launched on Ethereum last year in June, issued the over-collateralized stablecoin USDi, allowing users to deposit wETH, wBTC, or UNI into the collateral pool and borrow USDi against that collateral. It also supports users in minting 1 USDi by depositing 1 USDC into the Interest Protocol, and burning 1 USDi to mint 1 USDC. All USDi holders automatically earn interest without needing to stake their holdings.

In addition, GFX Labs also has a high level of trust within the Uniswap community.

May 17th, Tally page shows that the Uniswap community has passed the proposal to deploy Uniswap V3 on Polkadot's EVM-compatible parallel chain Moonbeam with nearly 100% support rate, and the technical entity responsible for the deployment is GFX labs.

Without coincidence, on May 18th, GFX Labs, she256, and Michigan Blockchain jointly proposed a proposal in the Uniswap community on the governance page. The proposal suggested deploying Uniswap V3 to Base on the Coinbase L2 network when it launches, and the proposal was subsequently supported by the community with unanimous votes.

In addition, GFX Labs was once a representative of a16z participating in governance matters of Optimism. On February 15th, a16z announced the first batch of representatives of the Optimism Foundation who will vote on behalf of a16z. Each representative will receive 1 million OP delegation authorizations, including GFX Labs, and the other 6 are blockchain associations of universities. February 15th.

That is to say, among the representatives selected by a16z to vote on behalf of Optimism governance, only GFX Labs is a non-academic organization. This is enough to show the credibility of GFX Labs in the crypto community.

Uniswap smart contract has been deployed to the Bitcoin network

Additionally, there is another noteworthy entity, Uniswap. As early as the first half of this year, Uniswap had already entered the Bitcoin ecosystem.

This year on May 11th, according to CoinDesk, the protocol developers of the Bitcoin DEX project Trustless Market have deployed Uniswap's smart contract onto the Bitcoin network to take advantage of the BRC-20 Token craze and develop the DeFi ecosystem.

It is reported that one of the developers of Trustless Market, @punk3700, once stated on social media: "The use of Bitcoin is far more than just a currency. We started with art, then moved on to artificial intelligence, and DeFi is naturally the next field to be added."

In fact, there are already many DeFi projects in the Bitcoin ecosystem, such as cross-chain bridge projects MultiBit, XLink, and LSD project Fairlight CDP. However, the real leader has not yet emerged, and BlockBeats will continue to pay attention.

Related reading: "Bitcoin DeFi ecosystem is on the rise, what protocols should we pay attention to recently?"

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data