What is cryptoeconomics?

Simply put, cryptoeconomics combines cryptography with economics to coordinate the behavior of network participants.

Specifically, cryptoeconomics is a field of computer science that attempts to solve problems in the digital ecosystem through cryptography and economic incentives. participant coordination issues.

The construction of decentralized networks cannot be separated from cryptoeconomics, because this mechanism can be used to adjust participant incentives without being trusted Third Party Involvement.

Cryptoeconomics is not a subset of traditional economics. It integrates game theory, mechanism design, mathematics, and other methodologies in the field of economics. The main goal of cryptoeconomics is to understand how to fund, design, develop and facilitate the operation of decentralized networks.

This article will delve into the origins of cryptoeconomics and its role in the design of Bitcoin and other decentralized networks.

What problems does cryptoeconomics solve?

Before the launch of Bitcoin, it was widely believed that it would be impossible to create a peer-to-peer network that could reach consensus without obvious vulnerabilities to attacks and failures.

This problem is often called the Byzantine Generals Problem. This is a logical dilemma that shows the importance of different actors reaching agreement in a distributed system. This problem assumes that because some actors may be unreliable, an agreement can never be reached and the network cannot function as intended.

With the creation of Bitcoin, Satoshi Nakamoto solved this problem by introducing economic incentives into the peer-to-peer network.

Since then, decentralized networks have continued to rely on cryptography to reach consensus on the state of the network and its history. Additionally, most networks employ financial incentives to encourage network participants to behave in certain ways.

This synergy of cryptographic protocols and economic incentives enables a new decentralized web ecosystem that is both resilient and secure.

The role of cryptoeconomics in Bitcoin mining

Bitcoin aims to create a value transfer network that is both immutable and censorship-resistant to accurately verify value transfers.

This is achieved through the mining process, in which miners who successfully verify blocks of transactions are rewarded with Bitcoins . Financial incentives like these encourage miners to act honestly, thereby increasing the reliability and security of their networks.

The mining process requires solving a mathematical puzzle based on a cryptographic hash algorithm. In this case, hashes are used to join the blocks together, essentially creating a timestamped record of approved transactions, also known as a blockchain.

Hashes are also used in computational puzzles that miners compete to solve. In addition, transactions must adhere to the consensus that Bitcoin can only be used if a valid digital signature is generated through a private key.

These technical rules related to mining comply with the security requirements of the Bitcoin network, including preventing malicious actors from taking over the network.

How cryptoeconomics can improve Bitcoin security sex?

Bitcoin’s security model is built around the majority principle. This means that a malicious actor could potentially take control of the blockchain by controlling a majority of the Bitcoin network’s computing power, an attack commonly known as a 51% attack.

In this case, an attacker would be able to prevent new transactions from getting confirmed, or even completely reverse the transaction. However, controlling such a large amount of hashing power is extremely expensive and requires a lot of hardware and power support.

Cryptoeconomics is one of the reasons why Bitcoin is successful. Satoshi Nakamoto implemented some assumptions and based on these assumptions provided certain economic incentives to different categories of participants in the Bitcoin network. These assumptions relate to how network participants respond to certain economic incentives and largely determine the security of the Bitcoin system.

If its encryption protocol is not strong enough, there will be no secure account units available to reward miners. Without miners, there would be no guarantee that the transaction history in the distributed ledger is valid unless the transaction is verified by a trusted third party, which would negate one of Bitcoin's major advantages.

The symbiotic relationship between miners and the Bitcoin network, based on cryptoeconomic assumptions, provides this guarantee. However, this does not guarantee that the system will continue to exist in the future.

Encryption Economic Circle

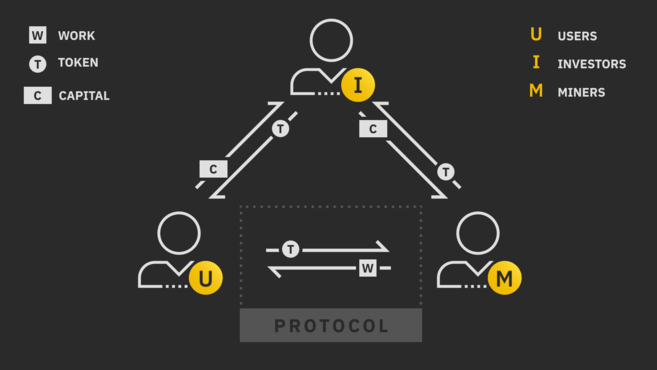

The cryptoeconomic circle is an overall model of cryptoeconomics. Published by Joel Monegro, it demonstrates the abstract flow of value between different categories of participants in such a peer-to-peer economy.

The The model represents a three-party market between miners (supply side), users (demand side) and investors (capital side). Parties exchange value with each other using scarce cryptoeconomic resources (tokens).

In the miner-user relationship in this circle, miners are compensated for their work through the tokens used by users. The network’s consensus protocol standardizes this process, while the cryptoeconomic model controls when and how miners are paid.

Creating a network architecture maintained by distributed providers (miners) is desirable as long as the pros outweigh the cons, and the advantages are usually These include censorship resistance, unbounded transactions, and higher reliability. But compared to centralized models, the performance of decentralized systems is often lower.

In this model, investors have a dual role: both to provide liquidity for miners to sell tokens and to support higher The price of the token at the cost of mining funds the network.

To illustrate the above dual role, the model divides investors into two groups: traders (short-term investors) and long-term holders (long-term investors). investor).

Traders are responsible for creating token liquidity, allowing miners to sell their mined tokens and pay operating costs, while holders Others provide funding for the network by supporting the price of tokens, thereby promoting the growth of the network. The miner-trader relationship drives the direct flow of value, while the miner-holder relationship drives the indirect flow of value.

This simply means that all participants in the economy need to depend on each other to achieve their economic goals. This design results in a strong and secure network. It is more beneficial for individual participants to comply with the incentive rules than to commit malicious activities, which in turn increases the resilience of the network.

Summary

Although cryptoeconomics emerged with the launch of Bitcoin and is still a relatively new concept, it has become a must-consider when designing decentralized networks. an important aspect.

Separating the different roles in a cryptoeconomic model helps analyze the costs, incentives, and value streams for each type of participant. Additionally, it helps to think about relative power and identify potential directions of centralization, which is critical for designing more balanced governance and token distribution models.

In the future development of the network, the field of cryptoeconomics and the use of cryptoeconomic models may be of great benefit. Studying cryptoeconomic models that have been tried and tested in real-world environments can help improve the efficiency and sustainability of future networks, leading to a more robust decentralized economic ecosystem.

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Data

Data