Abstract

Foreign exchange is the world’s largest and most liquid trading market. Brokers, businesses, governments, and other economic entities participate in international trade by trading currencies and foreign exchange derivatives.

Traders will also participate in the foreign exchange market for speculative purposes. There are many opportunities for arbitrage transactions using exchange rates and interest rates in the foreign exchange market, which is favored by large-value transactions and leveraged transactions.

The foreign exchange market consists of legal currency pairs and their relative market prices. These trading pairs are usually bought and sold in "lots". A standard lot contains 100,000 units of the trading pair's base currency, but smaller sizes are also available, starting with 100 units.

Traders often use leverage to magnify their investment capital. In addition, traders can offset trading risks by agreeing to trade currency pairs at a specific price in the future through forwards and swaps. Combining these two tools with other trading strategies and products creates a variety of investment opportunities for Forex traders.

Introduction

Even if you do not participate in foreign exchange transactions, the international currency market will have an impact on your daily life. Deep impression. While the impact of a stock market decline may not necessarily be obvious, fluctuations in currency values are likely to affect the prices of goods and services. People who have traveled abroad have a deep understanding of this and have long been accustomed to exchanging currencies based on real-time foreign exchange quotes and exchange rates.

Forex is a unique asset class distinct from stocks, commodities and bonds. By delving deeper into what makes Forex unique, we can clearly understand why the Forex market has reached the scale it does and why it is essential for a truly global Forex market.

What is foreign exchange?

Forex or foreign exchange trading (Forex, abbreviation offoreignexchange) is the act of buying and selling sovereign currencies and other foreign exchange products. When exchanging currency at a bank or exchange office, the exchange rate we see is directly affected by foreign exchange market conditions.

Exchange rate changes are the result of the combined effects of economic conditions, international situations, interest rates, politics and other factors. The foreign exchange market is frequently liquid and has the highest trading volume compared to other financial markets.

It consists of two main activities: transactions that facilitate economic transactions and speculative transactions. For companies and other economic entities entering the international market, buying and selling foreign currencies is an inevitable choice. Repatriating funds domestically or purchasing goods abroad are typical activities in the foreign exchange market.

Speculators make up the other side of Forex trading. They watch small fluctuations in currency prices and profit from large transactions in the short term. In the eyes of speculators, the foreign exchange market is full of arbitrage opportunities, which is one of the reasons why the trading volume in the foreign exchange market is so huge.

Traders also make money through long-term opportunities such as interest rate fluctuations. Economic events and geopolitics in the development process can also cause large fluctuations in currency markets. Buying a certain currency and holding it for a long time can also make long-term gains. You can also make plans several years in advance, agree on a certain exchange rate in the form of futures contracts, and bet against the market.

For small-scale users, foreign exchange trading is not easy. If you do not rely on borrowing or high principal, arbitrage or short-term trading may be difficult to achieve. International banks and financial institutions have therefore become the dominant force in foreign exchange transactions.

What is a foreign exchange currency pair?

Essentially, the foreign exchange market consists of currency pairs that describe the relative prices of two currencies. If you have ever participated in cryptocurrency trading, you will be familiar with how the foreign exchange market works. The first currency displayed in a currency pair is the base currency, and the second is the quote currency, sometimes also called the "counter currency." The quote currency represents the relative value of a unit of the base currency.

GBP/USD shows the price of 1 pound in US dollars. The ratio is presented as a number, for example: 1.3809 indicates that 1 pound is worth 1.3809 US dollars. GBP/USD is one of the most frequently traded currency pairs and is known as the "cable". The nickname comes from a 19th-century transatlantic cable that carried messages for exchange rates between London and New York.

Forex trading involves many liquid markets. The currency pairs with the highest trading volume include: USD/JPY, GBP/USD, USD/CHF and EUR/USD. These currency pairs are called mainstream currency pairs and consist of the US dollar, Japanese yen, British pound, Swiss franc and euro.

Why carry out foreign exchange trading?

Speculative trading is only part of the foreign exchange market. In order to carry out international trade, banks, enterprises and other foreign currency demanders also participate in foreign exchange transactions. Some companies will also fix the cost of currency exchange in the future by agreeing in advance on foreign exchange rates, which is called "hedging." Another use is for governments to build foreign exchange reserves and achieve economic goals, including currency pegging or promoting import and export trade.

For individual traders, the foreign exchange market is also very attractive:

- With leverage, small-scale traders can invest far more than their actual principal.

- The entry cost is friendly and small investments are supported. Buying a share in the stock market can cost thousands of dollars, but you can enter the foreign exchange market with just $100.

- You can participate in foreign exchange transactions almost anytime and anywhere, breaking time constraints.

- The market is highly liquid and the bid-ask spread is very small.

- Options and contracts are standard products. Traders who don’t want to buy or sell spot at the current market price can short the market.

Where to trade Forex?

Unlike stock trading, which is mainly based on centralized trading platforms such as the New York Stock Exchange (NYSE) or NASDAQ (NASDAQ), foreign exchange trading can be conducted in trading centers around the world. Participants can choose to trade directly over the counter (OTC), or go deep into the interbank market and complete purchases and sales through a large network of banks and brokers.

Countries have different regulations on currency management, which invisibly creates obstacles for the supervision of international currency transactions. Many jurisdictions have regulators for their domestic trading markets, but their oversight of international transactions is very limited. While traders must hold a license or trade forex through a certified broker, they can easily find trading markets that are lightly regulated.

The four major trading areas with the largest foreign exchange trading volume include: New York, London, Tokyo and Sydney. There is no central trading place in the foreign exchange market. As long as you find a broker, you can trade foreign exchange around the world.

In addition, there are many free online brokerage services to choose from. Individuals do not pay commissions directly, but Forex brokers set prices that maintain a spread from the actual market price. If you are a beginner, choose a broker that supports "micro lot" trading. We’ll get into this in depth later, but by far this is the easiest way for beginners to start trading Forex.

What is unique about foreign exchange trading?

Unique features of Forex compared to other financial markets include:

- Extensive geographical coverage. There are 180 recognized and legal foreign currencies in the world, and almost every country has a trading market.

- Extremely liquid and huge trading volume.

- Market prices are affected by many factors around the world, including politics, economic conditions, speculation, and remittances.

- Open five days a week, basically achieving 24-hour trading. The foreign exchange market is not fully centralized, and trading platforms or brokers are open to users almost 24/7. Although the market is closed on weekends, some platforms still provide after-hours trading.

- Profit margins are low, but profits from large transactions are still substantial. Small exchange rate differences can be magnified through large transactions, creating huge profits.

How to trade foreign exchange?

There are many ways to trade foreign exchange that individual traders can choose from. The simplest way is to buy and hold currency pairs in the spot market. For example: Buy Euros with the USD/EUR currency pair. If the counter currency appreciates, it can be sold in exchange for the base currency and profited from it.

Using leverage to enlarge the investment capital is also a feasible solution. As long as you can afford the loss, you can trade with borrowed funds. The third way is FX options, which involves buying or selling a currency pair at a set price at a specific time. Also popular are futures contracts, which allow individuals to trade at an agreed price in the future.

One of the great advantages of Forex trading is that traders can profit from interest rate differences. Central banks around the world set different interest rates, creating investment opportunities for Forex traders. You can convert your cash holdings and deposit them in a foreign bank, potentially earning a higher return than if the funds were kept at home.

However, there are additional costs associated with moving funds, including remittance fees, bank fees and charges arising from tax differences. Regardless of your investment strategy, all additional costs should be taken into account. Arbitrage opportunities and gains are often minimal, and profits are even more negligible. Once unexpected expenses arise, all expected benefits can be wiped out.

What is a "dot"?

Points (i.e. percentage points) are the minimum price changes supported by a Forex currency pair. Taking GBP/USD as an example again:

A change of 0.0001 upward or downward is the minimum change range of the currency pair (1 points). Of course, not all currency transactions are calculated to four decimal places. The Japanese yen does not carry decimal points, and all currency pairs whose quoted currency is Japanese yen use 0.01 as the standard point.

0.1 pip

Some brokers and trading platforms break the standard and offer currency pairs that extend to one decimal place. For example: GBP/USD does not retain four decimal places as usual, but five decimal places. USD/JPY expands the conventional two decimal places to three. The extra bit is called "0.1 point".

What is the "hand" in foreign exchange trading?

In foreign exchange trading, currencies are bought and sold in specific quantities, called "lots." Unlike the stock market, foreign currency trading lots are traded at a set value. One lot is usually 100,000 units of the base currency in the currency pair, but purchase quantities can be smaller, including mini, micro and nano lots.

Hand | Unit |

Standard | 100,000 |

Mini | 10,000 |

Micro | 1,000 |

Nano | 100 |

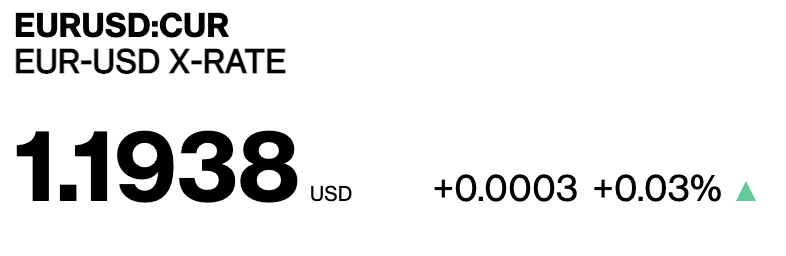

When trading in lots, profits and losses can be easily calculated based on pip changes. Let’s take EUR/USD as an example:

If you buy a standard lot of EUR/USD, you will buy 100,000 for US$119,380 EUR. When the price increases by 1 point, this lot is sold again, which is equivalent to a change in the quoted currency of 10 units. Such an appreciation would mean selling €100,000 for $119,390 would result in a gain of $10. If the price increases by 10 pips, the profit is $100.

As trading becomes increasingly digital, standard lot sizes are less commonly used and more flexible options are increasingly favored. On the other hand, large banks have even increased the size of a standard lot to one million units to meet the needs of large transactions.

How to use leverage in foreign exchange trading?

One of the characteristics of the foreign exchange market is that the profit rate is relatively low. In order to increase profits, transaction volume must be increased. Banks can easily achieve their goals, but individuals have limited funds and can only use leverage to trade.

Leverage is the use of relatively small amounts of collateral to borrow funds from a broker. Brokers express the amount of leverage as a multiple of the funds provided. For example: 10x or 20x is equivalent to 10 times or 20 times the capital. US$10,000 using 10x leverage is equivalent to trading with US$100,000.

In order to successfully borrow funds, traders should deposit a margin amount sufficient for the broker to cover potential losses. 10% margin corresponds to 10x leverage, 5% corresponds to 20x leverage, and 1% corresponds to 100x leverage. With leverage, investment gains and losses will be calculated solely based on the total leverage amount. In other words, leverage magnifies profits and losses.

Let’s take EUR/USD as an example. If you want to buy one lot of the above currency pair (100,000 euros), you need to prepare a principal of approximately US$120,000 at the current exchange rate. As a small-scale trader with insufficient funds, you may consider 50x leverage (2% margin). At this time, investing $2,400 can earn $120,000 in the money market.

If the currency pair falls by 240 points ($2,400), the position is closed and the account is immediately closed (funds return to zero). With leverage, small price movements can lead to sudden and large changes in gains or losses. Most brokers allow individuals to increase their account margin and top up their accounts as needed.

How to hedge in foreign exchange trading?

The exchange rate of any floating currency may change at any time. Speculators try to gain from price fluctuations, others are more focused on stability. For example: A company planning to expand its international business wants to lock in exchange rates and plan expenditures more rationally. This is easily achieved through hedging.

Lock-in a specific exchange rate is also a desire among speculators who want to protect against the risks posed by economic shocks or financial crises. There are many financial instruments for hedging foreign exchange rates, and the most common method is to use futures or options contracts. With a futures contract, an investor or trader agrees to trade at a specific exchange rate and amount at a future date.

Futures Contract

Suppose a futures contract is signed, agreeing to buy one USD/EUR currency pair at an exchange rate of 0.8400 (84,000 euros for 100,000 U.S. dollars) within one year. It was later sold in the euro zone, with plans to repatriate the proceeds within a year. Futures contracts eliminate the risk of potential appreciation of the U.S. dollar against the euro and help traders complete financial planning more rationally. In this example, if the U.S. dollar appreciates, one euro will be exchanged for fewer U.S. dollars when the funds are repatriated.

If the U.S. dollar appreciates and the exchange rate of the USD/EUR currency pair in a certain year is 1.0000, then without a futures contract, it will cost 100,000 euros to exchange 100,000 U.S. dollars at the spot exchange rate. However, you do not need to trade at this exchange rate, but to execute the previously signed contract, that is, to purchase one USD/EUR at an exchange rate of 0.8400 (84,000 euros for 100,000 U.S. dollars). This simple example proves that if handling fees are not considered, the contract can save 16,000 euros per transaction.

Options

Options reduce transaction risks through hedging, in a similar way to contracts. Unlike futures contracts, options allow you to buy or sell an asset at a predetermined price on a specific date or in advance. After paying the purchase price (premium), options contracts provide protection against the risk of unexpected appreciation/depreciation of a currency pair.

For example: A British company sells goods and services to the United States, and they purchase a GBP/USD call option. Using this financial instrument, the company will be able to purchase GBP/USD at a predetermined price in the future. If the pound appreciates or maintains the current exchange rate when the dollar is paid, the company only loses the price of the option contract. If the pound weakens against the dollar, then they have hedged the exchange rate and can get a better price than the market price.

To learn more about futures contracts and options contracts, please read "What are forward contracts and futures contracts?" ”and“ What is an options contract? 》.

Covered arbitrage

Global exchange rates are constantly changing, and foreign exchange traders can use exchange rate differences to arbitrage while offsetting the impact of exchange rate changes. risk. The most commonly used method is offset arbitrage. This trading strategy reduces risk by hedging against the future price movement of a currency pair.

Step 1: Find arbitrage opportunities

For example: the exchange rate of the EUR/USD currency pair is 1.400, and the deposit interest rate in the Eurozone is 1%, while it is 2% in the United States. Then, the annual income from investing 100,000 euros in the Eurozone is 1,000 euros; if you invest in the United States and the exchange rate is stable, the income can reach 2,000 euros. However, this simple example does not take into account various fees payable, bank fees and other expenses.

Step 2: Hedging foreign exchange rates

Use the one-year EUR/USD futures contract with a forward exchange rate of 1.4100 to enjoy the high interest rates in the U.S. dollar area and secure fixed returns. . The forward exchange rate is the foreign exchange rate agreed in the contract.

Banks or brokers take into account different interest rates and current spot prices, and use mathematical formulas to calculate the corresponding exchange rates. The forward rate will be at a premium or discount to the spot rate based on market conditions. In order to prepare for arbitrage, we sign a 1-year futures contract and agree to buy one EUR/USD currency pair at an exchange rate of 1.41.

Step 3: Complete arbitrage

In this strategy, you sell one lot of EUR/USD in the spot market at an exchange rate of 1.400, that is, you exchange 100,000 euros for 140,000 Dollar. After obtaining funds through spot trading, deposit them in a U.S. bank and enjoy an annual interest rate of 2%. At the end of one year, the total funding can reach $142,800.

The next step is to convert the $142,800 back into euros. Through the futures contract, you can directly sell back 142,800 US dollars at the agreed exchange rate of 1.4100, and finally obtain approximately 101,276.60 euros.

Step 4: Comparing returns

Assuming all other conditions are true, let’s compare the returns generated by hedging/unhedging exchange rates. After executing the offset arbitrage strategy in the United States, the gain is 101,276.60 euros; if the exchange rate is not hedged, as mentioned above, the gain is 102,000 euros. Hedging causes earnings to decline, so what’s the point of doing so?

The main reason is that traders avoid the risk of exchange rate fluctuations through hedging. It is almost impossible for a currency pair to remain stable for a year. Therefore, even if the income decreases by 723.40 euros, at least 1,276.60 euros are locked. Another factor is that the above example assumes that the central bank will not change interest rates for a year, which is not the case.

Summary

If the international economy, trade and If you are interested in global current affairs, you can also gain a unique trading experience different from the stock and share markets by participating in the foreign exchange market. For small-scale investors, Forex trading may not seem as convenient as cryptocurrency or stock trading. However, with the rise of online brokers and increased competition in the public financial services industry, Forex trading will no longer be out of reach. Many Forex traders rely on leverage to make significant profits. However, leveraged trading strategies carry a high risk of forced liquidation. Before taking the plunge, be sure to fully understand how leverage works.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR