Table of contents

Introduction

What Is it a K-line chart?

What is the working principle of K-line chart?

How to read K-line charts?

What information cannot be provided by K-line charts?

What is the average K-line chart (Heikin-Ashi)?

Summary

Introduction

Introduction h2>

For beginners in the field of trading or investing, trading charts can be as confusing as a bible. Some people invest based solely on intuition and subjective assumptions. While this luck-based approach occasionally works in rising market conditions, it may not necessarily work in the long run.

The essence of trading and investing is a game related to probability and risk management. Therefore, understanding K-line charts is the key to almost all investment methods. This article will explain what K-line charts are and how to read them.

What is a K-line chart?

K-line chart is a financial chart that graphically presents the changes in asset prices within a given time frame. As the name suggests, it consists of many candlestick patterns, each representing the same period of time. Candlestick patterns can represent any virtual time frame, from as short as seconds to as long as years.

The history of K-line charts can be traced back to the 17th century. It is generally believed that a Japanese rice merchant named Homma invented this charting tool. His ideas laid the foundation for the modern candlestick charts we use today. Many latecomers have optimized and improved Homma's invention, the most famous of which is Charles Dow, one of the founders of modern technical analysis.

While K-line charts can be used to analyze any other type of data, their primary use is to simplify financial market analysis. If used correctly, it can help traders assess the probability of price movement outcomes. Traders and investors can use this as a basis to form personal opinions through market analysis.

What is the working principle of K-line chart?

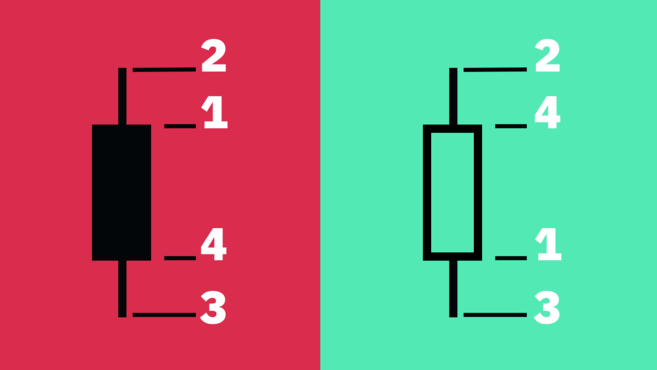

The following price points are required when creating a candlestick pattern:

Opening Price - the price of an asset within a specific time frame FirstTransaction price data.

Highest Price - Data on the highest trading price of an asset within a specific time frame.

Low Price - Data on the lowest price an asset has traded at during a specific time frame.

Close Price - The last trade price data for an asset within a specific time frame.

This data set is often collectively referred to as "OHLC value". The relationship between the open, high, low and closing prices determines the overall appearance of the candlestick pattern.

The distance between the opening price and the closing price is called the "real body", and the distance between the real body and the highest/lowest price is called the wick or shadow. The distance between the high and low points of a candle pattern is called the candlestick range.

How to read the K-line chart?

Many traders believe that although the various charts provide similar information, K-line charts are more understandable than traditional bar and line charts. Through the K-line chart, traders can easily view price data, and the entire price trend is clear at a glance.

The candlestick pattern actually shows the game between bulls and bears within a certain period of time. Generally speaking, the longer the candlestick, the greater the buying and selling pressure on the chosen time frame. If the candlestick is short, it indicates that the high (or low) price in the selected time frame was close to the closing price.

Colors and settings may vary depending on the drawing tool. Under normal circumstances, if the body is green, it means that the asset's closing price was higher than the opening price; red means that the price fell during the selected time frame, that is, the closing price was lower than the opening price.

Some chartists prefer black and white, where the chart does not use green and red, but instead uses empty spaces to indicate rising prices and solid black to indicate falling prices.

What information cannot be provided by the K-line chart?

K-line charts are useful for getting a general idea of price trends, but they may not provide all the necessary data for comprehensive analysis. For example, a K-line chart cannot show the changes between the opening and closing prices in detail, but can only show the distance between two points (and the highest and lowest prices).

For example, while the wicks of a candlestick chart do show the high and low of the time period, we cannot tell which price point occurred first. However, most charting tools support changing time frames, allowing traders to zoom in to view trends on shorter time frames for detailed information.

K-line charts may also contain a lot of market disturbance information, which is especially obvious on charts with shorter time frames. Moreover, the K-line changes rapidly and is difficult to interpret.

What is the average K-line chart (Heikin-Ashi)?

So far, we have discussed the traditional K-line chart that originated in Japan. However, there are other ways to calculate candlestick chart data. For example, the average K-line chart (Heikin-Ashi) technology.

Heikin-Ashi stands for "average standard" in Japanese. This type of candlestick chart is based on an improved formula using average price data, with the main goal of eliminating price fluctuations and filtering out market noise. Therefore, using average K-line charts makes it easier to determine spot market trends, price patterns, and potential reversals.

Traders often combine average K-line charts with regular K-line charts to avoid being misled by false signals and increase the chance of finding market trends. In an average K-line chart, a green white candlestick without a lower wick usually indicates a strong uptrend, while a red black candlestick without an upper wick may indicate a strong downtrend.

Although the average K-line chart is a powerful tool, like other technical analysis methods, it still has corresponding limitations. Since these charts use average price data, they may need to be viewed over a longer time span to see developments. Additionally, they do not show price gaps and may obscure other price data.

Summary

K-line chart is one of the most commonly used basic tools for all traders and investors. This chart provides the flexibility to analyze data on different time frames, in addition to a clear view of the price movement of a given asset.

If traders can conduct extensive research on K-line charts and patterns, are good at analysis, and have sufficient practical experience, traders may have an advantage in market transactions. However, most traders and investors believe that relying solely on K-line charts is not scientific and must be combined with other methods (such as fundamental analysis) to make correct judgments.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR