Citadel CEO's Latest Interview: The Future of the Trump Administration, the US Economy, and Cryptocurrency in the Era of the "Red Wave" | In-Depth Discussion

Original Title: Capital, Politics and Power: Ken Griffin on the 2024 Election and What's Next for the U.S. Economy

Original Translation: zhouzhou, BlockBeats

Editor's Note: This conversation is about the U.S. economy, investment, cryptocurrency, and future technology, with a focus on the flexibility of American capitalism, entrepreneurial spirit, the potential of cryptocurrency, and the future of investment. In particular, the guest discussed his views on cryptocurrency, expressing a reserved attitude towards its future despite missing investment opportunities. The conversation also covered wealth growth, technological innovation, economic differences between Europe and the U.S., and future market trends.

Below is the original content (slightly reorganized for better readability):

Host: Today's guest is Ken Griffin, the founder and CEO of Citadel. I believe he may be one of the most influential individuals in the current financial markets. His hedge fund manages around $65 billion in assets, but more importantly, I think Citadel Securities processes nearly a quarter of the U.S. stock market's daily trading volume.

He is also a significant philanthropist and wields considerable influence in American politics. In the recent election cycle, he was among the top five donors to the Republican Party, second only to Elon Musk.

I want to start with politics and policy because as mentioned earlier, you are one of the largest Republican donors. However, it's interesting that I noticed you did not donate to the elected President Trump. I want to read you a passage: "I did not support Donald Trump, I struggled with this issue. I know who I'm voting for, but I'm not happy." Now that the election is over, are you happy now?

Ken Griffin: Yes, because the Republican Party has won the House, Senate, and White House. We now have the opportunity to govern and make America serve ordinary Americans, bringing America back to a principled, powerful, and prosperous nation. I am excited about this possibility.

About the Second "Trump Administration"

Host: Could you talk about your dissatisfaction with the President-elect?

Ken Griffin: I think the President-elect has experienced tremendous personal pressure over the past few months. Imagine that he not only had to face endless attacks from the American legal system but also narrowly escaped an assassination, literally just an inch away. But he persevered, went through the election. At that time, what we saw was a person under tremendous pressure, without a doubt.

This kind of pressure doesn't always bring out the best in him, which is understandable. However, now that he is the President-elect, I will do everything I can to support his future role as the President of the United States.

Host: You have said that you were not happy when you voted, I assume you voted for him, right? So are you satisfied with this result?

Ken Griffin: Yes, I voted for him. I believe that between the two candidates, from a policy perspective, this was clearly the best outcome.

Host: So let's talk about some policy issues, perhaps the biggest one is the tariff issue. This issue currently has no clear answer, but its impact on the economy is enormous.

Ken Griffin: The United States is now open for business again, the paralysis caused by regulation and litigation during the Biden administration has come to an end. So when I talk to a group of American business executives, whether from the telecom sector or the consumer sector, whether they voted for Trump or Harris, from a business development perspective, they are all smiling. Because now they can focus on creating value for customers, creating job opportunities, growing their businesses, and achieving prosperity, instead of being plagued by endless and meaningless litigation and regulation.

For example, Lina Khan, she seems to have completely missed the advanced economics course in college. Her impact on weakening American productivity is significant. So I think for the United States, all these issues about tariffs, energy extraction, are secondary, the primary issue is that America is back in business.

Host: Why do you say these are secondary? The Biden administration's regulatory policies have indeed brought a lot of uncertainty.

Ken Griffin: This is not uncertainty, it is total loss.

Host: There is now new uncertainty, such as the tariff issue. How do you view this issue?

Ken Griffin: I think we may need several months or even years to figure out where all of this is going. It is clear that this uncertainty will indeed weaken capital formation, there is no doubt about that. At the same time, we must remember that the President's background is in the real estate industry, and the negotiation rules in real estate are often different from what we see in stock or bond trading.

In the real estate industry, you may buy a building every few months or years, and you may never deal with the same seller again. The negotiation dynamics in this pattern are completely different from daily frequent trading. I think the President has brought this behavioral pattern to the White House because it is part of his economic background.

He will take some bold positions and then observe the other party's reaction. For example, you can see this in his tariff threats against Canada and Mexico.

Host: I think a bigger issue may be regarding the "BRICS" countries. For example, the President-elect stated that if these BRICS countries try to establish their own monetary system, the U.S. would impose tariffs on all of them. I imagine this new uncertainty may not have been something you anticipated before, right?

Ken Griffin: The key is: where is this going? The President won't do that, and it won't happen. The BRICS countries will not move away from the dollar in the next four years. Nor will he take retaliatory measures against their trade or other affairs because of this.

Host: Language is indeed important. When we read his tweets, statements, or other social media content, some words may seem meaningless. Do you think these declarations of his, even if you think they won't be realized, will have any impact on the country?

Ken Griffin: Of course, they will have an impact. As a media person, you should know that language is powerful.

Host: Agreed. So I'm curious, is this language important to you?

Ken Griffin: Of course, it's important. That's why I couldn't smile while voting. I hope his language is more precise, I hope the ideas he conveys are more transparent, clear, and easy to understand. But the core ideas he expresses— that America can be a great country, one that can offer a better life, one where people can make decisions for themselves— these values have resonated throughout the country.

Host: We need to distinguish the big picture here. The significance of this government lies in its representation of a free America, a prosperous America, a strong America, and a respected America. We should focus on these big picture issues; that is the core of America. However, the issue of being "respected" is indeed interesting, isn't it? If you continue to be in conflict with every country around you, that becomes a core issue.

Ken Griffin: Without a doubt, the whole world is looking to the United States for leadership. While we may threaten Mexico or Canada with tariffs, these are minor issues compared to the world's expectations of the United States. For example, when we tell Hamas to release hostages before the presidential inauguration, such statements have a significant impact on the entire world.

Host: Let me ask you a question; Trump just appointed Scott Besson as Treasury Secretary. I know you previously supported Mark Rowen, who was then at Apollo. What are your thoughts on Scott Besson as Treasury Secretary?

Ken Griffin: I personally do not know Scott, but I have a friend who is one of the most successful fund managers in history, and he speaks very highly of Scott. Frankly, Mark Rowen is very adept at managing large organizations. From my perspective, those around the president need to have the ability to manage large organizations; this is a crucial skill. So, I am naturally excited about Mark, but that doesn't mean Scott is unfit for the job.

Host: The reason I brought up Scott Besson is that both he and President-elect Trump have mentioned the possibility of weakening the Fed's independence. Later, we will see Trump with current Fed Chair Powell. Scott Besson has openly discussed an idea of creating a so-called "Shadow Fed Chair." This person would be nominated to the Fed, but even if not in the Fed, could influence the market, leading investors to be skeptical of the current Fed Chair's policies and more inclined to predict what actions the next chair might take. What are your thoughts on this idea?

About the Future Four Years of the U.S. Economy

Ken Griffin: We need to go back to the most fundamental question— the Fed's independence is crucial for the stability of the US dollar. I have always publicly supported Powell, not just in recent months, but for many years, because I genuinely believe that whether it's President Trump or any former president, the Fed's independence is vital to maintaining and enhancing the health of the U.S. economy.

Of course, every president will have some opposition when the Fed makes tough decisions. Politically, when the Fed raises interest rates to control inflation, leading to job losses, as a president, you can't say, "Great, I'm very excited about this." No one expects the president to play that role. The Fed Chair's responsibility is precisely to make those tough decisions that the political sphere dares not face.

Host: So far, how do you evaluate Jay Powell's performance?

Ken Griffin: I want to clarify that Jay Powell is facing one of the worst jobs because the Biden administration, with its irresponsible fiscal spending, has pushed this country into an unprecedented inflation trajectory, and then he has to deal with cleaning up the massive fiscal deficit, just as this government needs to clean up those deficits. So, over the past few years, his job has been very tough, with almost no winning moves.

So, some people think he may have landed successfully by now, or at least a soft landing, or we are still circling in the air. You can now look at the stock market. It feels good in the short term, but as Scott said, I applaud him, we must straighten out fiscal issues. As we clean up the federal finances, this will have other implications on our economy, and both the legislature and the Fed must address these issues.

Host: So right now, the stock market looks good, but the bond market may have a different performance. What do you think is happening?

Ken Griffin: I believe the bond market's volatility in the past few weeks hasn't been significant, although it has reacted somewhat.

Host: If you were a stock market investor, do you think what's happening now makes sense?

Ken Griffin: Without a doubt, let's go back to the opening remarks about U.S. companies; the situation now is better than before the election.

Host: Wouldn't that undermine all other uncertainties? Or do you think those uncertainties wouldn't happen at all, and that's what we should decide on?

Ken Griffin: No, this is about understanding the big picture versus getting caught up in the details. It's like not seeing the forest for the trees.

Host: But considering the White House, as you mentioned, Congress and the Senate have both turned red. Is there any control factor, perhaps the bond market, that will eventually address spending and other upcoming events, or things that may or may not happen? Do you think the bond market would be impacted if we don't get the situation under control?

Ken Griffin: If we don't get our fiscal house in order, the bond market should be affected, meaning that's exactly what the bond market should be doing.

Host: Do you believe in Elon Musk and Doge? Because this relates to whether the bond market thinks we have the situation under control.

Ken Griffin: Blaming everything on Elon Musk is a bit absurd, and we now have some extremely capable, competent, and smart people helping the president's advisers. We are back to the good old days when people like this weren't in the White House; I would now be happy to have Elon in the White House. What we hope for is that the president, Congress, Senate, and Department of Justice can all play a role in opposing crony capitalism.

Whether it's the current government or the previous government, one of my biggest concerns is the increase in American crony capitalism. When we use taxpayer money in Washington to play favorites, picking winners and losers, it is really unfair to American taxpayers, American consumers, and future generations. And this is not just a Washington issue. Look at California, trying to provide electric vehicle subsidies to all companies except Tesla. I mean, it's so incomprehensible, how can it be so shocking?

Host: You are a Tesla investor.

Ken Griffin: That was a few weeks ago, we trade a quarter of the daily volume in the U.S. market.

Host: That is indeed a fact, I am actually quite interested, if you are a Tesla investor, or at least interested in it. A significant decision was made this week. I don’t know if you’ve been following, about Elon Musk's compensation package, this issue has been pending for the past year. What are your thoughts on this? In this case, shareholders voted for the compensation package, while the Delaware court, where Tesla is registered, said this was unacceptable. Do you have any thoughts?

Ken Griffin: I can only say one thing, if you have $5 billion at risk and still be fine, that must be great, but can you imagine that risk?

Host: Actually, this brings up a question. You happen to be one of the richest people in this country, maybe not with an extra $5 billion lying around, but you are up there. I want to read you something, I'm curious how it resonates with you.

Warren Buffett just wrote a letter, I don't know if you've seen it. He talked about giving away more money and letting his kids do it. He wrote the following, which I found interesting. He said he had confidence in getting rich at a very young age, but never, whether it's me or others, did he think about the magnitude of wealth that America could achieve over the past few decades.

He couldn't even believe such a thing could happen, even for himself, saying it was beyond the imaginations of Ford, Carnegie, Morgan, or Rockefeller. Today, billions have become the new millions. How do you view this idea? Because I think it is indeed a quite significant shift in our culture and society.

Ken Griffin: This is an astonishing part of American history; about 125 years ago, almost half of America's population was engaged in agricultural work. The transformation of our economy over 12 decades is astounding. We are now at an interesting economic inflection point where a clever idea can rapidly reach the market and overnight touch billions of consumers.

Indeed, think about the instant impact we have from this conference today. Conferences like this can now connect you to the entire world, which I thought was impossible 50 years ago. So it means that in this era, great entrepreneurs have the ability to create an idea, bring it to market, and launch it globally in a way you couldn't do before, right? If you think back 70 years, you would open a single retail store. If all went well, you might open another store on a street a few miles away or in the next town, right? But today, with Jeff Bezos' Amazon, yes, Amazon provides instant access to everyone, but you can't imagine what it was like 50 years ago.

Host: I'm not against that at all; it's an amazing thing. But the question is, if billions are the new millions, then I guess we'll soon see trillions.

Ken Griffin: I think Warren was very clever in his choice of words. After all, the number of millionaires is much smaller compared to billionaires.

Host: Sean Fain said billionaires should not exist at all. You are a capitalist, how do you see this? I just want to know your view on this kind of despair.

Ken Griffin: That is his challenge on many fronts — he fails to understand the consequences of his actions. We can all become poor, but I would rather not be poor, and everyone would rather not be poor. In our country, we'd rather not be Venezuela.

Host: I have a few quick questions to ask you, actually it's a question about your specific business at the moment.

Ken Griffin: The flexibility of the U.S. capital system and the U.S. labor market are critical parts of the story of our country's standard of living, where no other nation can compete with the U.S. on average in terms of the standard of living of its people and the opportunities that children have. Look at Europe, sluggish by comparison to the U.S. It is a continent disappearing on all fronts, facing challenges in birth rates, slow economic growth, heartbreaking per capita statistics, and a lack of optimism about the future. Do you want to be like Europe? I don't. I want to be an American.

Host: I have a question about the investment business because it has changed a lot over the years, and I believe there are now two models in operation. One is the model you are in, I would put you alongside Millennium Capital, possibly even Point72, and even Jane Street in this category. The other is those individuals who have their own firms, and one question is can we effectively compete with larger firms, what are your thoughts on this concept?

Ken Griffin: If Serena Williams came today and asked me to play tennis, I'd say, wouldn't you express your views through tennis?

Host: What I mean is, there are now two types of large pools of funds gathering various information, I'm not talking about illegally obtained information, but how these large teams can pass on the cost of acquiring a lot of information to their investors. This is completely different from the business model 10 or 20 years ago. If you were to start today, do you think you could start a small fund and compete with your current enterprise?

Ken Griffin: Isn't that the power of youthful naivety? Just like when I started, I had to compete with companies like Solomon Brothers and Goldman Sachs, which seemed immense.

Host: So if you were to start a fund today or do something, what would you do?

Ken Griffin: That's what entrepreneurs have, right, they have this belief: despite almost no set of metrics that would suggest you have a chance, you go do it. Do you think Elon Musk thought he could take on large automotive companies just based on first principles? No, I think it's working hard and bringing together better people and then finding a way, finding a way to achieve the goal like an entrepreneur does.

How has the investment business changed over the past 30 years? There has certainly been massive change, the rise of passive investing has been enormous. Now nearly 50% of all assets are in passive investment vehicles, almost free to the investor. But the premise of those tools is that the market is efficient because active management companies like Citadel, Millennium, Point 72 exist.

And let's be clear, there are hundreds of other very good, very capable hedge funds, like D1, and so on. These are very well-run companies doing very good research. Because that's the fun of my work. The essence of my work is research. It's about gathering information, coming to conclusions, understanding the business model, understanding the product, and understanding the parts of the story that aren't reflected in the stock price.

Host: In this country's narrative that you're describing, given all of these factors, what large-scale investment would you make now? Are there specific areas or companies that you would invest in?

Ken Griffin: The global trend is more resources flowing to America, that's the global trend because it's the most vibrant country.

Host: Is there a sector, a company, or any place you can point to and say, this is where we're heading?

Ken Griffin: That's the challenge between investing and the economy, the direction of the economy is clear. Healthcare will continue to become more and more important, technology will continue to attract resources, and continue to innovate our lives. But the question is, the valuation of these companies as investment targets, have we fully priced in a bright future, or have we overpriced a bright future.

The Future of Cryptocurrency

Host: So, what are your thoughts on another rapidly growing field now? That is Bitcoin and cryptocurrency.

Ken Griffin: Let's end it here. What do you think?

Host: So, cryptocurrency is not at all interesting to you?

Ken Griffin: It’s like I own a few paintings with oil paint on canvas, maybe the canvas cost $15, the paint about $20, total cost about $35, but these paintings trade for tens of millions of dollars, who am I to value cryptocurrency?

Host: But you have been asked to value cryptocurrency for a long time, and you made a judgment by not buying it, right?

Ken Griffin: That was a mistake indeed.

Host: So, do you regret it now? I'm a reporter, I tell the truth, I hold mutual funds but don't allow investments, so I missed out, too.

Ken Griffin: That's a shame, but of course, I wish I bought things a few years ago that only traded for 100 times what they are now, right? We all have this psychology, it's universal human psychology. There's always that feeling of missing out. And then the second question is, where I don't care about cryptocurrency is where it can solve our economic problems?

Host: What do you think will ultimately happen? Because you have mentioned many times, what problems cryptocurrency solves, why we need to solve these problems. Do you think the whole cryptocurrency is just a crazy speculative bubble that will ultimately end badly as Warren Buffett said, or do you think it will continue to exist in this digital form and make sense?

Ken Griffin: I think it comes back to a question similar to why people vote for Trump, because they want to get rid of the government's shackles.

Host: So maybe it might have a future, right?

Ken Griffin: It may have a future. You have to remember for assets like this, an intangible asset where its value is derived from the intangible aspects, part community, part the feeling of ownership like "I stand against the nation-state power," right? People derive pleasure from it. I think one of the phenomena we've seen in this election cycle is that Americans are saying, 'I want agency over my own life,' and cryptocurrency is a part of that.

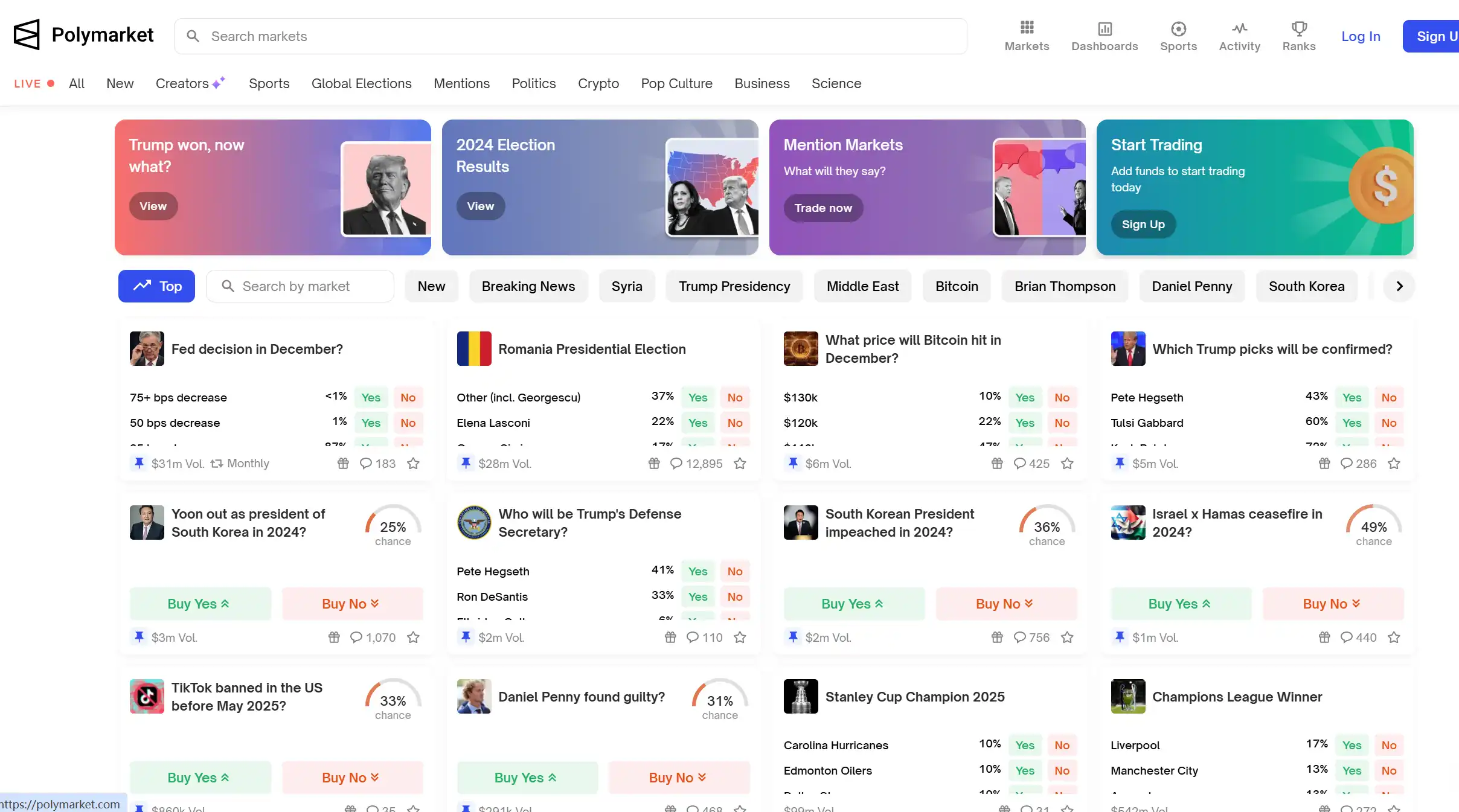

Host: How do you view founders like those of Polymarket, how do you see people betting on elections now? Is this a market? Is this an area you want to get into?

Ken Griffin: I don't know, but anyway, it's not something for us to do. But congratulations to Polymarket for building such an international brand in a matter of weeks through their massive bets on the pro-Trump side. It's not something I've spent too much time thinking about.

Host: Shane, he doesn't want to get into your industry. But I am curious since you now have a market where you can bet on all sorts of things, do you eventually want to get into this industry?

Shane: You know, I'm a product builder, I can't say I'm a trader, but I do think that everything having a market is inevitable, and this flourishing situation is very exciting. And in my view, the greatest financial figures may be a bit dismissive, thinking these markets are too small, but it's still an opportunity for us. I think, as Ken mentioned, the youthful naivety and entrepreneurial spirit, those seemingly small opportunities today could become very big tomorrow.

Host: Maybe we will all end up betting on these markets eventually. Before you go, I have one last question. A few years ago, I don't know if you remember, you bid on a seat on a Blue Origin spaceship during a Robin Hood event, you spent $8 million to buy that seat. Do you remember that? I do. And you gave the seat to a teacher. My question is, do you have aspirations to take a trip to space yourself?

Ken Griffin: If you live to be 98, I'll tell you.

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群:https://t.me/theblockbeats

Telegram 交流群:https://t.me/BlockBeats_App

Twitter 官方账号:https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI