Will Bitcoin, once assimilated, eventually become another tech stock?

Original Article Title: "Will Bitcoin, Being Co-opted, Ultimately Turn into Another U.S. Stock?"

Original Article Author: jk, Odaily Planet Daily

Bitcoin's price volatility has long exhibited two markedly different trends compared to the traditional financial markets, leading to two completely different narratives: As a risk asset, in times of market optimism and increased risk appetite, Bitcoin's performance often correlates positively with the U.S. stock market, showing a high level of correlation. This is mainly due to increased participation from institutional investors, aligning its flow of funds with other high-risk assets. However, during market panic or risk events, Bitcoin is again seen as a safe-haven asset, decoupling from the stock market trend, and even exhibiting negative correlation, especially when investors lose confidence in the traditional financial system.

These two narratives make Bitcoin's role more complex, as it has become part of a risk asset while also potentially playing a safe-haven asset role. Which one will it be? Especially at this time when Trump is about to take office?

Price Correlation: More "Safe Haven" Than U.S. Treasury Bonds

According to TradingView's statistics, over the past decade, Bitcoin has had a correlation of 0.17 with the S&P 500 index, lower than other alternative assets. For instance, the S&P Goldman Sachs Commodity Index had a correlation of 0.42 with the S&P 500 during the same period. Although Bitcoin's correlation with the stock market has historically been low, this correlation has increased in recent years. In the last five years, its correlation has risen to 0.41.

However, the strong volatility of Bitcoin makes this correlation data less reliable: The relationship between Bitcoin and the S&P 500 showed a negative correlation of -0.76 on November 11, 2023 (around the FTX event), but by January 2024, it had reached a positive correlation of 0.57.

In comparison, the S&P 500 has shown relative stability, with an average annual return of about 9% to 10%, serving as a benchmark for the U.S. economy. Although the overall return of the S&P 500 may be lower than that of Bitcoin, it benefits from its stability and low volatility.

Log comparison between Bitcoin and the Nasdaq Index. Source: FRED

You can see that during macroeconomic events, the two usually exhibit a strong correlation: for example, during the market recovery period after the 2020 COVID-19 pandemic, both experienced a significant upward trend. This may reflect an increased demand for risk assets by investors in a loose monetary policy environment.

However, during other periods (such as 2022), the trends of Bitcoin and the Nasdaq differ greatly, showing a weakening of the correlation, especially during periods of black swan events specific to the crypto market, where Bitcoin experiences a significant one-sided drop.

Of course, in terms of periodic returns, Bitcoin can easily outperform the Nasdaq. However, purely based on price correlation data, the correlation between the two is indeed strengthening.

A report released by WisdomTree also mentioned a similar viewpoint. The report stated: although the correlation between Bitcoin and the US stock market is not high in absolute terms, recently this correlation has been lower than that of the S&P 500 Index with US Treasuries.

Trillions of dollars of assets globally use the S&P 500 Index as a benchmark or attempt to track its performance, making it one of the most watched indices globally. If an asset could be found that has a return correlation with the S&P 500 Index of -1.0 (completely inverse) and a relatively stable correlation, then this asset would be highly sought after. This characteristic means that when the S&P 500 Index performs negatively, this asset may provide a positive return, demonstrating a hedge-like property.

Although stocks are generally considered risk assets, US Treasuries are considered by many to be closer to a "risk-free" asset. The US government can meet its debt obligations by printing money, although the market value of US Treasuries, especially long-term ones, may still fluctuate. An important discussion point in 2024 is that the correlation coefficient between the S&P 500 Index and US Treasuries is approaching 1.0 (positive correlation 1.0). This means that both types of assets may rise or fall simultaneously during the same period.

The simultaneous rise or fall of assets is exactly the opposite of the intention of hedging. This phenomenon is similar to 2022 when both stocks and bonds recorded negative returns in the same year, contradicting the expectations of many investors for risk diversification.

Bitcoin currently does not exhibit a strong hedging capability against the S&P 500 Index returns. From the data, the correlation between Bitcoin and the S&P 500 Index is not significant. However, the recent correlation of Bitcoin with the S&P 500 Index returns is lower than the correlation of the S&P 500 Index with US Treasuries. If this trend continues, Bitcoin will attract more attention from asset allocators and investors and gradually become a more attractive investment tool over time.

From this perspective, compared to the risk-free asset US Treasury bonds, Bitcoin only needs to be the "hedge asset that runs faster than US Treasury bonds." Investors will naturally choose Bitcoin as part of their portfolio.

The chart shows the 50-day rolling correlation between the price of Bitcoin and the S&P 500 Index in 2022. On average, the correlation is about 0.1, with peaks exceeding 0.4 and lows below -0.1. Source: WisdomTree

Institutional Holdings: ETF Share Growing

Institutional investors are playing an increasingly important role in the Bitcoin market. So far, the distribution of Bitcoin holdings has shown a significant increase in institutional market influence, and this centralization trend may further drive the correlation between Bitcoin and the US stock market. Here is a specific analysis:

According to data, Bitcoin has currently mined 19 million coins out of a total of 21 million coins, leaving 1.1 million coins yet to be mined.

Among the mined Bitcoins, the holdings of the top 1000 dormant addresses older than 5 years account for 9.15%, equivalent to about 1.82 million coins. These Bitcoins usually do not enter the circulating market, effectively reducing the active supply in the market.

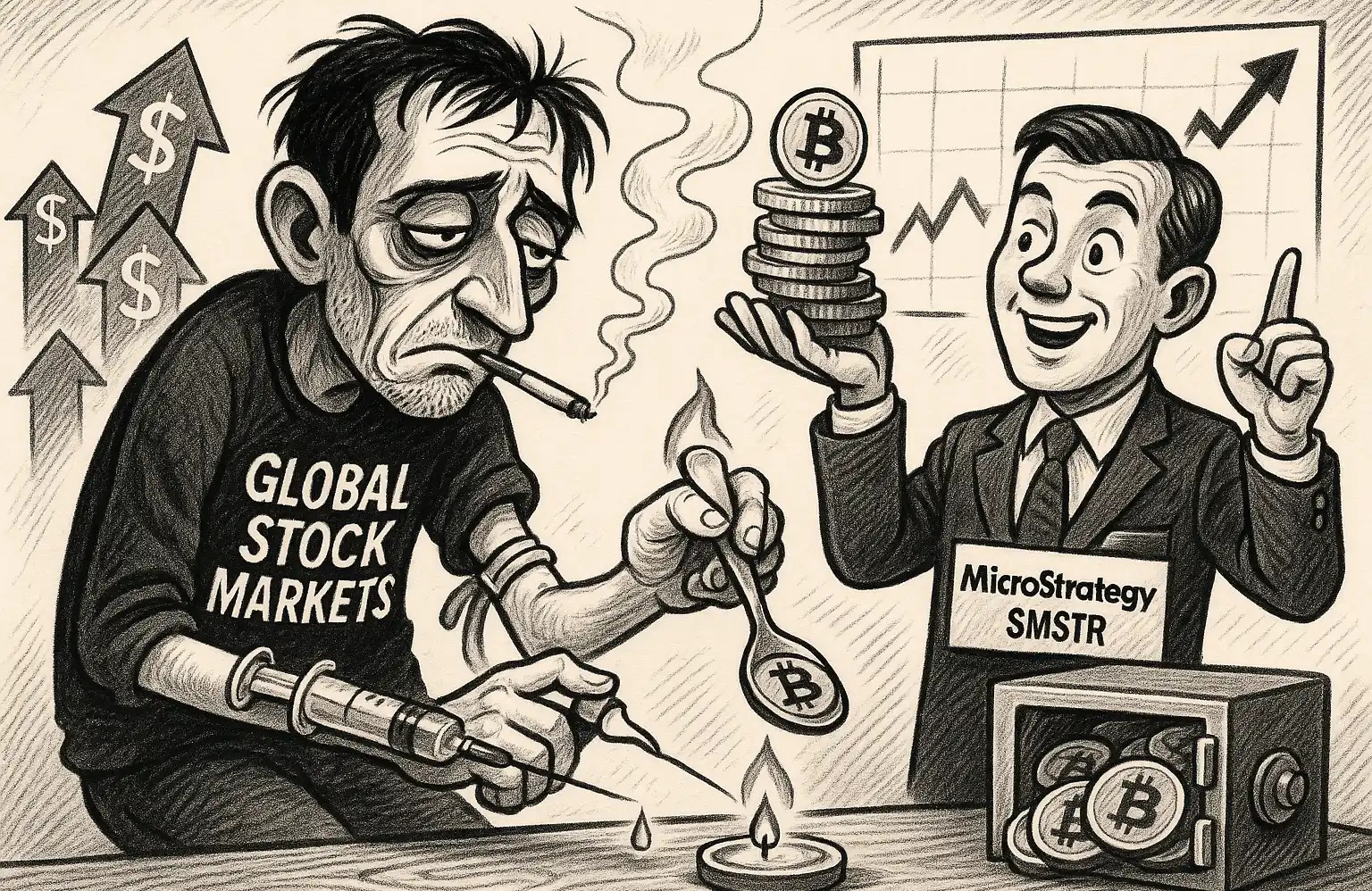

Furthermore, according to Coingecko data, the holdings of the top 20 publicly traded companies, including Microstrategy, account for 2.63%, about 520,000 coins, with Microstrategy alone holding 2.12% of the total Bitcoin supply (about 440,000 coins).

On the other hand, according to The Block's data, as of the time of writing this article, the institutional holdings of all ETFs have currently reached 1.17 million coins.

· Assuming the Bitcoins in dormant addresses, the unmined quantity, and the holdings of publicly traded companies remain unchanged, the theoretical circulating supply in the market = 19.9M - 1.82M - 520K = 17.56 million coins

· Institutional Holdings Share: 6.67%

It can be seen from this that ETF institutions currently control 6.67% of the Bitcoin circulation, a proportion that may further increase in the future as more institutions get involved. From the same period last year to this year, we can see a significant shrinkage in the share from exchanges, while the share from ETFs has continued to grow.

Bitcoin Holding Percentage. Source: CryptoQuant

Similar to the US stock market, as institutional investors gradually increase their market holding percentage, their investment decisions (such as buying or selling) will play a more crucial role in price fluctuations. This market centralization phenomenon can easily lead to Bitcoin price movements being significantly influenced by US stock market sentiment, especially in investment fund flows driven by macroeconomic events.

“Americanization” Process

The impact of US policy on the Bitcoin market is becoming increasingly significant. Regarding this issue, it is currently more of an unknown: according to Trump's current style of action, if in the future, crypto-friendly individuals occupy key decision-making positions, such as promoting a more lenient regulatory environment or approving more Bitcoin-related financial products, Bitcoin adoption rates will inevitably further rise. This deepening adoption will not only solidify Bitcoin's status as a mainstream asset but may also further narrow the correlation between Bitcoin and US stocks, two assets that reflect the direction of the US economy.

In summary, the correlation with US stocks is gradually strengthening, mainly due to price reactions to macro events, institutional holdings significantly influencing the market, and potential impacts of US policy trends on the market. From this perspective, we can indeed use the trend of US stocks in the future to infer more about the trend of Bitcoin.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI