Summary

Users have the option to create new cryptocurrencies or tokens. Currencies have their own blockchain, while tokens can only be created within an existing network. Cryptocurrencies run on blockchain due to their security and decentralized nature.

Creating a token requires less expertise and takes less effort than creating a cryptocurrency. Successfully creating a currency often requires an entire team of developers and experts to work together. Although there are technical barriers to tokens, they can be successfully created in a few minutes by using blockchains such as Ethereum, Binance Smart Chain, Solana, and Polygon.

Users can choose to create tokens or currencies based on customization and utility needs. In summary, the cost depends on the size of the effort, such as whether to hire external developers and the length of time invested.

Ethereum and Binance Smart Chain are popular blockchains for creating digital currencies. Users can choose to create their own tokens using ready-made code, or pay for currency creation services. Sidechains rely on the advantages of their main blockchain to provide a higher degree of customized services, making them another popular choice.

Before creating a proprietary cryptocurrency, its utility, token economics, and legal effects all need to be considered. In the subsequent development stage, you need to choose the blockchain, consensus mechanism and its architecture. Next, consider project audits and eventual legal compliance reviews. Although almost anyone can create a cryptocurrency, developing a stable and reliable project still requires a lot of effort and serious research.

Introduction

Many cryptocurrency enthusiasts are eager to try and create their own cryptocurrency and cases, and Get an audience. So, where is the best place to start? There are actually many different ways to create currencies and tokens. Depending on the complexity of the project, the cost and knowledge required will vary. For those who are considering creating their own cryptocurrency, our article will provide a framework of basics to get started.

What is cryptocurrency?

Cryptocurrency, the English abbreviation of "crypto", is a digital asset with multiple uses. Cryptocurrencies primarily enable people to digitally transfer assets to each other, including monetary value, ownership, and even voting privileges. Cryptocurrencies are rooted in blockchain technology and are distinct from other digital payment systems. This essential difference gives cryptocurrencies a higher degree of freedom and will not be restricted by central entities such as governments or banks.

Bitcoin is a well-known cryptocurrency. Bitcoin's use case is simple, it can transfer monetary value to anyone around the world without the involvement of an intermediary, and its blockchain records all transactions and ensures the security of transactions and the stability of the network.

The difference between currency and token in cryptocurrency

Cryptocurrency can be roughly divided into two categories: currency and token . The two are very easy to distinguish. Currencies have their own native blockchain, such as Bitcoin. Ethereum (ETH) has the Ethereum blockchain. Currencies often have a specific utility across the network, such as paying transaction fees, staking, or participating in governance.

Tokens are built on existing blockchains. Tokens have some similar functions to currencies, but they mainly achieve utility through their own projects. In Binance Smart Chain, PancakeSwap’s CAKE is a representative example. CAKE can be used to pay for certain transactions in the PancakeSwap ecosystem, such as minting non-fungible tokens or purchasing lottery tickets within it. However, CAKE does not have its own blockchain and therefore cannot be used across all applications on Binance Smart Chain (BSC). The thousands of ERC-20 tokens issued on the Ethereum blockchain are also similar. Each token is part of a specific project and has different use cases.

Creating cryptocurrencies and tokens

As mentioned earlier, creating tokens is simpler than creating currencies Much more. Creating a currency requires first developing and stably maintaining a blockchain. Although it is possible to fork (create copies of) other existing chains, this still does not solve the problem of finding users and validators to keep the network alive. However, creating a new currency does have a higher chance of success than creating a token. Here's a basic overview of both:

Tokens | Tokens |

Run on its own blockchain network | Created in an existing blockchain with a certain user base |

Requires a high-level area Blockchain expertise and coding skills | Easy creation with ready-made tools and open source code |

Blockchain development is more expensive and takes longer | Token development is fast, simple and low-cost |

Create currency

If you need to develop your own blockchain to create a new currency, it will take a lot of time . However, forking an existing blockchain can be done quickly and lay the foundation for a new currency. Bitcoin Cash (BCH) is a classic example of a fork project. To do this, a high level of blockchain technology and coding expertise is still required. The success of the project also depends on getting new users to participate in the blockchain network, which is no easy task.

Create a token

The benefit of creating a token in an existing blockchain is that you can leverage its good reputation and security. Although creators do not have full control over their tokens, they can still achieve a lot of customization. There are various websites and tools for creating proprietary tokens, with a particular focus on Binance Smart Chain (BSC) and Ethereum.

Should you create a currency or a token for your project?

For decentralized finance (DeFi) applications or coin-earning games, tokens are usually sufficient. Both Binance Smart Chain (BSC) and Ethereum offer developers a great deal of flexibility and freedom.

If you want to get the most out of a currency or blockchain, it might be better to create the currency via your own blockchain. Needless to say, creating new blockchains and currencies is more difficult than simply issuing cryptocurrency tokens. However, if done correctly, it will bring many innovative opportunities and new possibilities. Binance Smart Chain, Ethereum, Solana and Polygon are all successful cases.

Of course, both methods require a lot of effort and the support of technical, economic and market expertise to achieve success.

Preferred solutions for creating cryptocurrencies

The most common cryptocurrency creation solutions include Binance Smart Chain (BSC), Ethereum and Solana. These are all existing networks that meet standards and can be used to create various tokens. The BEP-20 and ERC-20 token standards are precedents and are supported by almost all cryptocurrency wallet providers.

ERC-20 belongs to the Ethereum blockchain, while BEP-20 is part of the Binance Smart Chain (BSC). Both networks enable the creation and customization of smart contracts to create proprietary tokens and decentralized applications (DApps). Ecosystems can be created through DApps to provide more use cases and functionality for tokens.

In addition, side chains rely on the advantages of large-scale chains such as Ethereum or Polkadot to ensure security and can also provide some customization. The Polygon network is affiliated with Ethereum and can also provide similar services at a lower cost and easier to use.

After selecting the blockchain, the next step is to determine the method of creating exclusive tokens. If you go through Binance Smart Chain (BSC) and other Ethereum Virtual Machine-based blockchains, the process will be relatively simple. Another approach is to use off-the-shelf tools to create tokens based on your own parameters and rules. These are usually paid services, but can be more useful for users unfamiliar with smart contracts.

If you plan to create your own blockchain and currency, you will need to form your own blockchain development team and assemble industry experts. Even just considering forking a blockchain like Ethereum or Bitcoin requires a lot of work to set up the network. This also includes encouraging users to become validators and run nodes to keep the blockchain running.

Things to consider when designing a cryptocurrency

In addition to choosing a blockchain and creating a currency or token, There are some other key factors to consider:

Determine the utility of a cryptocurrency

Cryptocurrencies can serve a variety of functions. Some act as keys to access services. Others can even represent stocks or other financial assets. In order to understand and plan the process of creating your own cryptocurrency, you need to determine its functionality from the beginning.

Designing token economics

Token economics is the economics that governs cryptocurrency, such as total supply, issuance method and initial pricing. If the design of token economics is not reasonable and users do not enjoy the incentive policy for purchasing cryptocurrency, then no matter how good the concept is, it will be useless. For example, if a certain stablecoin is created but fails to be properly linked to legal currency, no one will be willing to buy or hold it.

Verify legal compliance

Countries and regions around the world have enacted laws and regulations related to cryptocurrency. Some jurisdictions even ban the use of cryptocurrencies. Therefore, creators must fully consider their legal obligations and compliance issues they may face.

6 steps to create your own cryptocurrency

If you are just creating a token, then one of the following tutorials These steps may not apply. The first three design steps are the top priority. Much of what we explain will cover the basics of creating a blockchain before eventually minting your own cryptocurrency.

1. Choose the right blockchain platform

If you are considering creating a token, you must first choose the blockchain that mints the cryptocurrency. Binance Smart Chain (BSC) and Ethereum are popular options, but sidechains are also good options. If you are creating a proprietary currency, consider designing it yourself or having someone create a customized blockchain.

2. Choose a consensus mechanism

If you create a blockchain by yourself, or you are not sure about the type of token, first consider which consensus mechanism to use. These mechanisms will determine how participants confirm and verify transactions in the network. Most blockchains use proof-of-stake due to low hardware requirements and flexibility. Bitcoin uses proof of work. Some people think this is more secure, while others think that daily maintenance costs are too high and it is not environmentally friendly.

3. Design the blockchain architecture

This step only applies to currency creation. Not all blockchains allow the public to validate transactions or run nodes. Therefore, you must first determine whether to create a private chain, a public chain, a permissioned or a permissionless blockchain. The architecture of a blockchain is determined by the currency and the purpose of the project. For example, if a country or company creates a currency, it may choose to run it on a private chain in order to increase regulation.

4. Start developing blockchain

If you do not have professional development knowledge, you need to seek external help to build a development concept. Once a blockchain is put into practical use, it is extremely difficult to change its core concepts and rules. Use a testnet first to make sure everything goes as planned, and ideally work with the entire development team to create your own blockchain.

5. Audit cryptocurrencies and their code

Audit firms such as Certik can review the code of blockchains and their cryptocurrencies to look for any vulnerabilities. The audit can then be released publicly and the project can be corrected accordingly based on the audit results. This process provides some security for the creator himself and any potential users or investors.

6. Carefully verify legal compliance issues

When the blockchain starts to operate normally and is ready to mint cryptocurrency, it is best to consult legal professionals to verify whether it is necessary Apply for permission. Again, this step is difficult to complete on your own and requires outside assistance.

7. Mint exclusive cryptocurrency

Whether you create a token or a currency, it must eventually be minted into a cryptocurrency. The specific approach varies depending on the token economics formulated. For example, fixed-supply tokens are typically minted in one go via smart contracts. Currencies like Bitcoin are gradually minted as miners continue to verify new blocks of transactions.

How to create BEP-20 tokens

Creating simple BEP-20 tokens requires basic knowledge Coding technology to deploy smart contracts to Binance Smart Chain. You also need to install MetaMask and deposit some Binance coins in your wallet to pay for gas fees.

1. Make sure the Binance Smart Chain (BSC) mainnet has been added to MetaMask. Please read the Associating a MetaMask Wallet on Binance Smart Chain guide for detailed instructions.

2.Go to the Remix online application. Here you can develop and deploy blockchain smart contracts compatible with the Ethereum Virtual Machine. Right-click on the [contracts] folder and click on [New File].

3.Name the file "BEP20.sol".

4. Make sure the programming language is set to [Solidity], otherwise the smart contract will not run properly . Click the icon boxed on the right below to set it.

5.Copy the BEP-20 smart contract code and put it into the file. Go to the GitHub website to learn more about the code's parameters and functions.

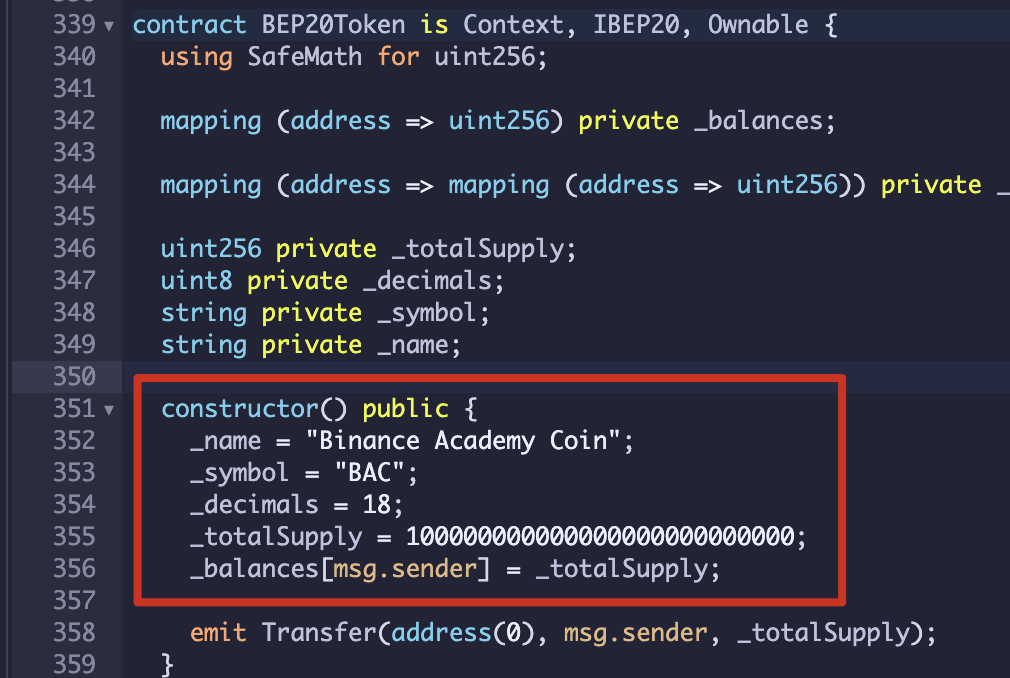

6.Modify the token name, symbol, decimal places and total supply. Assume here that "Binance Academy Coin (BAC)" is used as an example, set to 18 decimal places and the total supply is 100 million. Remember to fill in "0" to make up for 18 decimal places.

7.Next step, write a smart contract. Click the icon at the bottom left of the screen, check [Auto compile] and [Enable optimization], and then click the [Compile] button.

8.Click the [ABI] button to copy the ABI (Application Binary Interface) of the contract .

9. Click the highlighted icon at the bottom left of the screen. Select [Injected Web3] as the environment and allow MetaMask to connect to Remix. Finally, confirm the selection of the BEP20 contract and click [Deploy].

10.At this time, the transaction fee needs to be paid through MetaMask to deploy the contract to the blockchain. After the smart contract is launched, the source code of the contract needs to be verified and released.

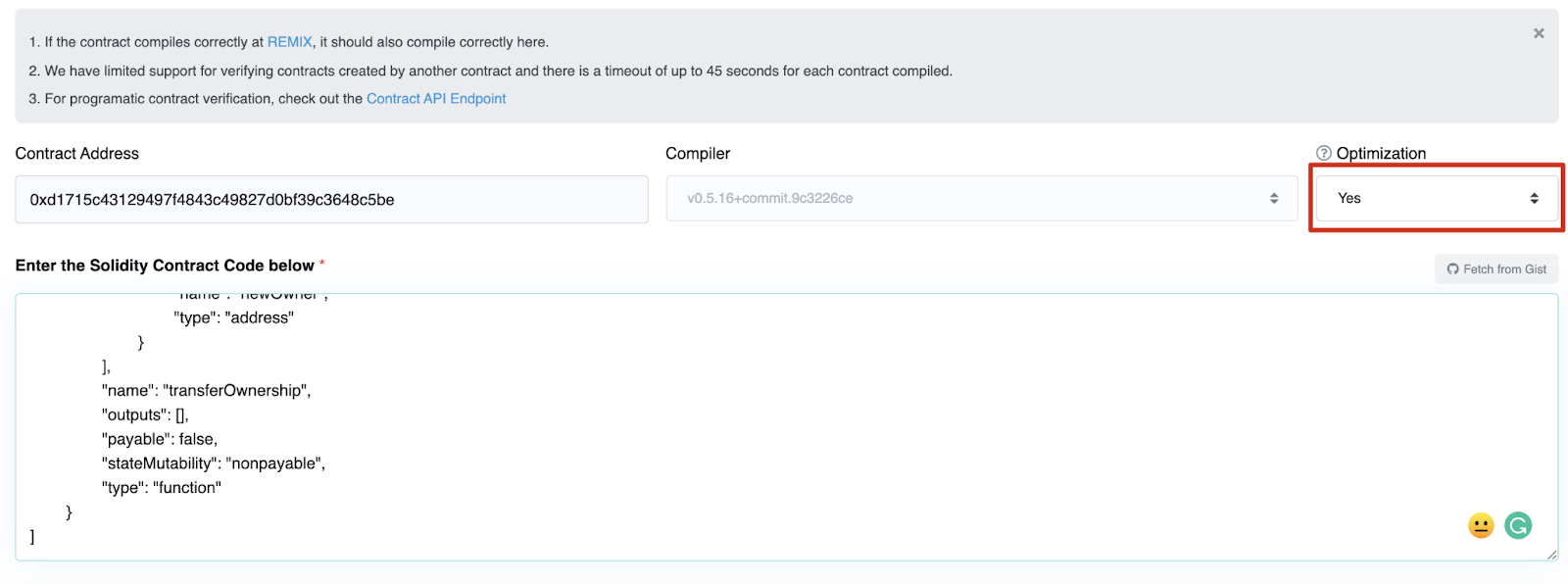

Copy the contract address to BscScan, select the writing type as [Solidity (Single)], and match the writing version in step 7.

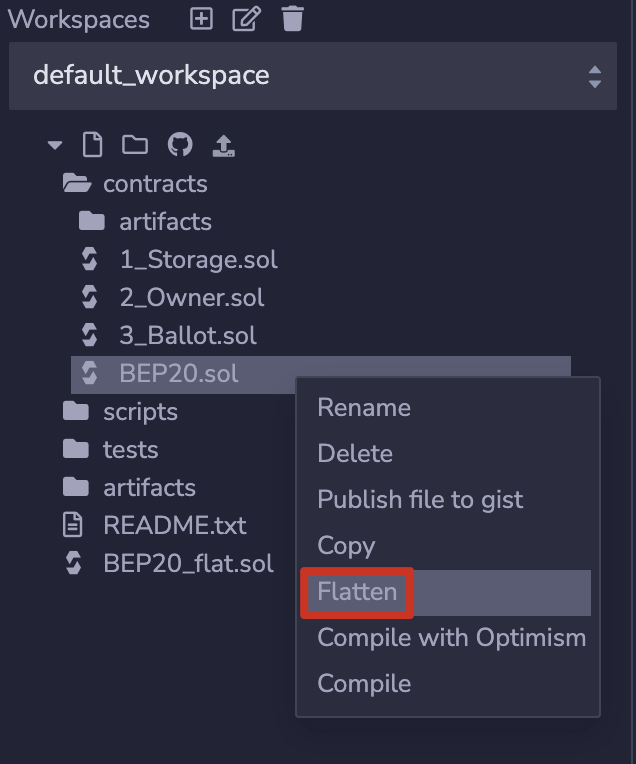

11. Next, right-click "BEP20.sol" in Remix and click [Flatten] (flatten). Remix needs to be allowed to flatten the code here.

12.Copy the code from “BEP20_flat.sol” into the field and confirm [Optimization ] (Optimization) is set to "Yes". Then click [Verify and Publish] at the bottom of the page.

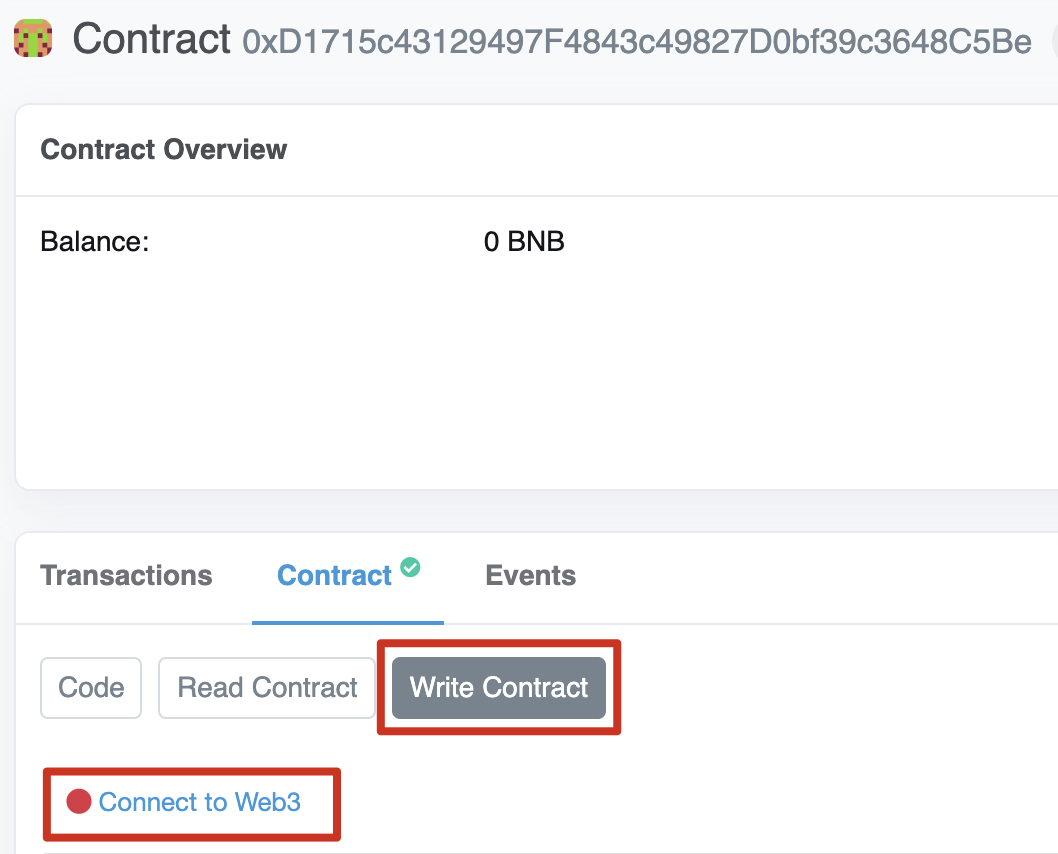

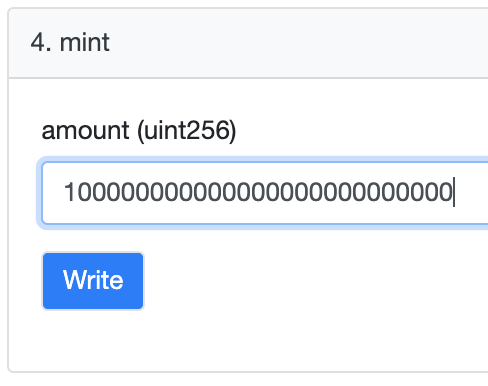

13.A successful startup screen will be displayed on the screen. With the verified code, tokens can be minted via BscScan using the _mint call implemented in the contract. Visit the contract address in BscScan, click [Write Contract], then click [Connect to Web3] (connect to Web3) to connect to the MetaMask account.

14. Scroll to the minting area at the bottom of the page and enter the number of tokens you want to mint. Let’s take the minting of 100 million BAC (Binance Academy Tokens) as an example. Don't forget to enter enough digits, our setting here is 18 digits. Click [Write] and pay at MetaMask.

15.The minted tokens will be displayed here and have been sent to create Smart contract wallet.

How to list cryptocurrency h2>

By listing your currency on a cryptocurrency trading platform such as Binance, you can promote your currency or token to a wider audience in a safe and regulated manner. If you are confident that the cryptocurrency project you create and develop is mature and reliable, you can fill out Binance's online application form and choose to list the currency directly or issue it through Launchpad/Launchpool.

Each cryptocurrency will undergo a rigorous due diligence process. During the application period, progress must be reported to Binance regularly. Additionally, your cryptocurrency ecosystem needs to accept Binance Coin and BUSD (e.g. as a means of providing liquidity) or during an initial coin offering (ICO) or token sale.

The Cost of Creating Your Own Cryptocurrency

The costs involved and the method of creation are largely related to the setup choices. Choose to create a currency and blockchain, and you'll need to pay for the entire team over a few months. The cost of choosing a reliable team to audit your code is approximately $15,000. Binance Smart Chain (BSC) has the lowest cost for simple tokens, costing just $50 each to complete. Creating a potentially successful cryptocurrency can cost thousands of dollars, from creation to marketing to community building.

Summary

Before officially creating an exclusive cryptocurrency, Please read the information we have provided as a guide to getting started. This is a topic that needs to be explored in depth and will take a long time to fully understand. In addition to deciding whether to create a token or currency, you also need to consider how to issue it later to make the project successful. Studying other projects and their issuances, summarizing their advantages and disadvantages, will be of great benefit to us when creating our own cryptocurrency.

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data