Summary

Mining is the process of validating Bitcoin transactions and adding them to the blockchain. The goal of miners is to find efficient answers to complex mathematical problems. Miners who successfully solve the problem will be rewarded with new Bitcoins as well as transaction fees.

In the early years, Bitcoin users could use personal computers to join mining competitions. Today, obtaining mining profits can only rely on extremely professional mining machines. It is difficult to make a profit from single-machine mining, so many miners choose to join mining pools to increase the probability of obtaining block rewards (the rewards are shared proportionally among the members of the mining pool).

Introduction

Bitcoin mining ensures that the latest legitimate transactions are recorded on the blockchain. At the time, it was a unique solution for creating trust in a trustless environment. From this perspective, mining is the core of Bitcoin’s security model.

Earning Bitcoin rewards through mining sounds like a very attractive deal. Gone are the days of using computer CPUs for mining, but physical mining machines are not a necessity to participate in mining. Before deciding whether to participate in mining, let’s briefly discuss the principles of Bitcoin mining.

What is Bitcoin mining?

When users create a new Bitcoin transaction, they need to wait for other network users (nodes) to verify and confirm the validity. Miners are responsible for collecting new pending transactions and centralizing them into candidate blocks (new blocks awaiting verification).

The miner's goal is to find valid block hashes for candidate blocks. The block hash value consists of a string of numbers and letters, which is a unique ID that distinguishes different blocks. Here is an example of a block hash:

0000000000000000000b39e10cb246407aa676b43bdc6229a1536bd1d1643679

In order to create a new block hash value, the miner needs to collect the hash value of the previous block, the data of the candidate block, a random number and substitute them all into the hash function.

However, the miner must find a random number that combines all the data to generate a block hash that starts with a specific number of zeros. The number of zeros changes with the mining difficulty. If the block hash is valid, it proves that the miner completed the necessary work to verify the candidate block (i.e., proof of work).

After collecting pending transactions and creating candidate blocks, miners can only make changes to the nonce - this is exactly how miner mining works. In an intensive trial-and-error process, the miner constantly changes the nonce and hashes the combined data multiple times until it finds the solved value for the block (i.e., a hash that starts with a specific number of zeros).

Once a valid hash is found, the miner can verify the candidate block and claim the Bitcoin reward. At this point, the blockchain transaction in the block changes from "pending" to "confirmed".

How much can Bitcoin miners earn

Each new zone Each block brings a block reward to the miner, consisting of newly generated Bitcoins (block subsidy) as well as transaction fees. Block rewards are almost entirely derived from block subsidies, so most people directly regard block subsidies as block rewards (transaction fees are ignored).

In 2009, the initial block subsidy for Bitcoin mining was 50 Bitcoins, and the reward was halved every 210,000 blocks mined (about four years). These halving events resulted in the mining reward being reduced to 25 Bitcoins in 2012, 12.5 Bitcoins in 2016, and finally to 6.25 Bitcoins in 2020. The next halving event is expected to occur in 2024. As of May 2021, miners will receive approximately $300,000 in block rewards for every block mined.

However, there are still many factors to consider when evaluating mining equipment and profitability. Among them, the speed at which the mining machine generates and tests random numbers is a key indicator. This value is called the hash rate, and it is key to the success of Bitcoin miners. The greater the hash rate, the faster you can test random inputs.

Another important indicator is the energy consumption of the mining machine. If the electricity cost is greater than the mining revenue, there will be no profit at all.

Bitcoin Mining Beginner's Guide

Decentralization and open source are the two major characteristics of Bitcoin. So everyone can join the mining competition. Previously, it was possible to participate in mining new blocks using a personal computer. As mining difficulty increases, more high-performance computers will come into use (more on this below).

Theoretically, a personal computer can still participate in Bitcoin mining, but the chance of finding a valid hash is slim. Hash functions are relatively fast to calculate, but take longer to calculate massive random inputs. Therefore, the prerequisite for miners to achieve profitability is to have professional hardware.

Which mining equipment should be used?

Generally speaking, cryptocurrency mining can use CPU, GPU, FPGA or ASIC mining machines (will be introduced one by one later). Currently, some altcoins can be mined using graphics cards (GPUs). Considering the mining algorithm, difficulty and electricity costs, FPGA mining machines can also be an option. But when it comes to Bitcoin, ASIC miners are the most efficient equipment.

CPU (Central Processing Unit)

The CPU works like a multi-function chip and is responsible for issuing commands to different areas of the computer. However, its efficiency cannot meet the requirements of cryptocurrency mining.

GPU (Graphics Processing Unit)

The GPU has many uses, but is basically only used to process graphics and output them to the screen. The GPU divides complex tasks into several subtasks to improve performance. Some altcoin mining can use GPUs, but the efficiency depends on the mining algorithm and difficulty.

FPGA (Field Programmable Gate Array)

FPGA can be programmed and reprogrammed to serve different functions and applications. This type of equipment can be customized and is more cost-effective than ASIC, but it will reduce the efficiency of Bitcoin mining.

ASIC (Application Specific Integrated Circuit)

ASIC is the abbreviation for Application Specific Integrated Circuit, which means these computers are designed for a single purpose. ASIC miners are devices tailor-made for cryptocurrency mining. Although the customizability is inferior to FPGA and the price is more expensive, the hash rate and energy consumption level determine that ASIC is the most efficient choice for Bitcoin mining.

Mining Pool

The probability of mining a block alone is very slim. Joining a cryptocurrency mining pool can Individuals combine their computing power with that of other miners. When the mining pool successfully mines a block, the mined Bitcoins will be shared by all miners. The mining pool reward is proportional to the mining power contributed by the individual.

How to join the mining pool?

When joining a mining pool using local hardware, you must configure your personal software to work with other miners. The process usually involves registering an account and connecting to the mining pool server.

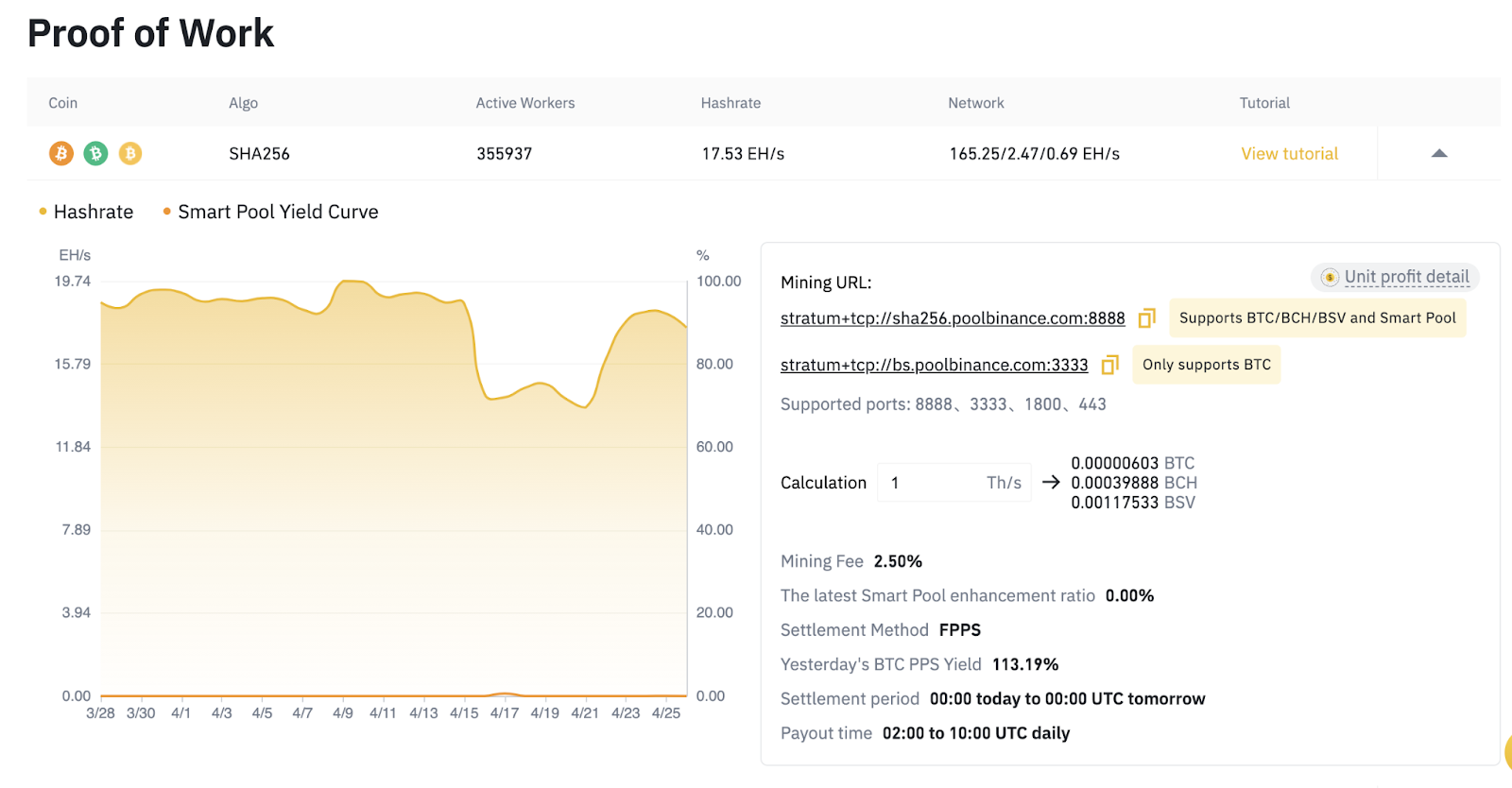

If you already own a mining rig, Binance Pool is ideal for mining Bitcoin and other coins based on the SHA-256 algorithm. In order to maximize profits (paid in Bitcoin), miners will freely switch between BTC, BCH and BSV.

For details on earnings, please visit the Binance Pool page. Bitcoin earnings will be transferred to the Bitcoin wallet on a daily basis.

Cloud Mining

If you want to stay away from cumbersome technical operations, You can also join a cloud mine and leave the software and hardware to the mine owner. Broadly speaking, cloud mining farms usually pay people to hire people to mine on their behalf. The mine owner will take a certain percentage of the profits as compensation. However, this approach is highly risky and there is no guarantee that the investment will pay off. To make matters worse, many cloud mining operations are scams themselves and must be approached with caution.

Summary

If you understand the basic working principles of Bitcoin mining, you can avoid making mistakes. With the right combination of software and hardware, anyone can participate in mining and contribute to the security of the Bitcoin network. Even if you find that mining is not for you, you have contributed to the operation of the Bitcoin node.

Making profits through mining is extremely challenging, the initial investment is very high and there are many potential risks. Final returns will also be affected by market conditions and external factors such as energy prices and hardware improvements. Before investing in a mining machine, be sure to think twice and conduct careful research.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR