「Shanzhai 312」 vs 「BTC All-Time High」, Who Took Your Money During the Crash?

「If you ignore the big pancake and only look at the altcoins, I thought we had hit 312.」 This was a helpless sigh from a community member.

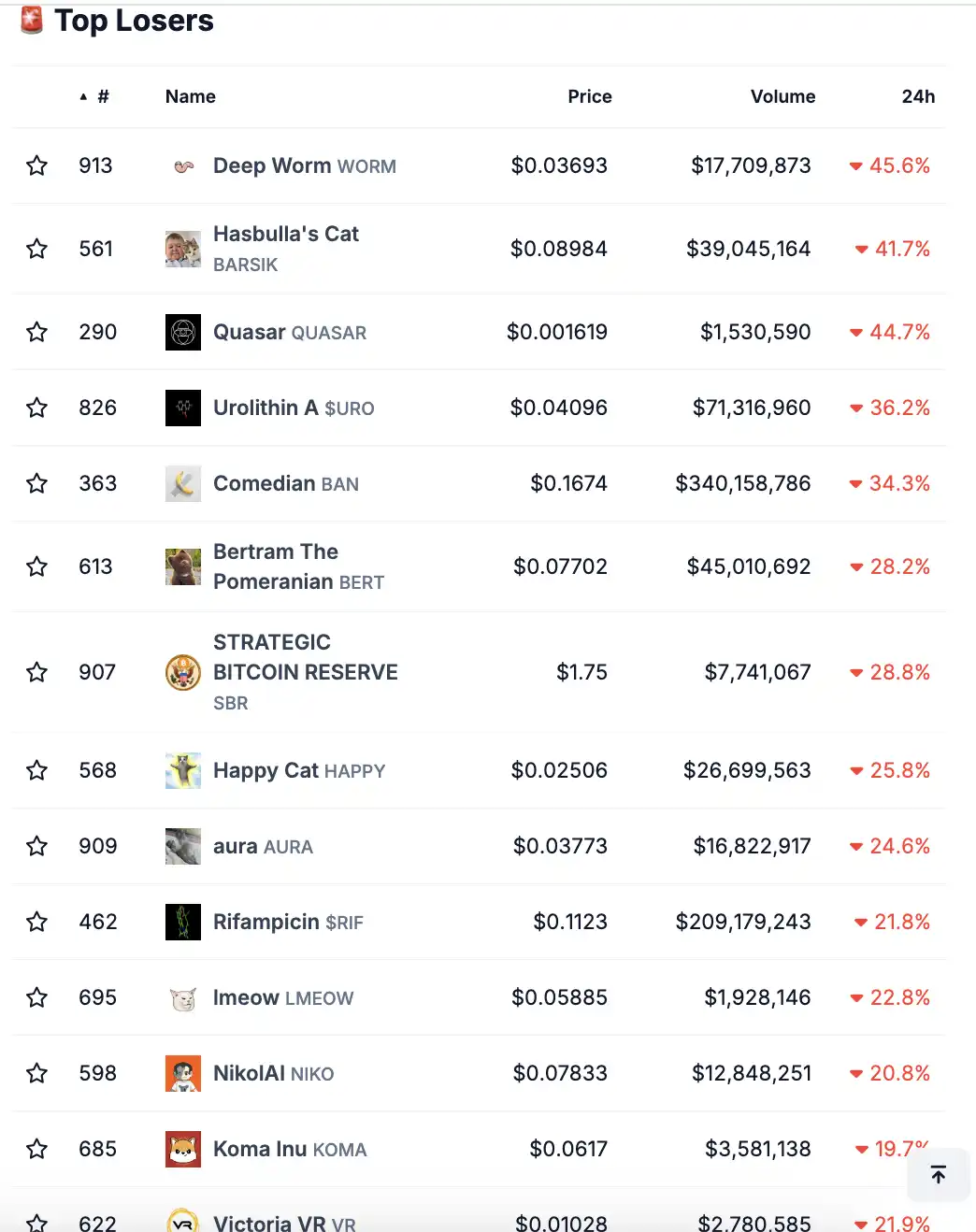

This sigh is not groundless. On-chain data truthfully presents a grim scene: the relentless red downtrend is devouring the community's hope, leaving devastation in its wake. Taking the BIO ecosystem as an example, $URO plummeted by as much as 36.2%, while $RIF, unwilling to be outdone, fell by 21.8%.

The Torrent of Profit-taking Exodus

Since Trump confirmed his return to the White House, the altcoin season has surged like a tsunami, with a frenzy of price spikes, featuring intense and brutal PVP. The big waves have sifted the sand, creating a new generation of crypto-rich.

For example, a savvy whale address 'GcYC1...quyt6' had already built a position in $RIF at the low point in late September when the DeSci Meme narrative had not yet taken off, profiting a staggering $1.05 million from a $14,000 investment, yielding a remarkable 7400% return on investment. This is a myth that no trading market dares to imagine and can only happen in the crypto world.

Another example is based on LookIntoChain monitoring data, showing that within just 20 days, a trader bought $800 worth of URO and eventually made a $572,000 profit; then bought $300 worth of RIF, earning $957,000. This means that with an initial capital of $1,100, he increased the value of his position to $1.62 million, achieving astonishing growth rates of 3503x and 714x respectively.

There are countless such examples. These profitable funds gradually sold off altcoins during the upward trend, leading to the altcoin crash we are experiencing today, known as 'Altcoin 312'.

And where will these profits go? Today's market has given us the answer.

Just as altcoins are crashing on a large scale, Bitcoin's price has surpassed ninety-seven thousand, reaching a new high once again. Funds are flowing out of the altcoin market, returning to trading platforms, and ultimately moving towards Bitcoin. Bitcoin, once again, is using its price to reaffirm itself as the market's lighthouse.

The End of Altcoins is Bitcoin

At this moment, I am reminded of the story when SBF once wanted to keep BTC below twenty thousand dollars.

In the saga of the FTX incident and the trial of SBF, Caroline Ellison, the CEO of Alameda Research and SBF's former girlfriend, testified and provided evidence: SBF had instructed Alameda that if Bitcoin exceeds twenty thousand dollars, they should continue to sell Bitcoin, attempting to keep the Bitcoin price below twenty thousand dollars.

As for the reason for doing this, although they did not mention it in court, informed members of the community provided an answer: "The usual practice of trading platforms as market makers is to boost Crypto (with the main targets being ETH and a few other Top 20 coins) while suppressing the Crypto/BTC exchange rate. This is not just FTX's own practice, but other trading platforms do the same."

Doing this can slowly erode people's confidence in Bitcoin, attracting all funds to Crypto, once users' trading habits are cultivated, they can smoothly dump a huge amount of junk coins on lower-level players.

After all, having become accustomed to the explosive rallies and thousand-fold increases in the cryptocurrency world, how many people would have the patience to hold only Bitcoin, even if it is almost a certainty to double in value?

Today, the principle remains the same. The unique fanaticism and impatience of the cryptocurrency world have never changed. And those true large capital players have long understood the value of Bitcoin, exchanging your Bitcoin for junk altcoins and patiently waiting for the harvest.

The best example is MicroStrategy, as of the writing deadline on November 21, MicroStrategy's Bitcoin holdings hit a new all-time high: 331,200 bitcoins with an average purchase price of $49,874. Easily doubling their investment.

Not to mention BlackRock and other Wall Street giants; if they were to start buying Bitcoin in advance of applying for a Bitcoin ETF, their costs would mostly be controlled while Bitcoin was trading between $20,000 and $60,000, and no one knows how many chips they have accumulated.

Perhaps, for the average investor, the wisest choice is: hold onto your Bitcoin tightly and have fewer fantasies of overnight riches. Allocate a large portion of your portfolio to Bitcoin and only use a small portion of your funds to "gamble." Do you really think you are smarter than BlackRock, MicroStrategy, and other Wall Street elites?

Finally, I'll end with a story meme I saw on Twitter today:

"When Bitcoin hit $100,000, you were still holding a shitcoin that was down thirty points. You retweeted the news of Bitcoin breaking $100,000 from ChainNews, your family and friends praised you, saying you must have made a killing getting in early. With tears in your eyes, you replied, 'Didn't make much, just a little profit.'

Let's hope this is not the story of most of us.

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群:https://t.me/theblockbeats

Telegram 交流群:https://t.me/BlockBeats_App

Twitter 官方账号:https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI