Table of Contents

- Introduction

- What is Golden Cha?

- What is a dead cross?

- What is the difference between a golden cross and a dead cross?

- How to trade based on the golden cross and dead cross patterns

- Summary

Introduction

The chart forms of technical analysis applications are very rich. We have previously discussed in "Beginner's Guide to Classic Chart Patterns" and "12 Common K-line Chart Forms in Technical Analysis". However, day traders, swing traders and long-term investors still have two forms to refer to, which are the "golden cross" and "death cross" introduced in this article.

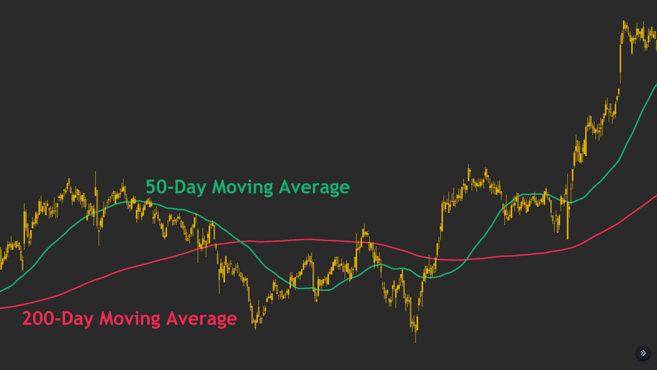

Before introducing the two forms, we first need to understand what a moving average (MA) is. Simply put, it is a line drawn on a price chart that measures the average price of an asset over a given period of time. For example, a 200-day moving average measures the average price of an asset over the past 200 days. If you want to learn more about moving averages, please read "Moving Averages Detailed Explanation".

So, what exactly are golden crosses and dead crosses, and how do traders use them in their trading strategies?

What is Golden Cha?

The golden cross (or golden cross) is a chart pattern that generally refers to the short-term moving average crossing upwards across the long-term moving average. We generally use the 50-day MA as the short-term average and the 200-day MA as the long-term average. However, this is not the only way the golden cross is presented. It can occur in any time period, and the basic situation is that the short-term average line crosses upward through the long-term average line.

Golden crosses generally appear in three stages:

- In a downtrend, the short-term average is below the long-term average.

- The trend reverses and the short-term average crosses the long-term average.

- The short-term average remains above the long-term average, and the upward trend begins.

The golden cross appears, indicating that Bitcoin is showing New uptrend.

In many cases, a golden cross may be considered a bullish signal. why? The reason is simple. We know that a moving average measures the average price of an asset during the charting period. From this perspective, a short-term average below the long-term average means that short-term prices are trending bearish compared to long-term price action.

Now, what happens when the short-term average crosses the long-term average? The answer is that the short-term average price will be higher than the long-term average price. This indicates a potential change in market trend, making the golden cross a recognized bullish signal.

In conventional concepts, the golden cross refers to the 50-day moving average crossing above the 200-day moving average. However, the general idea behind a golden cross is that the short-term moving average crosses the long-term moving average. Therefore, golden crosses may also appear on other time frames (15 minutes, 1 hour, 4 hours, etc.). Nonetheless, signals over long periods tend to be more reliable than short periods.

So far, we have introduced the golden cross of the simple moving average (SMA). However, there is another common method of calculating moving averages called the exponential moving average (EMA). It uses a completely different formula that emphasizes recent price action.

EMA can also be used to look for bullish and bearish trend crossovers, including golden crosses. This tool is able to react more quickly to recent price movements, but the crossover signals they produce may be less reliable and subject to more false signals. Even so, EMA crossovers are a common tool as a tool for identifying trend reversals.

What is a dead cross?

Si Cha is basically the antonym of Golden Cha. In this chart pattern, the short-term average is below the long-term average. For example, the 50-day moving average is below the 200-day moving average. Therefore, a dead cross is a recognized bearish signal.

The dead cross also generally appears in three stages:

- In an upward trend, the short-term average is above the long-term average.

- The trend reverses and the short-term average falls below the long-term average.

- When the short-term average continues to be below the long-term average, a downtrend occurs.

The dead cross confirming Bitcoin’s downward trend .

After understanding the golden cross, we can easily understand why the dead cross is a bearish signal. The short-term average falls below the long-term average, indicating a bearish market outlook.

Throughout history, Sicha has issued bearish warnings before many financial crises (such as 1929 or 2008). However, it can also send out wrong signals, and 2016 was a typical misjudgment.

In 2016, a false dead cross signal appeared in SPX.

As seen in the example, the market has a dead cross signal, but quickly resumes its upward trend, eventually forming a golden cross.

What is the difference between golden fork and dead fork?

After discussing the concepts of Golden Cha and Death Cha, the difference between the two is naturally not difficult to understand. They are essentially opposites of each other. A golden cross may be considered a bullish signal and a dead cross a bearish signal.

Both can be confirmed by high trading volume. When analyzing cross lines, some technical analysts will also refer to other technical indicators. Common examples include the exponential moving average (MACD) and the relative strength index (RSI).

It should be noted that the moving average is a lagging indicator and has no predictive function. Two intersection points usually identify a trend reversal that has occurred, but cannot analyze an ongoing reversal trend.

➟ Want to start a digital currency journey? Buy Bitcoin on Binance today!

How to trade based on golden cross and dead cross patterns

The basic idea behind these patterns very simple. If you understand how traders utilize MACD, it is easy to understand how to trade based on these crossover signals.

When talking about golden crosses and dead crosses, we usually look at daily trading charts. Therefore, the simplest strategy is to buy when the golden cross appears and sell in time after the dead cross occurs. This has been a relatively successful Bitcoin trading strategy over the past few years, despite many false signals. Therefore, blindly following a signal is usually not the best strategy. There are numerous factors that traders need to consider when it comes to market analysis techniques.

To learn more about a simple strategy for recommending long-term positions, please read "Analysis of DCA".

The crossover strategy mentioned above is based on daily moving average crossovers. What about other time periods? Golden crosses and dead crosses occur in the same situation, and traders can make full use of both indicators.

However, as with most chart analysis techniques, signals on longer timeframes are generally more accurate than on shorter timeframes. When you see dead crosses occurring within a time range of hours, if you extend the span to a week, golden crosses may appear. Therefore, zooming in on the timeframe and looking at chart trends (and considering multiple parameters) is the way to go.

When trading based on golden crosses and dead crosses, many traders also focus on volume. Like other chart patterns, volume is an important tool in confirming a trend. When a volume spike is accompanied by a crossover signal, many traders become more certain that the signal is valid.

After the golden cross appears, the long-term moving average may be regarded as a potential support area. On the contrary, when a dead cross signal appears, it can be regarded as a potential resistance area.

Cross signals can also be cross-checked with other technical indicators to find fusion points. Fusion traders combine multiple signals and indicators into a single trading strategy, making trading signals more reliable.

Summary

In this article, we discussed the most commonly used crossover signals: Golden Cross and Dead Cross .

The golden cross refers to the short-term moving average crossing upwards across the long-term moving average. A dead cross is when the long-term moving average falls below the short-term moving average. Whether it’s the stock market, forex or cryptocurrency markets, both indicators are reliable tools for confirming long-term trend reversals.

Do you have any more questions about trading based on crossover signals such as golden crosses and dead crosses? Please visit our Q&A platform Ask Academy, where community members will patiently answer your trading questions.

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data