South Korea's Crypto Great Escape: Capital, Enterprises, and Talent Exodus

Original Title: Korea Exodus: The Migration of Capital, Talent, and Companies

Original Authors: Jay Jo, Yoon Lee, Tiger Research

Original Translation: Luffy, Foresight News

Key Points

· South Korea's cryptocurrency trading volume remains high, attracting global attention, but unclear regulation and a lack of guidance hinder industry development.

· The government prohibits opening cryptocurrency exchange real-name accounts for businesses. This restriction, coupled with a vague regulatory framework, has led to the outflow of talent, capital, and companies, weakening the competitiveness of the Web3 ecosystem.

· With the global Web3 industry poised for rapid growth under the Trump administration, South Korea must reform its regulatory policies to ensure the long-term sustainability of the industry.

1. Introduction

The inauguration of the "crypto-friendly president" Trump and the establishment of the Crypto 2.0 Task Force by the U.S. Securities and Exchange Commission (SEC) will accelerate the structural transformation of the global Web3 market. This is a key turning point. Talent, capital, and companies may migrate to countries with sound regulatory frameworks, while the outflow from jurisdictions with regulatory uncertainty will intensify.

2024 Global Fund Flows, Source: Henry & Partners

South Korea is also part of this trend. The Henry & Partners' "2024 Private Wealth Migration Report" shows that South Korea leads in high-net-worth individual migration in Asia. Economic, social, and cultural factors are driving this migration wave. Although not directly related to the Web3 industry, these individuals often serve as canaries in the coal mine, signaling changes in a country's business environment.

Against this backdrop, it is crucial to reexamine South Korea's Web3 industry. This report explores the movement of capital, companies, and talent in the South Korean Web3 market, as well as the key challenges this industry must address.

2. Capital Flight: Offshore Exchanges and Accelerated On-Chain Transfers

The cryptocurrency market in Korea has been rapidly growing. With 15.6 million cryptocurrency investors holding assets worth $73 billion, the daily trading volume of cryptocurrency exchanges now rivals the combined trading volume of the Korea Composite Stock Price Index (KOSPI) and the Korea Securities Dealers Automated Quotations (KOSDAQ). This reflects Korean investors' enthusiasm for crypto assets, driven by low stock market returns and politically related unrest.

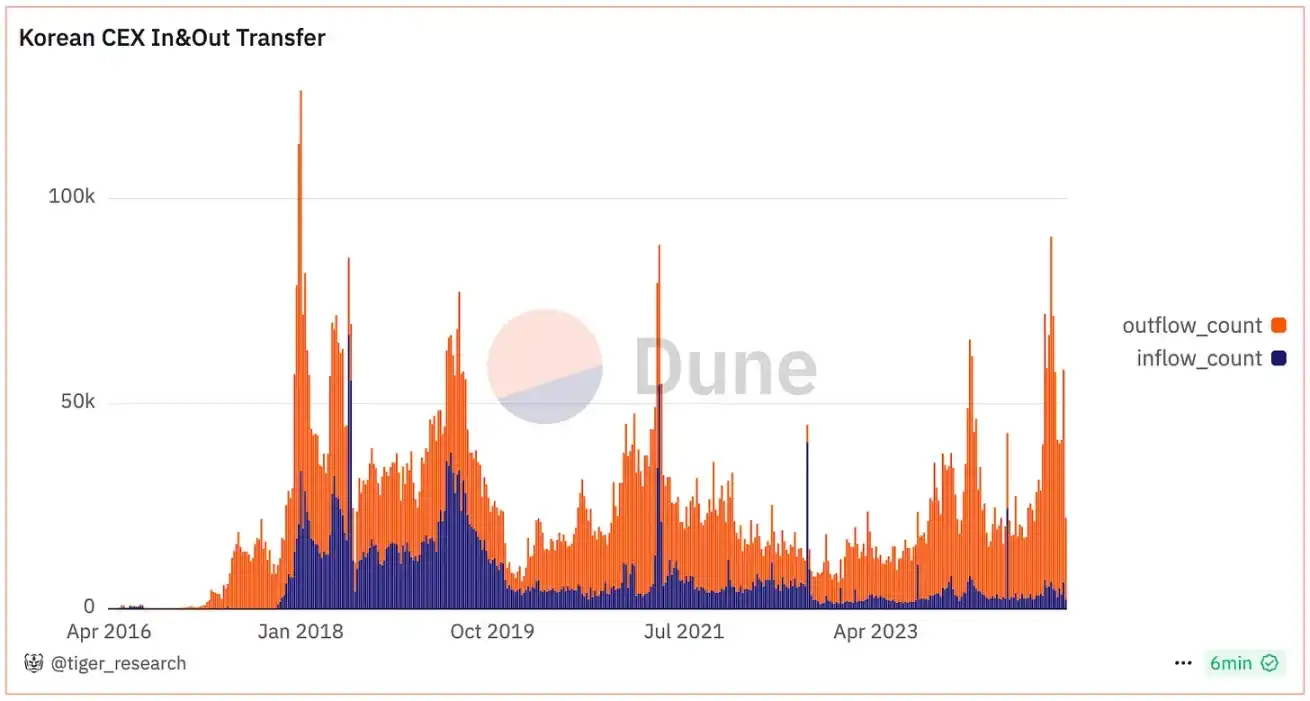

However, cryptocurrency outflows have reached concerning levels recently. During times of unrest, service disruptions at major local exchanges undermined people's trust in the stability of these platforms. Meanwhile, foreign exchanges and the diverse investment opportunities offered by decentralized finance (DeFi) have further fueled capital migration.

A survey by the Financial Services Commission of Korea in the first half of 2024 on Virtual Asset Service Providers (VASPs) revealed a 2.3-fold year-on-year increase in funds transferred to overseas VASP wallets. On-chain data confirms this trend, indicating a continuous rise in asset migration from local exchanges to foreign platforms.

In the long run, capital flight may harm Korea's Web3 industry. Transaction fees and service revenues flowing abroad erode the competitiveness of the local ecosystem and diminish investor protection. This has also raised concerns about declining demand for the Korean won and increased volatility in its value.

3. Migration Wave: Relocating Headquarters to Crypto-Friendly Countries

Korea's Web3 companies are accelerating their offshore migration. In 2024, Nexon's blockchain division Nexpace, as well as Klaytn and Line Finschia's Kaia Foundation, moved to Abu Dhabi. WeMade's Wemix relocated to Dubai. The Web3 industry is swiftly shifting to countries with clearer and more favorable regulations.

Korea faces numerous obstacles in promoting Web3-related businesses. Companies are unable to open corporate accounts for cryptocurrency transactions, making the use of crypto assets challenging. This complexity hinders the monetization of crypto assets and creates issues in accounting, taxation, and business operations. For example, in a cryptocurrency payment business, Company A may receive crypto assets from a consumer and need to settle payments with the seller in Korean won. Without a corporate account, cashing out assets becomes nearly impossible.

While Korea has established a regulatory framework, the lack of specific guidance on stablecoins, DeFi, and Web3 gaming restricts industry growth. The country's proactive regulatory approach limits unlicensed activities. In contrast, the global market benefits from regulatory sandboxes supporting various pilot projects.

The Trump administration's stance on cryptocurrency may highlight this difference, and a favorable regulatory environment overseas is accelerating the migration of Web3 companies from Korea.

4. Brain Drain: Weakening the Technical Competitiveness of the Web3 Industry

The migration of Korean Web3 companies abroad may have a negative impact on the domestic Web3 talent pool. As companies move to countries with clearer and more favorable regulations, domestic employment opportunities may decrease, leading to a brain drain. This could hinder the development of the domestic Web3 ecosystem.

Talent migration is not just a problem for the Web3 industry in Korea. Korea is one of the countries with the highest proportion of key talent migrating to the United States, especially those with master's and doctoral degrees. This trend is particularly pronounced in the technology-dependent Web3 industry and could undermine the industry's competitiveness.

In contrast, countries like the United States and the UAE are promoting their Web3 industry development through clear regulations and supportive policies. Korea's unclear regulatory environment is accelerating talent outflow, posing a long-term threat to Korea's technological competitiveness and industry ecosystem.

5. Challenges and Opportunities for the Korean Web3 Market in 2025: Regulatory Reform and Industry Growth

Korea has received global attention due to its cryptocurrency trading volume. However, this trading volume has not promoted industry development, making the country a liquidity conduit for global traders. This structure is not conducive to sustainable growth. Korea urgently needs to make progress in business and technology to strengthen the Web3 ecosystem.

Source: Arthur Hayes

Due to a lack of local innovation and regulatory uncertainty, Korea is on the edge of the global Web3 development. This overreliance on trading volume rather than ecosystem development has led to a "Korea discount" in the international market.

By 2025, with a new government in place, significant changes are expected in the global industry. In these changes, Korea stands at a critical crossroads. Positive steps include allowing cryptocurrency operators to open corporate accounts, establishing stablecoin regulatory guidelines, and advancing cryptocurrency legislation. However, these efforts only scratch the surface.

To make progress, Korea must address risks, analyze global policy shifts, and develop a regulatory framework tailored to domestic conditions. Korea must shift from a focus solely on trading volume to establishing a sustainable innovation hub characterized by outstanding business and technical leadership.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data

Summarized by AI

Summarized by AI