Delphi Digital 2024 DeFi Outlook, the interest rate derivatives market has unlimited potential

Original author: Stacy Muur

Translated by: Deep Tide TechFlow

Recently, Delphi_Digital released its outlook for DeFi in 2024. Author Stacy Muur selected the main content, and this article compiles it for readers' reference.

Flowing Collateral

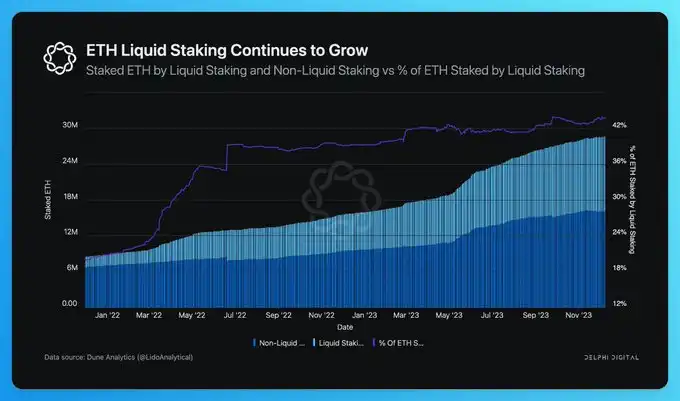

· Compared to the total supply of 120.2 million ETH, the current staking rate of ETH is 23.7%. The amount of ETH staked is approaching the target of 33.5 million ETH (27% of the total supply of ETH). This staking amount is considered the optimal level to ensure network security.

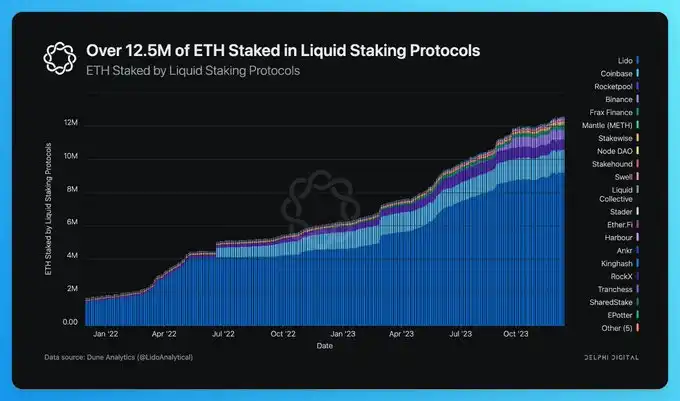

· The adoption of LSD has also seen significant growth, with approximately 44% of all staked ETH currently existing in these protocols. Compared to other LSDs, the superior usability provided by Lido's stETH gives it a huge competitive advantage.

· In the LST field, Frax has shown stable growth, and the ETH staking amount will increase from 38K to 233K by 2023. Frax stands out for its innovative sfrxETH design and integration within its ecosystem, particularly in Fraxlend.

· Mantle has launched its mETH product using the protocol it owns with ETH. The purpose of mETH is to generate revenue for Mantle and enhance the liquidity of DEX.

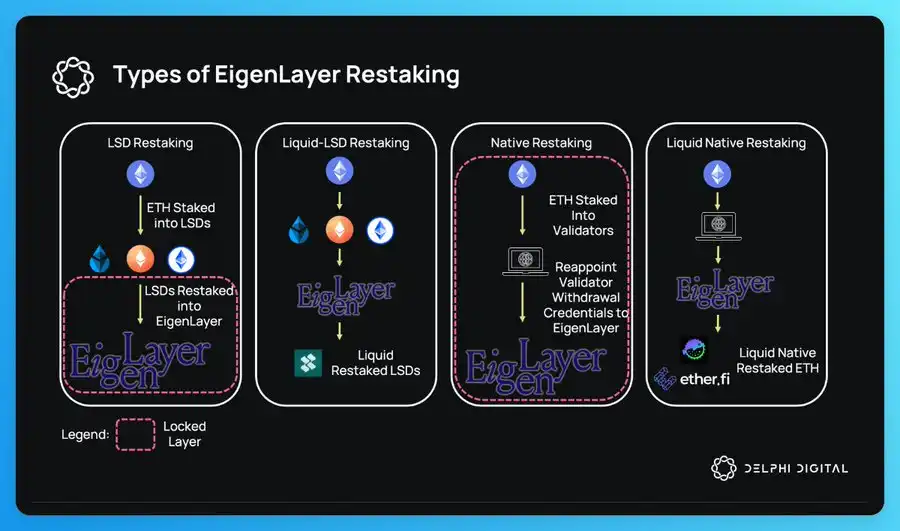

· Ether.fi and Renzo have implemented native liquidity re-collateralization on EigenLayer.

· The LSD industry on Ethereum has matured, become highly competitive, and saturated.

· Many LSDfi projects have lost their appeal due to the decrease in high returns driven by incentives.

· Re-collateralization (Eigenlayer) will be the fastest growing area in the 2024 collateralization agreement.

DEX

· Uniswap v4, Uniswap X, and other intent-based DEXs are becoming the theme of 2024 in the encryption industry.

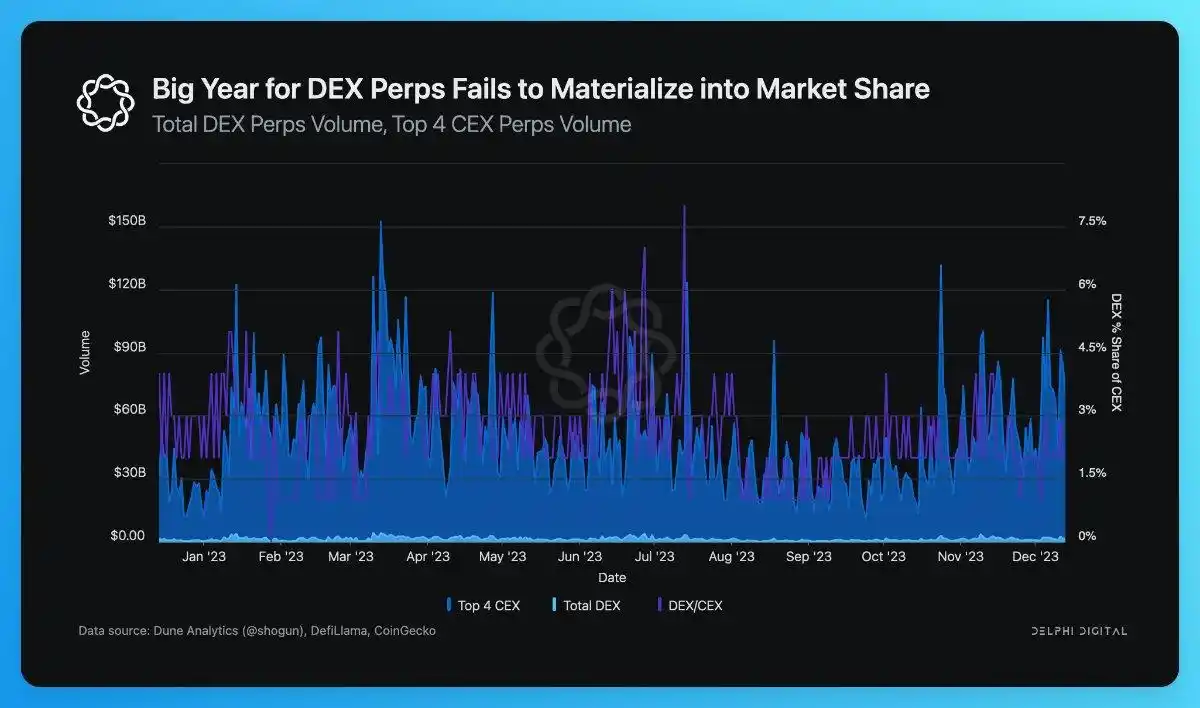

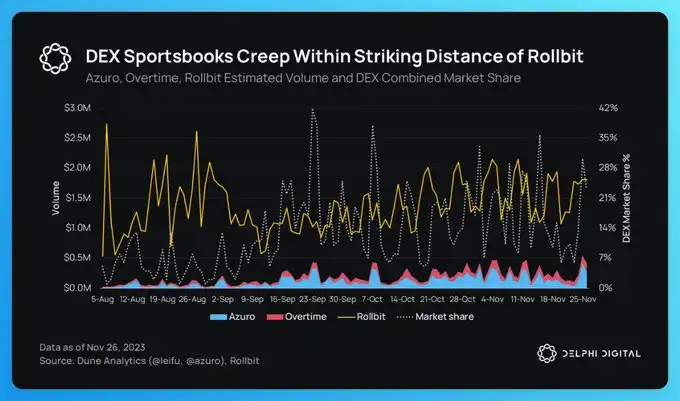

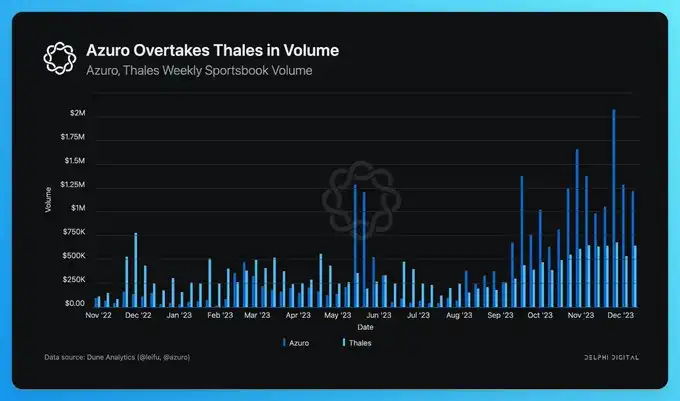

· Perp DEX has gone through a year of development, but its market share has not increased:

· dYdX v4 jumps into the Cosmos application chain.

· Aevoxyz pioneered the OP stack.

· Vertex boosts DEX UX

· Rabbitx becomes a booster for Starkware.

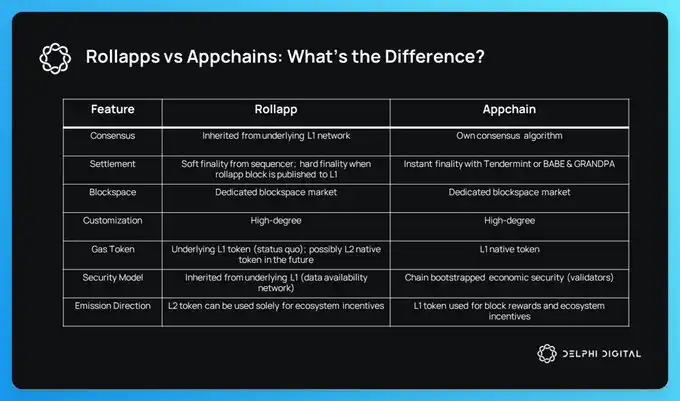

· Application-specific Rollup: Aevo paves the way for rollapp (forks Optimism and deploys DEX on top of it to expand its supported usage)

· Most DEXs, especially derivatives, will benefit from having their own execution environment.

RWA

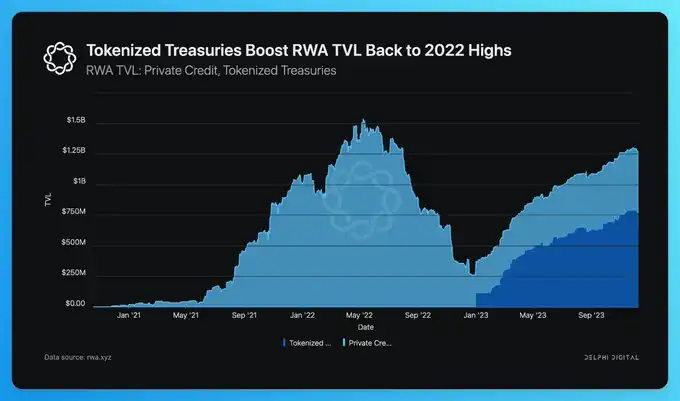

· RWA is one of the most successful areas of cryptocurrency in 2023.

Interest Rate Derivatives

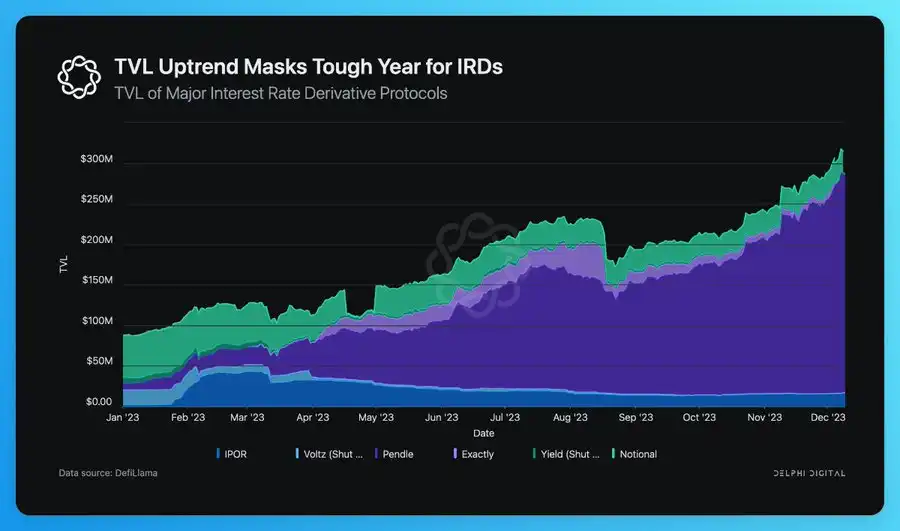

Atm, Pendle, Notional (fixed-rate loans), and IPOR are sustainable interest rate derivative agreements. Interest rate derivatives may become one of the more attractive narratives in the cryptocurrency industry in the coming years.

Decentralized Stablecoin

· Decentralized stablecoins only account for a small portion of the entire stablecoin market value.

· The derivatives market is becoming a key area with untapped potential for decentralized stablecoins, namely Synthetix.

Wallet

· User experience and wallet experience are the top priorities for most wallet developers. Delphi_Digital lists some features of wallets:

· MetaMask is a leader in the wallet industry.

· The transaction simulation function in Phantom wallet is excellent.

· Rabby is the best EVM wallet.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI