Abstract

Public enthusiasm for non-fungible tokens has led to a boom in cryptocurrency collectibles and NFT art. Both are the most prominent use cases in the decentralized finance (DeFi) ecosystem, but they are not the only ones. The scarcity and uniqueness of non-fungible tokens fit well with real-world assets, logistics, music royalties, etc. As NFT matures, more experimental use cases are expected to be fully promoted.

Introduction

Before the advent of non-fungible tokens, the digital scarcity of assets was difficult to define. Even with multiple copyright protection laws in place, consumers can still easily copy or steal digital artworks.

The development of NFT has incubated cryptocurrency art and digital collectibles, and this is just the beginning. Industries ranging from real estate to logistics can use NFT to prove the authenticity of many unique collectibles.

Although the NFT ecosystem is still immature, there are still many interesting projects waiting to be explored, and some creators and consumers have already created huge value through them.

Art NFT

Non-Fungible Token (NFT) solves the long-standing scarcity problem in the field of digital art. If virtual works of art can be digitally reproduced, where does scarcity begin? Although fakes do exist in the real world, they can usually be identified.

Much of the value of crypto art comes from digitally verifying authenticity and ownership. Although anyone can view CryptoPunk images on the Ethereum blockchain and download or save them, we cannot prove that we own the original.

For example: Anonymous digital artist Pak created a series of NFT works. All the works are exactly the same, just with different names. Pak named the works "Cheap", "Expensive" and "Unsold" and set different values according to the names. This collection is thought-provoking: Where does the value of works of art come from?

In the field of NFT, the value of a work of art is usually not in the work itself, but in proving the ownership of this specific asset. As a result, crypto art becomes the most popular NFT use case.

NFT collectibles

Whether it is PancakeSwap Bunny or Binance Anniversary Commemorating NFTs, the potential demand for digital collectibles is huge. With the launch of "NBA Top Shot", an NBA NFT trading card with huge collectible value, such use cases have even entered the mainstream public's vision.

These non-fungible tokens and digital NFT art have become popular, creating considerable sales in NFT markets such as Opensea, BakerySwap and Treasureland. NFTs are inextricably linked to cryptocurrency art, and the former can even integrate collectibles with works of art. Currently, these are the two most mature use cases.

Twitter CEO Jack Dorsey’s first tweet is an excellent example of an NFT collectible. Compared with CryptoPunk, which has both collection value and visual art, its NFT value comes purely from its collectability.

Jack Dorsey sold his NFT through the Valuables platform, which tokenizes tweets. Anyone can bid on any tweet, and others can cut it off and offer a higher price. Ultimately, the tweet author decides to accept or reject the bid. If the bid is accepted, the tweet will be minted into an NFT in the blockchain and become an exclusive product signed by the author.

Each NFT is signed by the certified creator by adding their Twitter account. In other words, only the original creator can mint personal tweets into NFTs. The above is the process of creating digital rare collectibles, and the finished products can be traded or kept for yourself. The concept of selling tweets may be difficult to understand, but it is enough to illustrate how NFT creates collectible value, because its essence is a digital version of a signature.

Financial NFT

It is easy to overlook the fact that songs, pictures or collectibles are not the value of all NFTs. source. In the field of decentralized finance (DeFi), NFT can also create unique economic benefits. Most NFTs will also come with artwork, but the value still comes from utility.

For example: JustLiquidity has created an NFT pledge model. Users can stake a pair of tokens in the fund pool for a period of time and transfer them to the next fund pool after harvesting the NFT. NFTs are like admission tickets and will be destroyed as soon as the user joins a new fund pool. This model creates a secondary market for these NFTs based on the access qualifications provided by NFTs.

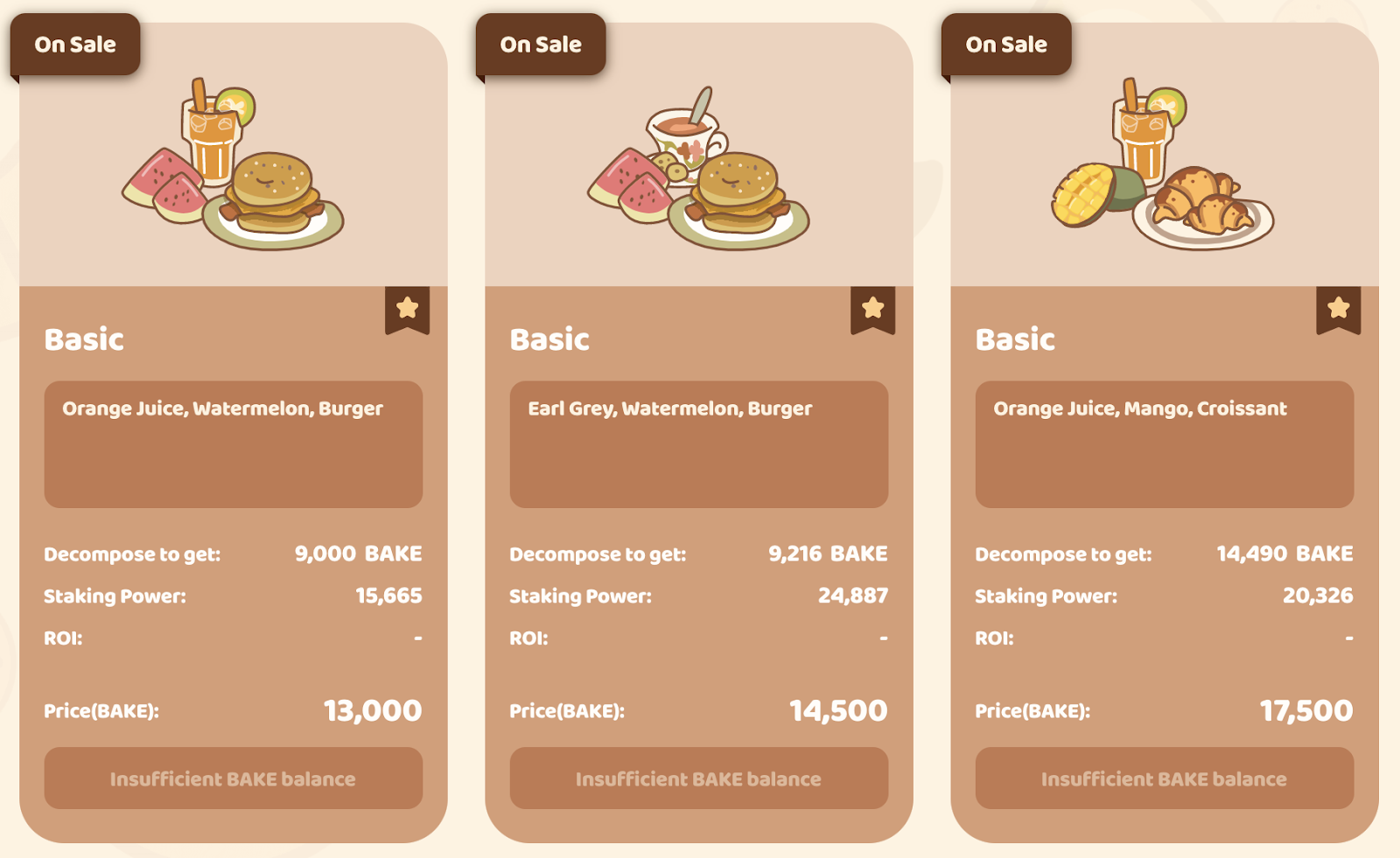

Another example is BakerySwap’s NFT food packages, which create higher staking rewards for holders. By investing in BAKE, users can get an NFT package and improve their staking capabilities to varying degrees. Users can speculate on these packages, sell them on the secondary market, or pledge them. This model perfectly integrates gamification NFT with decentralized finance (DeFi), becoming another interesting NFT use case.

Game NFT

In the game field, the trading and The purchase volume is huge. The scarcity of an item is directly linked to its price, and gamers have long been accustomed to expensive digital items. Small transactions and in-game purchases have propelled games into a multi-billion dollar industry, which is also the source of the development of NFT and blockchain technology.

In terms of the nature of NFT, this is also a promising field. In the eyes of gamers, video game tokens combine artistic value, collectible value, and practical value. Of course, if it is a money-burning video game masterpiece, the application of NFT still has a long way to go.

At the same time, other projects have actively integrated blockchain technology into their games. "Axie Infinity" and "Battle Pets" are both Pokémon-style games, in which pets and props can be traded. Users can also buy and sell these tokens on external markets (peer-to-peer sales).

Game NFT can be skins or various functional props. Each "Axie" pet has exclusive combat skills. After trading these skills, the value of the pet will also be affected. CryptoKitty is worth a lot of money just because of its unique reproductive function. The value of each pet is determined by factors such as unique appearance, function and utility value. In the picture below, both pets have many rare attributes and are not ordinary breeds.

Music NFT

Like image files or videos, audio also It can be bound to NFT and become a collectible music work. We can think of it as the digital "first edition" of a record. Tying songs to NFTs and artwork examples are similar, but there are other use cases as well.

The difficult problem faced by musicians is how to obtain a fair and reasonable royalty share. Currently, there are at least two methods that are relatively balanced: streaming media platforms based on blockchain technology and using blockchain to track royalties. It is difficult for small blockchain projects to compete with Amazon Music or YouTube platforms as streaming services. Even industry giants like Spotify, which purchased a blockchain royalty solution called MediaChain in 2017, failed to allow artists to make any real gains.

At the same time, small projects ultimately choose to work primarily with independent artists. Binance Smart Chain’s Rocki project creates a platform for independent artists to sell royalties and play their music. Their first NFT royalty sale on the platform successfully sold 50% of the royalties, raising 40 Ether using the ERC-721 token standard.

Whether this model can become more popular depends entirely on the application of large-scale streaming media services. Combining music with NFT is a very creative use case idea, but without the support of music labels, it may be difficult to succeed.

Real-world assets NFT

Combining real-world assets with NFT , we can prove ownership digitally. For example: the real estate industry generally uses paper property deed transactions. Creating property deeds as tokenized digital assets is equivalent to transferring illiquid assets, such as property or land, to the blockchain. This application has not yet received support from any regulatory agency. It is still in the initial stage of development, and its future development potential cannot be underestimated.

In April 2021, real estate agent Shane Dulgeroff created NFT as a vehicle to sell a property in California. The coin also comes with a piece of crypto art. The winner of the auction will receive both the NFT and ownership of the house. However, the specific legal issues involved in the sale and the rights of the buyer and seller have not yet been clarified.

For small items like jewelry, NFTs can prove legal ownership when resold. For example, a genuine diamond from a legal source usually comes with a certificate of authenticity, which can also be used to prove ownership. If a certificate is not provided at the time of resale, the authenticity of the diamond cannot be verified and the buyer will question the legal owner status of the seller.

This concept also applies to NFTs. After being associated with an item, holding an NFT is equivalent to owning the asset. With physical cold storage wallets, NFTs can even be embedded in items. As the Internet of Things continues to develop, cases of integrating NFT with real assets are expected to continue to emerge.

Logistics NFT

Blockchain technology has both immutability and transparency and can play a huge role in the logistics industry. These Features can ensure that supply chain data is authentic and reliable. For food, commodities and other perishable goods, it is crucial to understand their transportation trajectory and storage time.

Using NFTs to represent unique items has other added benefits. Based on the metadata such as product origin, transportation route and warehouse location stored in NFT, we can trace the product's whereabouts throughout the process. For example:

High-end luxury shoes carefully crafted in Italian factories, with NFTs attached to the packaging that can be quickly scanned.

Time-stamped metadata clearly shows when and where the shoe was made.

Once a product enters the supply chain, just scan the NFT and a new timestamp can be added to the metadata. Data will include warehouse locations and product arrival/departure times.

When the shoes arrive at their final destination, the store only needs to scan the NFT to mark them as "received." This authentic and detailed record can be viewed at any time to verify the authenticity of the shoes and the logistics route.

Today, many hypothetical solutions for applying NFT to the supply chain are waiting to be demonstrated, but all of them require that all links in the supply chain must use the same infrastructure. Given the large number of global players and stakeholders involved, the real-world application of these systems still faces many challenges, and only a handful of actual use cases have emerged.

Currently, Maersk Group’s TradeLens system and IBM’s Foot Trust are examples of blockchain logistics solutions. Both use the IBM blockchain-Hyperledger Fabric architecture that supports NFT. However, whether NFT can play a role in the two major systems is still unknown.

Summary

As NFT continues to gain popularity, many innovative ideas and use cases will meet us in the future. Currently, many NFT applications are still in the conceptual or small experimental stage and must stand the test of time. After repeated verification, applications that are impractical or cannot be popularized will be eliminated. However, NFTs can really make a difference when it comes to more basic and intuitive issues like the scarcity of art and collectibles.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR