Community Release - Author: Dimitris Tsapis

Abstract

Market sentiment is investors’ opinions on assets Opinions, feelings and attitudes. These feelings do not consistently reflect the fundamentals of an asset or project, but can significantly impact price.

Market sentiment analysis is a research method that hopes to predict price trends based on relevant information. By tracking market participants' overall attitudes toward market dynamics, you can get a sense of the public's level of excitement or fear about a particular cryptocurrency.

Introduction

Like other assets, the price of cryptocurrency is directly related to market supply and demand. There are many factors that trigger changes in market power, including public opinion, news, and social media.

Many traders actively analyze market sentiment and predict the short- and medium-term potential of cryptocurrency assets. In addition to technical and fundamental analysis, studying cryptocurrency market sentiment is also an important addition to a trader's skills.

What is market momentum?

Market sentiment is the collective attitude of traders and investors towards financial assets or markets. This concept exists in all financial markets, including cryptocurrencies. Market sentiment can indeed influence market cycles.

However, optimistic market sentiment is not necessarily a sign of positive market conditions. Sometimes, extremely optimistic market sentiment (about to skyrocket!) can precede a market correction or even a market decline.

By analyzing market sentiment, in addition to gaining insight into market demand, traders can also predict potential profitable trends. Market sentiment usually does not take into account a project's fundamentals, but the two occasionally correlate.

Let’s take Dogecoin as an example. Much of Dogecoin’s surge in demand during the bull market stems from social media hype (stimulating optimistic market sentiment). Many traders and investors got caught up in the high market sentiment and jumped on the bandwagon to buy Dogecoin, ignoring the project’s token economics or goals. Even a tweet from a figure like Elon Musk can trigger either optimism or gloom in the market.

Why is market sentiment analysis important?

Market sentiment analysis is an important part of many trading strategies. As with technical or fundamental analysis, traders should consider all known information before making a move.

For example, market sentiment analysis can help determine whether the fear of missing out (FOMO) is truly legitimate or simply a herd mentality. In summary, by combining market sentiment research with technical and fundamental analysis, you can:

- Deeply understand short- and medium-term price action.

- Effectively control your emotional state.

- Find potential profit opportunities.

How to conduct market sentiment analysis

Understanding market sentiment requires gathering the views, thoughts and opinions of market participants. Again, although market sentiment analysis can provide practical information, it must not be used as the only reference. The information collected must be combined with existing professional knowledge and experience to draw practical conclusions.

To grasp some basic concepts, it is recommended to research relevant social media pages and platforms to clarify the attitudes of the community and investors towards a specific project. You can also join the official forum, Discord server or Telegram group to communicate directly with the project team and community members. But be careful! Many criminals are also lurking in these groups. Don’t trust others and do your own research before taking a risk.

Social platforms are only the first step, and there are many ways to fully understand market sentiment. In addition to following social platforms (especially Twitter, where many cryptocurrency fans gather), you can also consider the following methods:

1. Use data collection software tools to track social hot spots.

2. Follow the latest industry trends in real time through media portals and blogs. Binance Blog, Binance News, Bitcoin Magazine, CoinDesk and CoinTelegraph are all good choices.

3. Set up message push or track large-scale transactions of giant whales. Some cryptocurrency investors track these activities on a regular basis, and they do sometimes influence market sentiment. Both Telegram and Twitter have free whale message push bots.

4. Check market sentiment indicators and price signals on CoinMarketCap. These indices analyze different sources of information and provide a brief overview of current market sentiment.

5. Use Google Trends to measure the popularity of a certain cryptocurrency. For example: when the search volume for "how to sell cryptocurrency" is high, it means that the market sentiment is relatively depressed.

Market Sentiment Indicator

According to the market sentiment indicator, investors can Understand bullish/bearish sentiment on a market or asset. Indicators usually reflect these sentiments as a chart or some kind of scale. These tools can assist sentiment analysis, but they cannot be used as the sole basis. The best solution is to conduct a more balanced and comprehensive analysis of the market through comprehensive research and judgment of multiple indicators.

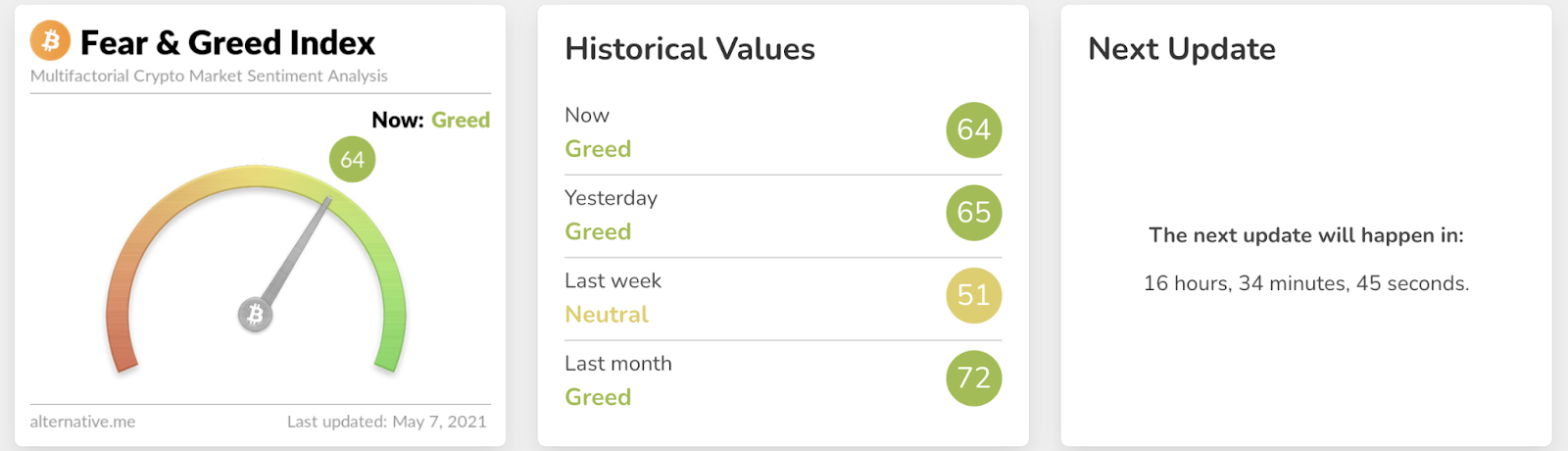

Most market sentiment indicators focus on Bitcoin (BTC), and the Ethereum (ETH) sentiment index is also worthy of attention. Bitcoin’s Crypto Fear & Greed Index is probably the best-known cryptocurrency market sentiment indicator. The index analyzes five major sources of information: volatility, market volume, social media, dominance, and trends to measure fear and greed in the Bitcoin market on a scale of 0 to 100.

The bullish and bearish indices on the Augmento platform are another sentiment indicator that focuses on social media. It uses artificial intelligence (AI) software to analyze 93 sentiments and themes from conversations in Twitter, Reddit and Bitcointalk. The creators also implemented back-testing of their indicator methods using valid data from that year. A scale of "0" represents extremely bearish, while "1" represents extremely bullish.

Learn from others’ strengths and learn from others

Analyze social media platforms and on-chain indicators and other cryptocurrency indicators that provide insight into market sentiment for a currency or project. With a deep understanding of current market attitudes, you are more likely to make sound trading or investment decisions.

To maximize the effectiveness of sentiment analysis, the following analysis methods are often combined:

- Technical analysis – Optimize predictions of short-term price action.

- Fundamental analysis – Determining the plausibility of disputed information or assessing the long-term potential of a certain token.

Summary

Many traders use market sentiment analysis in the investment market. The method is particularly applicable to the cryptocurrency market. The reason is that the blockchain industry and cryptocurrency market are still in a small-scale stage, and public perceptions and emotions can more easily trigger price fluctuations.

By using the above methods, you can begin to understand market sentiment and make smarter investment choices if you wish. To reiterate, to conduct market sentiment analysis, consider the following information:

- Track social media channels and sentiment related to your project.

- Follow the latest news and trends in the industry in real time.

- Actively use various indicators to gain insights into public interest in a specific token.

As practice and experience continue to accumulate, market sentiment analysis often produces more reliable results, but it may not be useful in some cases. Please do your due diligence before trading or investing. After all, any decision carries certain risks.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR