What is a trend line?

In financial markets, a trend line is a diagonal line drawn on a chart. Trendlines connect specific data points, making it easy for chartists and traders to understand price movements and understand market trends.

Trendlines are considered one of the most fundamental tools in the field of technical analysis (TA) and are widely used in the stock, fiat, derivatives and cryptocurrency markets.

Essentially, trend lines work similarly to support and resistance levels, but trend lines are composed of diagonal lines rather than horizontal straight lines. Therefore, trend lines have positive and negative slopes. Generally, the larger the slope, the more obvious the trend.

We can divide trend lines into two basic categories: up (uptrend) and down (downtrend). As the name suggests, an uptrend line is drawn from the low to the high of the chart. This line connects two or more points, as shown in the figure below.

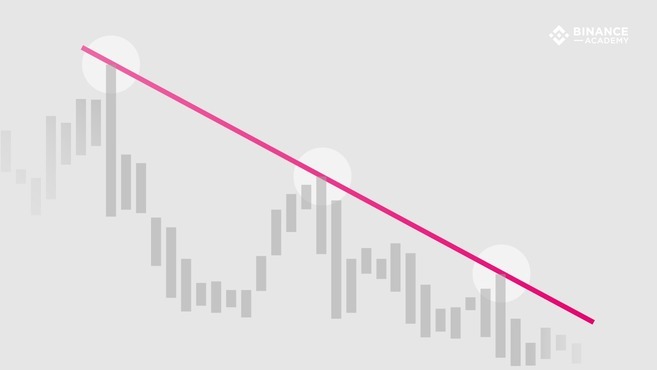

Downward trend lines are the opposite, drawn from the high to the low of the chart. The line connects two or more points.

Therefore, the difference between the two trend lines is reflected in the point at which the trend line is drawn bit selection. In an uptrend, a trendline is drawn using the lowest point on the chart (such as a candlestick bottom forming a higher low). On the other hand, a downtrend line is drawn using highs (i.e. a lower high is formed at the top of the candlestick chart).

How to use trend lines

Observe the highest and lowest prices on the chart, Trend lines will show where price briefly impacted the main trend, tested it, and then moved back into its favor. Trend lines can be extended and used to predict various key levels in the future. Trend lines can withstand several tests and have analytical value as long as they do not break through the critical point.

Although trend lines can be used in various types of data charts, in fact, trend lines are most widely used in financial charts (based on market prices) because the trend Lines can provide relevant parties with insights into market supply and demand. There is no doubt that an upward trend line represents rising purchasing power (supply exceeds demand), while in a downward trend line, prices will continue to fall, indicating that purchasing power continues to decrease (supply exceeds demand).

However, transaction volume must also be taken into consideration when analyzing. For example, if prices rise but trading volume declines or is relatively low, this could create the appearance of artificially high demand.

As mentioned earlier, trend lines can be used to grasp the specific situation of support and resistance levels, which are two basic concepts that are very important in the field of technical analysis. An ascending trendline would show support, and it is unlikely that the price will fall below the support level. Conversely, a downtrend line would show resistance above which price is unlikely to rise.

In other words, if a stock price breaks through a support or resistance level, either downward (for an uptrend) or upward (for a downtrend), the market is trending. No longer of analytical significance. In many cases, if these key levels fail to stabilize the trend, the market will tend to change direction.

Nevertheless, technical analysis is a more subjective field, as everyone tends to draw trend lines in a different way. Therefore, a variety of technical analysis methods and basic analysis methods must be combined to effectively reduce risks.

Draw trend lines with analytical significance

From a technical perspective, trend lines It is possible to connect only two points on the chart. However, most charting experts agree that a trend line must connect three or more points to be of analytical value. In some cases, the first two points can be used to show potential trends, while the third point (extended in the future) can test validity.

Therefore, if the price touches the trend line three or more times without breaking through the critical point, then the trend can be considered of analytical value. If a trend line is tested multiple times, it is a sign that the trend may not be just a coincidence caused by price movements.

Scale settings

When drawing a trend line, in addition to selecting enough points In addition to making trend lines analytically meaningful, it is necessary to consider appropriate setup factors. Among them, the most important chart setting is the scale setting.

In financial charts, the specific scale may depend on how the price shown is changing. Two of the most commonly used scales are the arithmetic scale and the semi-log scale. In an arithmetic chart, variables are clearly displayed as price moves up and down the Y-axis. Semi-logarithmic charts, on the other hand, show fluctuations in percentage terms.

For example, on an arithmetic chart, a price move from $5 to $10 is equidistant from a line segment from $120 to $125. Whereas on a semi-log chart, a 100% gain (from $5 to $10) would take up a larger portion of the chart, a move from $120 to $125 would represent only a 4% increase.

When drawing trend lines, be sure to consider the scale settings. Because various types of charts may produce different highs and lows, the trend lines may differ slightly.

Summary

Although trend lines are a powerful tool in the field of technical analysis Tools, but not foolproof. The points selected for drawing trend lines may affect the accuracy of their representation of market cycles and true trends, and are, to a certain extent, subjective.

For example, when drawing trend lines, some graphic experts only consider the main body of the K-line chart and ignore its shadow lines. Others draw trend lines based on the highest and lowest prices of shadow lines.

Therefore, when drawing trend lines, be sure to consider them in conjunction with other charting tools and indicators. Some of the more famous technical analysis indicators include Ichimoku Clouds, Bollinger Bands (BB), MACD, Stochastic RSI, RSI, and Moving Averages.

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data