How Solv Protocol Became an On-chain Microstrategy

On November 21, MicroStrategy's stock price rose by more than 10%, setting a new high, and its trading volume surpassed Nvidia and Tesla, becoming the most traded stock in the U.S. stock market that day. It can be said that MicroStrategy relied on Bitcoin to dominate the U.S. stock market that day.

Time goes back to August 11, 2020. On this day, Michael Saylor, chairman of MicroStrategy, announced that MicroStrategy purchased approximately 21,454 bitcoins for $250 million, becoming the world's first listed company to incorporate Bitcoin into its financial strategy.

At that time, MicroStrategy's stock price was still around $15, but now it has exceeded $500, and its stock price has soared 35 times, far exceeding the increase in Bitcoin itself.

MicroStrategy's All In Bitcoin method can be described as simple and crude: buy. In addition to using the company's reserve funds to purchase Bitcoin, MicroStrategy also purchases Bitcoin by issuing MSTR shares (ATM) and convertible bonds. As of the time of writing, MicroStrategy already holds 402,000 Bitcoins.

Original source: Ethean

Not only that, the Wall Street Journal once reported that the secondary market even produced the MSRT2x leveraged ETF specifically for MSTR, and its market value also exceeded US$5 billion, providing another layer of boost for the surge in MSTR.

Is MicroStrategy enough?

Not only MicroStrategy, but also another driver of this bull market - ETF, BlackRock IBIT already holds more than 500,000 Bitcoins. According to statistics, TradFi and governments around the world hold more than 14% of Bitcoin in total, but the liquidity of this part of assets is idle and cannot flow into the chain.

Top 15 Bitcoin Holding Entities

MSTR is not like the rootless flywheels of GBTC and Luna in the past. After all, it is still supported by real assets. But users still need to know what the purchased stocks mean? If the funds used to buy one Bitcoin are used to exchange for MSTR stocks, the ultimate value behind it is not equivalent to one Bitcoin, not to mention that Hold alone cannot create other value.

Going one step further, as block rewards decrease and pressure on miners increases, how can we ensure the security and sustainability of the Bitcoin network?

To solve the above problems, we must go beyond the crude Buy and Hold mode.

How does Solv Protocol become a micro-strategy on the chain?

If Buy is the common goal of everyone, then upgrading Hold to Earn is a small step, not only for Bitcoin, but also for the entire industry.

Not only TradFi represented by MicroStrategy, but in fact, Bitcoin, with a total market value of nearly 2 trillion US dollars, is the largest gold mine in the crypto world.

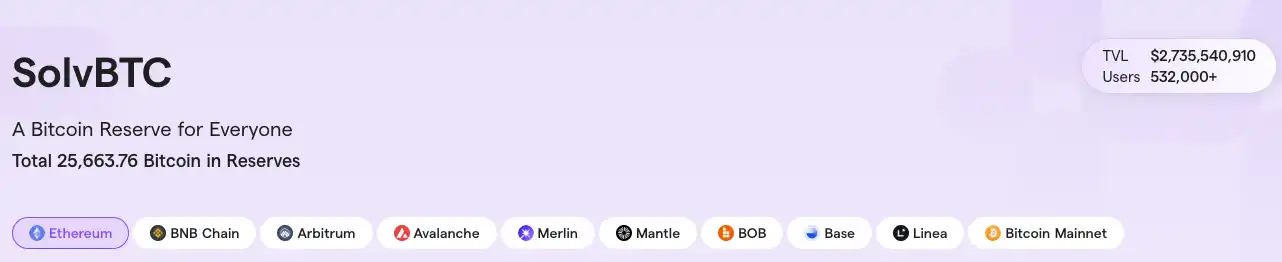

Committed to becoming a "micro-strategy on the chain", Solv has released the ecological vitality of BTC with SolvBTC. More than 25,000 bitcoins have been earned through Solv-ranked 7th compared with BTC ETF, 6th compared with enterprises, and 5th compared with national reserves. The era of Buy and Earn is coming to us.

Solv's Growth History

The most important thing about the DeFi track is safety and reliability.

The Solv team consists of a group of experienced and professionally diverse members. The core team has a deep background in financial analysis, blockchain technology integration and industry applications. They have accumulated rich experience in large financial institutions, blockchain technology research and development, IT system design and other fields, and have led a number of projects with industry influence. Team members also participated in the creation of the innovative blockchain standard - ERC-3525, and are committed to promoting the deep integration of technology and application scenarios. These backgrounds and expertise ensure Solv's security and technical reliability in the DeFi field.

The professional team has also won the favor of capital. Solv Protocol has received investments from well-known institutions such as Binance Labs, Blockchain Capital, OKX, Laser Digital, MPCI, IOSG and Gumi, with a total financing amount of more than 25 million US dollars.

From 2020 to 2023, Solv built its own technology and built an on-chain fund platform, creating basic income opportunities for core assets such as USDC, ETH, and BTC, and accumulated rich practical experience. These explorations have laid a solid foundation for the expansion of subsequent businesses.

At the beginning of 2024, Solv keenly captured the opportunity of the rise of the BTC ecosystem, and quickly laid out in the BTC asset field with a deep understanding of industry trends and forward-looking insights into the market. From the development history of Solv, it can be seen that Solv is not a so-called track speculator, nor is it a common "throw-and-use" project party, but a rare explorer and pioneer in the industry, and has a strong ability to update and iterate products.

On-chain micro-strategy: releasing BTC liquidity

At the beginning of 2024, the BTC ecosystem took off, various BTC L2s appeared crazily, capital was vigorously deployed, and the community flocked to it. Relying on a deep understanding of the DeFi field and a deep insight into the development of the track cycle, Solv realized that the BTC ecosystem is different from ETH L2. Although the chain is important, the most important thing is the underlying asset - BTC. The key is to attract BTCs with a reasonable and safe way to earn interest. Solv launched SolvBTC to lower the threshold and unify the standards for the Bitcoin ecosystem. With strong technical strength and accumulation, as well as an excellent reputation in the industry, Solv quickly reached cooperation with major protocols and platforms, allowing SolvBTC to rise step by step and eventually become the largest liquidity in the Bitcoin ecosystem.

In general, SolvBTC is a new type of token designed to break the liquidity limitations of Bitcoin. Through a unique design, Bitcoin assets have higher liquidity and application value in the multi-chain ecosystem. It adopts a tiered reserve system, dividing reserve assets into core reserves and innovation reserves. This design ensures that every SolvBTC in circulation can be backed by 1:1 Bitcoin or trusted wrapped Bitcoin assets, while achieving transparent and real-time proof of reserves, providing users with higher security and trust.

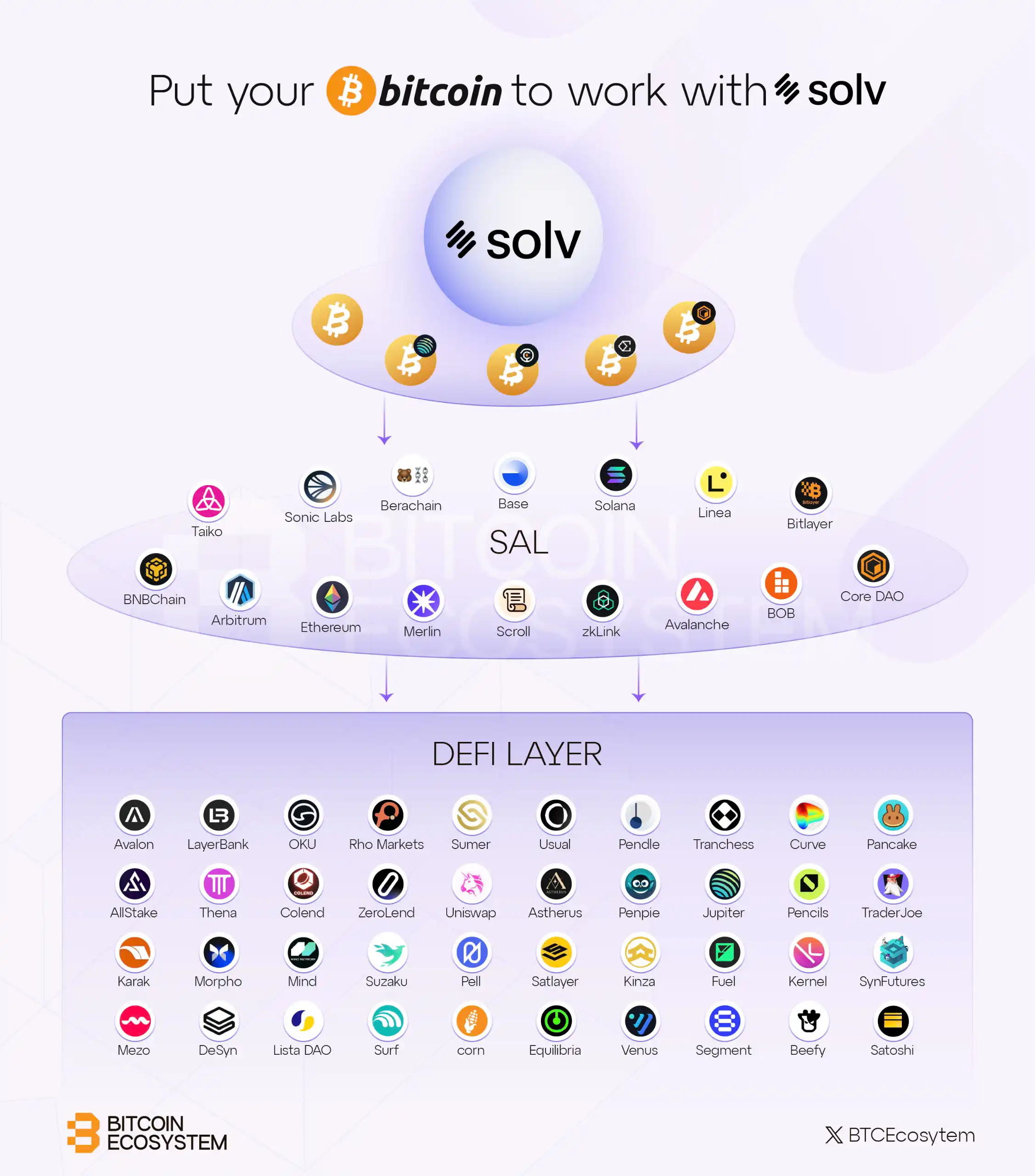

The core concept of SolvBTC is to solve the problem of liquidity fragmentation in the current blockchain ecosystem by integrating Bitcoin's liquidity. Whether it is Ethereum, BNB Chain, or more niche chains such as Mantle or Merlin, SolvBTC can seamlessly cross chains, thanks to its use of Chainlink cross-chain protocol and Free.tech technology. This cross-chain capability allows users to freely shuttle between DeFi applications on multiple chains without worrying about complicated conversion processes or high transaction costs.

At the same time, SolvBTC not only provides a flexible way to manage assets, but also opens up new income channels for Bitcoin holders. On the premise of ensuring the security of assets, users can apply SolvBTC to a variety of DeFi scenarios, such as liquidity mining, mortgage loans or income optimization, so that Bitcoin assets can realize greater potential.

The real innovation of SolvBTC lies in that it redefines the role of Bitcoin in the blockchain ecosystem in an open, flexible and compatible way, which not only guarantees the security of user assets, but also breaks the boundaries of traditional Bitcoin applications, bringing holders a true decentralized financial experience. By integrating transparent reserve management, powerful cross-chain functions and flexible income models, SolvBTC provides an efficient, safe and reliable new solution for the use of Bitcoin in the DeFi world.

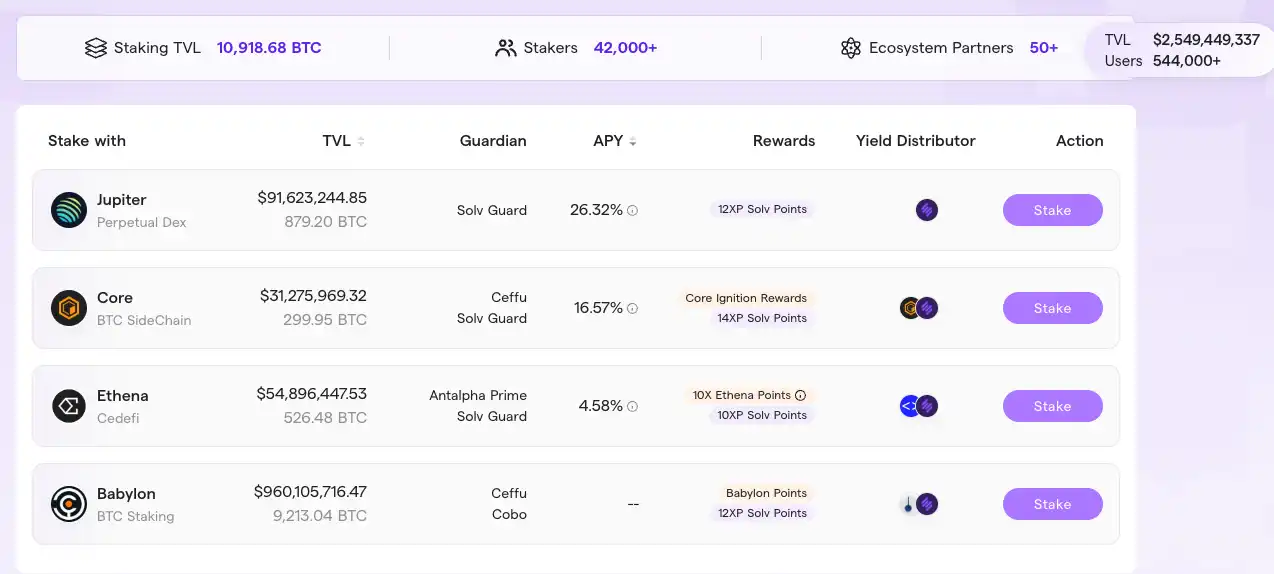

Solv currently has four high-quality BTC income assets, namely Babylon LST, CoreDAO LST, Ethena LST and Jupiter LST, and the utilization rate of SolvBTC is as high as 90%.

From Maximum Liquidity to Industry Standard

Winner takes all. Becoming a platform and standard is the ultimate goal of protocol development. With a solid underlying technical framework, the Staking Abstraction Layer (SAL) concept introduced by Solv is preparing to become the underlying standard of the BTC ecosystem by formulating industry standards.

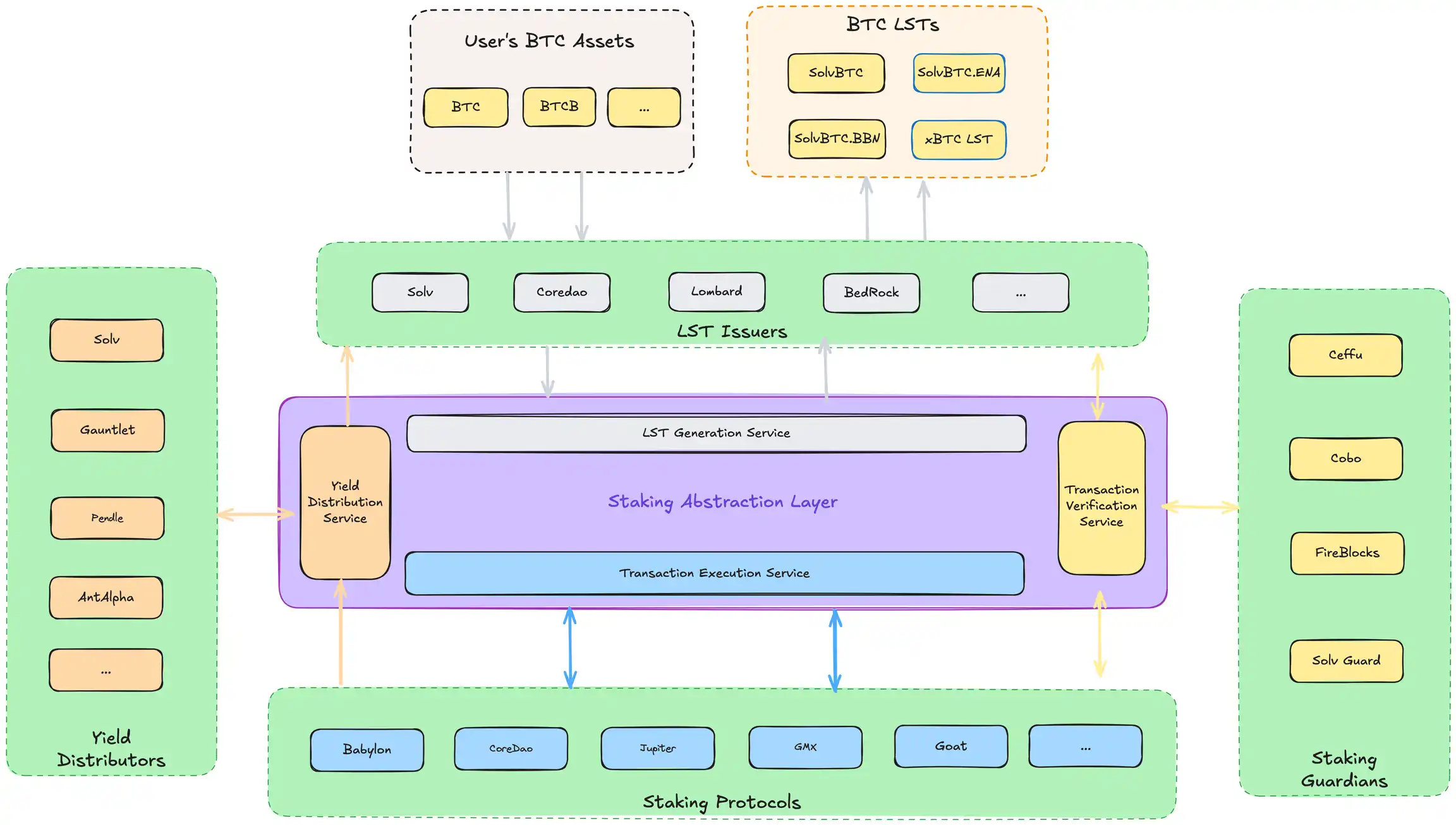

SAL is the core infrastructure of Solv Protocol, which aims to simplify the staking process of Bitcoin in multiple ecosystems and provide a unified interface for holders. In the SAL ecosystem, four key roles work together to ensure the transparency and security of the staking process:

1. Staking Protocols: These protocols are the infrastructure for Bitcoin staking and are mainly divided into three categories:

· Layer 1 or Layer 2 chains based on the PoS consensus mechanism: similar to the staking mechanism of Ethereum.

· Protocols that accept BTC assets and provide decentralized services: such as oracles or cross-chain bridges, similar to the re-staking protocol in the Ethereum ecosystem.

· General staking protocols: including various DeFi protocols that accept BTC assets and generate income.

2. Liquidity Staking Token Issuers (LST Issuers): LST issuers provide users with liquidity staking tokens, allowing them to maintain asset liquidity while staking BTC. Unlike Ethereum, Bitcoin's LST issuance involves the interaction of the EVM chain and the Bitcoin mainnet, so a transparent and secure mechanism is needed to win user trust.

3. Staking Guardians: This is a new role introduced by SAL, responsible for the transparency, integrity and security of the staking process. They assume responsibilities such as asset custody, transaction verification and co-signing to ensure the accuracy of staking transactions and prevent user asset losses.

4. Yield Distributors: Due to the multi-chain nature of Bitcoin staking, the distribution of income becomes complicated. Users' potential returns include not only rewards from the staking protocol, but also additional incentives from LST issuers. These rewards may come from the Bitcoin mainnet, the EVM network, or other ecosystems. The roles of the yield distributors are diverse, including converting rewards to BTC, converting points into tokens, and assisting users in claiming them.

By coordinating these roles, SAL provides a safe, transparent and efficient staking environment for Bitcoin holders, allowing them to easily participate in staking and earn income in multiple ecosystems.

The ultimate goal of SAL is to set standards for the industry, which will not only create a stronger platform effect for the protocol itself, but also lower the threshold for the Bitcoin ecosystem, attract more users and assets, and pave the way for large-scale applications.

Solv's vertical and horizontal alliances

Integration and application in DeFi are the key. The Solv ecosystem not only has TVL, but has also expanded to 15 chains and 50+ DeFi protocols, becoming an important link that cannot be avoided when talking about the Bitcoin ecosystem. SolBTC has also become one of the important underlying assets of many protocols.

Even with such a huge TVL, SolvBTC's APY has not fallen behind. Based on Solv's current four high-quality BTC income assets, except for Babylon, which has no clear APY, the average annualized rate of return of the remaining three products is 15%, which roughly estimates that it can generate about $400 million in income each year. With the launch of Solv's integration plan with traditional compliant funding channels, this income scale will continue to expand in the future.

Not only that, how can DeFi be without nesting dolls? On the DeFi protocol Pendle, users can choose to hold YT-SolvBTC.BBN, which will continue to amplify the potential benefits of SolvBTC.

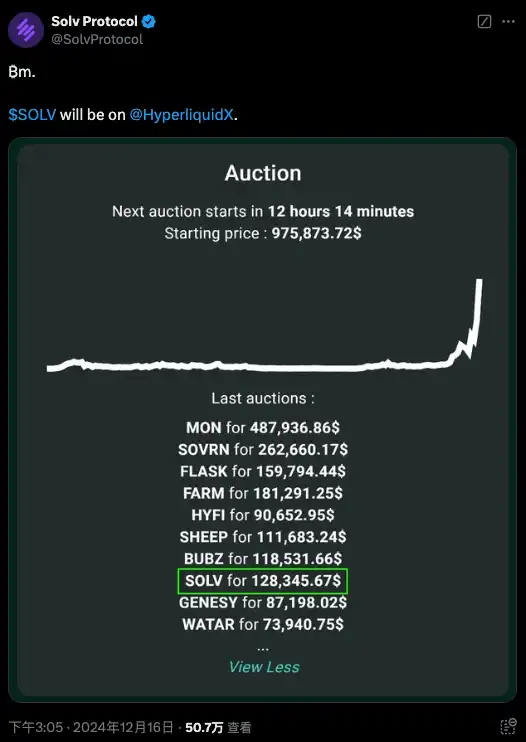

Solv's journey is not limited to the traditional DeFi track. Recently, the most popular on-chain contract platform Hyperliquid also has Solv's presence - Solv announced its participation in the Hyperliquid spot auction.

According to the outlook of community members, Solv may become the standard solution for Hyperliquid to enter the BTC standard and BTC collateral, similar to the situation where Ethena's USDe is connected to Bybit and included in the margin system. Solv is the largest liquidity on the Bitcoin ecosystem, and SAL is also gradually being rolled out. It happens to be the only channel for the unified BTC cross-chain standard after the Hyperliquid mainnet is launched. SolvBTC can not only provide more liquidity and interest-bearing income for Hyperliquid, but also provide SolvBTC users with a wider range of usage channels.

Community First

According to data from Solv's official website, it already has more than 529,000 users and an extremely large community.

At the same time, Solv is also actively cooperating with major platforms to convey information and gameplay of the BTC ecosystem to new users who have not been exposed to the BTC ecosystem. Solv cooperated with Binance Web3 wallet to bring a large number of users into the BNBchain ecosystem, and also brought a lot of activity to the BTC ecosystem. Earlier, Solv and OKX Web3 wallet's Cryptopedia event attracted more than 200,000 participants.

MicroStrategy's holdings of 400,000 bitcoins have given it a market value of more than $100 billion; in comparison, Solv Protocol already has more than 25,000 bitcoins on the chain, and Solv's valuation imagination can be infinitely raised. Solv Protocol recently stated that Solv is about to release Solv's token economic model - this will be the most innovative design on the market, a sustainable growth flywheel that will provide Bitcoin holders with unprecedented best returns. With the incentives of the token model, Solv's development may have just begun.

Not only can Bitcoin holders enjoy the price appreciation, but they can also obtain additional income generated from DeFi activities. This is what MicroStrategy and ETFs need, and it is exactly what Solv has built, a permissionless, transparent and open platform that redefines Bitcoin reserves and transforms it from a passive value storage into a vibrant financial engine.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI